It's easy to get lured by the stock market's day-to-day movements and cash out when your stock pops, but real money is made only when you can hold on to your stocks for years. That's when you let compounding interest work its magic, earning you mind-boggling returns, especially when the underlying companies of the shares you own have surefire growth prospects.

Case in point: the three companies discussed below. These are incredible growth stocks riding megatrends that could bring you exceptional wealth, provided you buy and hold these stocks for at least the next decade.

E-commerce is sending this stock to new highs

2020 might have been an exceptional year for the e-commerce sector thanks to the COVID-19 pandemic fueling virtual shopping, but the pandemic may have only accelerated the online shopping megatrend. Statista, for instance, estimates revenue in the global e-commerce market will grow at a compound annual clip of 7.4% between 2020 and 2025. With a convenient platform that enables merchants of all sizes to easily set up online stores and manage the entire process of sales, Shopify (SHOP -2.37%) is ready to ride the wave.

Image source: Getty Images.

More than one million merchants across 175 countries are part of Shopify's ecosystem today. In the third quarter (Q3), Shopify's gross merchandise volume, or the total value of orders processed through its platform, more than doubled to $30.9 billion. Its revenue jumped 96%, and it turned a profit of $191.1 million versus a net loss in Q3 2019. Shopify's holiday sales hit a record $5.1 billion between this Black Friday and Cyber Monday.

Shopify also continued its partnership spree in Q3 and launched its TikTok channel to enable merchants to market their products. The company already has similar collaborations with Facebook, Snap's Snapchat, and more. Plus, management continues to expand its logistics arm, Shopify Fulfillment Network, which could give the company a shot in the arm in the e-commerce space.

In short, there's a lot to like about Shopify. Even if you want to wait a bit before buying the stock since its recent rally, you'd likely reap rich returns in the long run regardless of your entry price point, given e-commerce's prospects.

This megatrend is only getting started

If e-commerce is bread and butter for Shopify, it's also the biggest tailwind for Visa (V 0.05%) for one simple reason: Online shopping and digital payments go hand-in-hand. More and more people across the globe are ditching cash and warming up to cashless modes of payments like credit and debit cards, opening up massive opportunities for Visa.

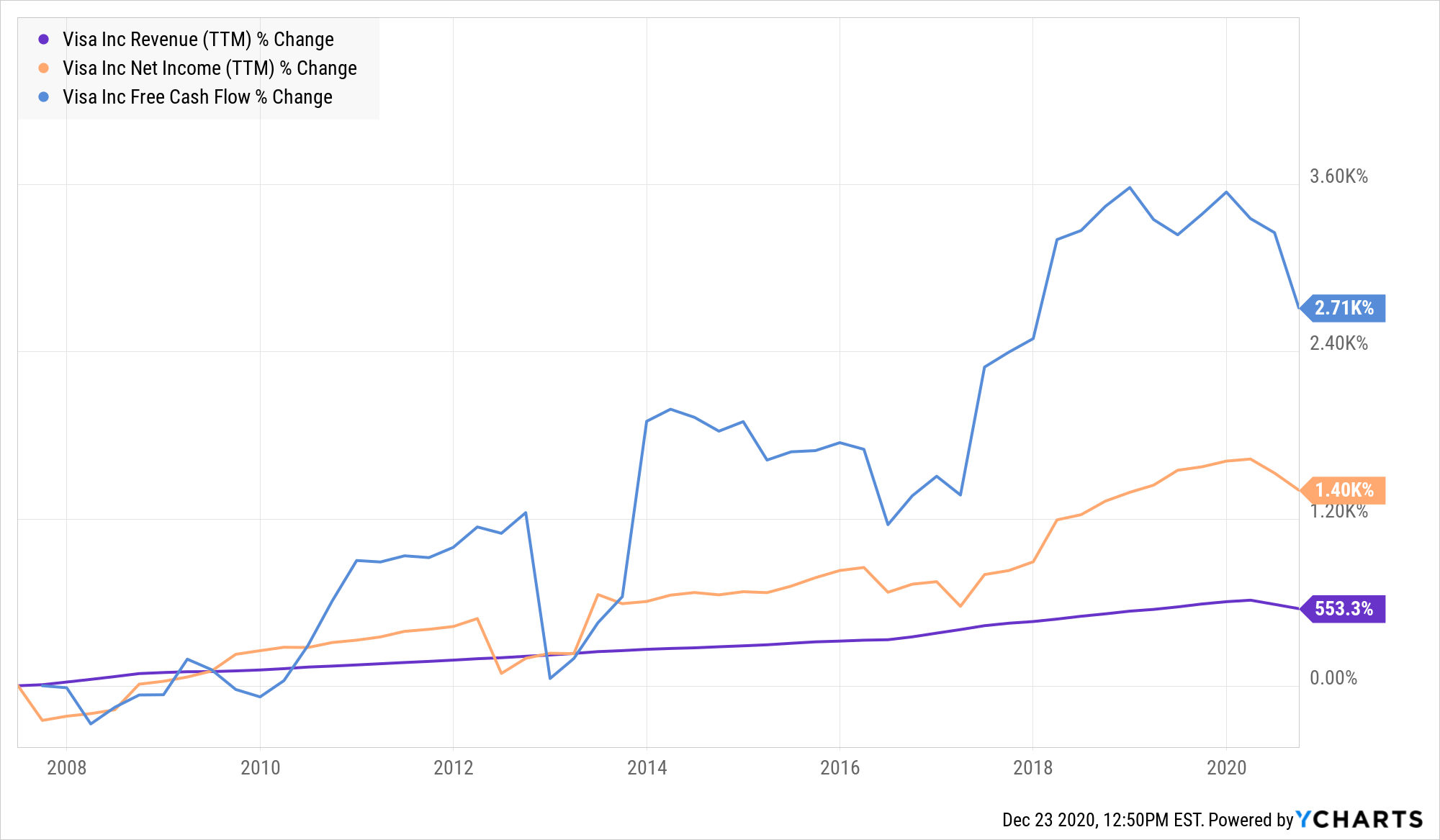

V Revenue (TTM) data by YCharts.

Visa is a growth machine and a cash cow. Because Visa primarily processes transactions made using its co-branded cards over its payments network, it's an asset-light, high-margin business model. Of course, there's a lot more to Visa than just payments processing; it also provides value-added services like fraud management, analytics, and security solutions. So, although Visa's payments volumes were muted in the year ended Sept. 30, 2020, its other revenues grew 9%.

While a booming global middle class and the ongoing "war on cash" should drive Visa's core consumer-payments business, new payments markets like business-to-business and business-to-consumer are pegged to be worth nearly $185 trillion. Visa is extensively expanding its presence in these areas. Visa's impending $5.3 billion acquisition of Plaid, a fintech company, may have run into regulatory hurdles, but the move reflects its hunger to grow in lucrative markets like the fintech one. This hunger, combined with the cashless megatrend, could bring in explosive returns for Visa shareholders in the coming decades.

A growth stock you've never heard of

An infrastructure stock is possibly the last to come to mind when you think of growth stocks, but that's the beauty of investing in Brookfield Infrastructure Partners (BIP -1.33%) (BIPC -0.47%). Though more popular for its dividends, Brookfield is a dream stock to own for both income and growth investors. Here's how the stock has fared since the company's inception in 2008.

The stock wouldn't have rallied so much if not for Brookfield's solid operational performance over the years, combined with dividend growth. Brookfield's dividend has grown at a compound annual rate of 10% since 2008. The thing is, Brookfield owns and operates critical infrastructure assets in utilities, transport, energy, and data. Most of these are essential to the running of the economy and are typically regulated or contracted in nature, so they can generate steady and stable cash flows.

BIP Revenue (TTM) data by YCharts.

One of Brookfield's biggest strengths is a strong balance sheet, which allows it to exploit timely growth opportunities. For example, taking advantage of a weak oil and gas market, Brookfield's parent company, Brookfield Asset Management (BN -0.74%), acquired interest in Cheniere Energy Partners. For Brookfield Infrastructure, an investment worth around $425 million has given it a stake in Cheniere's liquefied natural gas (LNG) export facility, which generates 85% revenue under long-term contracts. In another example, Brookfield recently acquired 135,000 towers in India to make headway into one of the world's largest telecom markets.

These are just two examples that reflect the kind of growth ahead for Brookfield. With management also aiming for 5% to 9% annual dividend growth and the stock consistently yielding 3.8%, Brookfield Infrastructure is a no-brainer, wealth-builder stock to buy and forget.