When I'm talking about the year's best stocks, I'm not just thinking about their straight-up market returns. I prefer to sift through the strongest performers while also considering their prospects for continued success. Nobody wants to buy into a skyrocketing stock just before it turns around and crashes back to earth, after all.

On that note, let's have a look at five stocks that delivered a rare combination of outstanding returns and plenty of rocket fuel left to burn.

Image source: Getty Images.

Fiverr: +779% in 2020

Freelancing marketplace operator Fiverr (FVRR -1.17%) plays a crucial role in the so-called gig economy, where people keep a roof over their head or earn some extra money on the side as a contractor or freelancer.

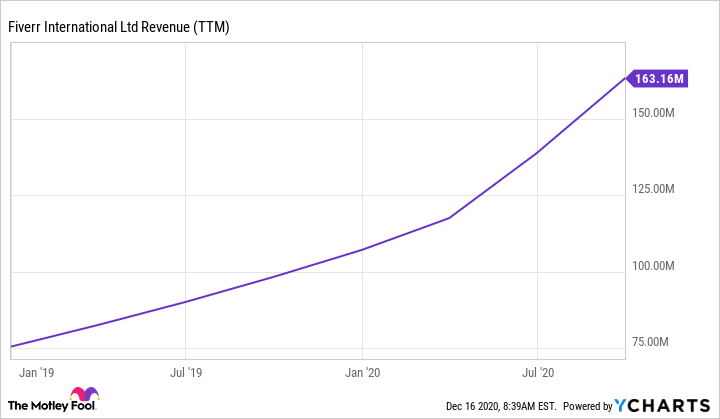

Fiverr nearly doubled its third-quarter revenue year over year, creating this beautiful hockey-stick moment of accelerating growth:

FVRR Revenue (TTM) data by YCharts

The company has merely started to nibble on an addressable market that management expects to be worth more than $100 billion of annual sales just in North America. The European market is even larger, and we haven't even looked at emerging markets or the Asia-Pacific region yet. On top of that enormous untapped business opportunity, Fiverr keeps expanding the list of freelance service categories it can manage and promote. We are looking at a future giant in its early, formative years.

"We're definitely very optimistic about the evolution of the market," CEO Micha Kaufman said in a virtual investor conference last week. It is changing. It is growing, and I think that, if anything, what COVID-19 did is it just gave it a boost in the embrace of this economy by more and more businesses."

Tesla: +665%

Electric vehicle and solar energy solutions specialist Tesla (TSLA -3.40%) is a polarizing company. Some investors feel that the stock is wildly overvalued and that the whole house of cards will fall down when people start buying electric vehicles in bulk from General Motors (GM 1.98%) or Ford (F 6.10%) instead. Others expect Tesla's car sales to keep rising until the energy business is ready to take over as Tesla's main business. Optimists know that Tesla never intended to sell cars forever, setting itself up from the start to pass the torch to the auto industry at large at some point.

So far, Tesla is delivering everything the bulls are asking for. Vehicle deliveries are up, revenues should rise by 46% next year, the company is exploring entirely new markets such as l light and heavy trucks, and Tesla widened its options by raising $5 billion of additional capital in a stock sale this month.

Like Fiverr, this company is just getting started executing an extremely ambitious long-term plan. I'm a Tesla investor for the long haul.

Etsy: +284%

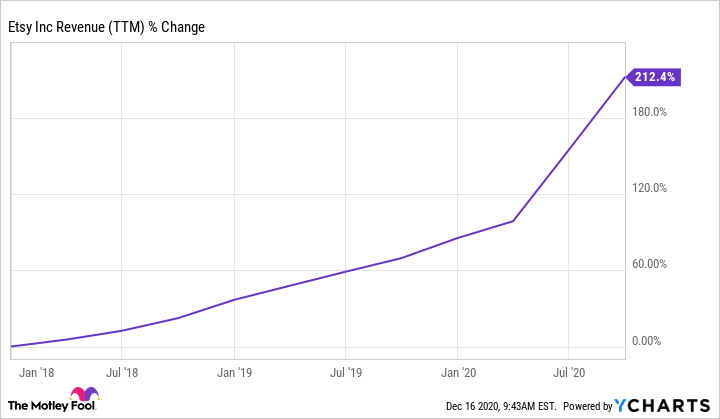

As a marketplace for handmade or vintage items with a focus on transactions between people rather than corporations, Etsy (ETSY -0.46%) is another play on the gig economy. Etsy's COVID-19 hockey stick is even sharper, indicating a more pronounced moment in the sun as consumers were stuck at home with plenty of time on their hands to spend on crafting projects.

ETSY Revenue (TTM) data by YCharts

The pandemic brought in millions of new buyers and sellers who had never done business through Etsy's services before. It also brought back millions of former users who hadn't used the platform for more than a year. Most of these additional users, both new and returning, found the experience worthwhile and came back for more.

"We think having so many buyers come and have so many positive shopping experiences on Etsy can only be great for the future, for the medium term in terms of what our market opportunity is," Etsy CEO Josh Silverman said at an industry conference in November. "We are very excited about the potential for Etsy in international markets. And I would say Etsy is at the very early stages of unlocking the opportunity in the U.S. and we're even earlier in other markets. I still think of Etsy U.S. as early stage."

There's a bit of a theme going on here. All of these companies view themselves as relative newcomers to enormous global markets, creating fantastic investment opportunities for those who dare to bet on these aggressive long-term business aspirations.

Amazon: +71%

At first glance, e-commerce and cloud computing giant Amazon.com (AMZN 1.49%) might feel like a break from the start-up ambitions I mentioned above. CEO Jeff Bezos disagrees, famously treating each and every day on Amazon's fantastic growth story as Day One of a brand new start-up company.

Amazon is an established leader in several exciting high-growth markets. The company is investing the resulting cash profits in further growth prospects for the long haul. Bezos has barely touched markets outside North America and Western Europe so far, but is now building out Amazon's infrastructure in promising markets like India and Brazil. The Prime subscription service that provides free shipping and various media-streaming services is both an important profit center and a great customer loyalty program. Amazon's in-house shipping solutions are expanding around the world, offering next-day and even same-day shipping to millions of Prime members.

Amazon isn't exactly a traditional start-up, but the company behaves like a hungry newcomer. Amazon's stock sports the third-largest market cap on the market today and -- say it with me -- that's just the beginning of a much larger long-term ambition.

Netflix: +61%

Surely Netflix (NFLX -0.08%) will break the "hungry start-up" pattern? The video-streaming veteran already posted disappointing subscriber growth over the summer on the heels of an unsustainably magnificent springtime surge.

Yeah, right. Like every name on this list, Netflix will be chasing untapped growth opportunities for years to come. It was only natural to see the early COVID-19 surge leading up to a muted growth rate after a few months, but the total results in 2020 are putting Netflix's overall growth in recent years to shame:

Image source: Netflix.

That number of paid memberships sounds like a lot, but it's a big world out there with roughly 2 billion households. Broadband-speed internet access is becoming widely available for the first time to millions of families around the world, along with more reliable banking and payment services. All of these macroeconomic trends point to a massive opportunity for further growth in the video-streaming market as a whole and Netflix's sector-leading slice in particular.

At the same time, Netflix's original content strategy is moving closer to the tipping point where the big cash investments of yesteryear will produce both continued growth and positive cash flows for years to come.

"We became global in 2016, nearly twenty years after starting Netflix," the company states in its official long-term view document. "Over the following decades, streaming entertainment will replace linear TV, and we hope to keep leading by offering an amazing entertainment experience."

Remember that Netflix didn't hesitate to abandon the video rental market as soon as the streaming opportunity started to carry its own weight. I can't wait to see what Netflix will do if and when the streaming media idea runs out of steam. This innovative company is a winner for the ages.