What happened

Shares of Avis Budget Group (CAR -0.37%), a global provider of rental vehicles and broader mobility solutions through its Avis and Budget brands, jumped as much as 10% higher Wednesday morning after SRS Investment Management disclosed a sizable new position in the rental company.

So what

SRS purchased 18,421,082 shares of Avis Budget Group common stock, which is roughly 26.4% of its outstanding common stock.

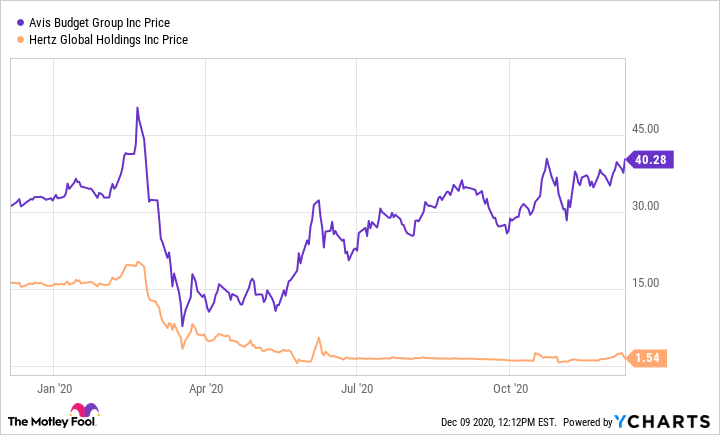

The COVID-19 pandemic hit the travel industry, and especially vehicle rentals, hard as you can see in the graphic above. In fact, Hertz was put under so much pressure due to the financing of its massive vehicle fleet that it was forced to file for bankruptcy protection, while Avis shares have slowly but surely climbed back to near pre-pandemic levels.

Avis posted a significant 44% decline in third-quarter revenue but had managed to reduce its fleet size by selling over 100,000 vehicles globally and removed roughly $1 billion in costs. That brought the total of costs removed year to date to $2 billion. Avis also generated positive cash flow from operations and from adjusted free cash flow during the third quarter thanks to the aggressive cost-cutting.

Image source: Getty Images.

Now what

For investors, Avis has proved it will focus on what it can control through cost reduction and fleet management. Nobody knows if and when travel will return to pre-pandemic levels, but management's cost-cutting should position the company well when demand returns. Also, while Hertz's bankruptcy still has many factors up in the air amid negotiations, it's broadly believed that Avis will stand to benefit regardless of the outcome, and SRS taking a huge stake in Avis is another vote of confidence.