Hydrogen fuel cells could play a key role in the world's transition toward renewable energy sources. The evolving technology has garnered interest from environmental bodies, governments, energy companies, and investors. Fuel cell stocks, including Plug Power (PLUG 4.02%) and FuelCell Energy (FCEL 12.97%), soared in 2020, reflecting this enthusiasm. But is one a better investment than the other?

Revenue growth

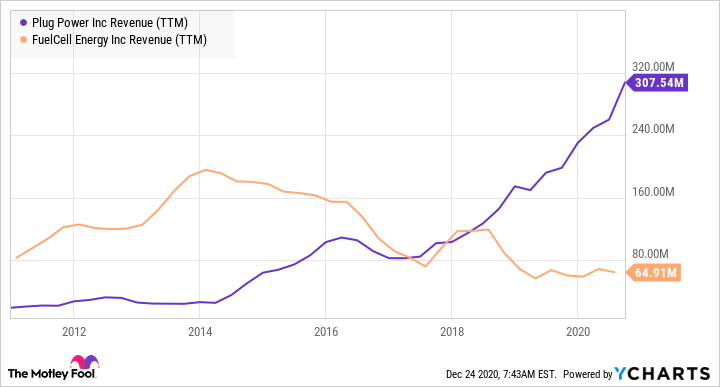

One of the factors that differentiates the two fuel cell companies is their revenue growth. With an average revenue growth of 37% over the last five years, Plug Power easily beats FuelCell Energy on this front.

PLUG Revenue (TTM) data by YCharts.

FuelCell Energy's revenue over this time frame was largely on a downward trend, as the graph above shows. The company's revenue fell 18% in the latest quarter.

Though this looks bad, the fall in FuelCell's revenue is largely attributed to a change in the company's strategy. FuelCell now focuses on power purchase agreements, or PPAs, instead of outright selling of fuel cell power plants. Under PPAs, FuelCell sells the generated power to customers (for example, utilities or universities), while retaining the project itself. This allows the company to benefit from future cash flows, which are cumulatively higher than those from outright sale, but generates less revenue up front. In comparison, Plug Power generated 65% of its 2019 revenue from the sale of fuel cell systems and related infrastructure.

FuelCell's strategy is surely better. But considering that the company doesn't have the capital to invest in the projects, and it hasn't generated profits at least in the last two decades, the strategy looks difficult to implement.

Risks

Both FuelCell and Plug Power face significant risks. Both have a very concentrated customer base. Nearly half of Plug Power's 2019 revenue came from just two customers. Likewise, FuelCell's top two customers accounted for 53% of its 2019 revenue. Both companies face competition from other fuel cell makers as well as from bigger, established auto or energy companies, which can develop and market products more cheaply than they can. With no profits, both companies are dependent on debt and equity financing for growth, which isn't sustainable.

Moreover, the growth of hydrogen fuel cells might not live up to the hype due to several practical constraints. Finally, both stocks can be very volatile. The stocks have historically seen wild swings in their prices, with FuelCell rising to an all-time high of $7,830 in the year 2000 and trading above $500 in 2014.

Image source: Getty Images.

While both face significant risks, a couple recent developments at FuelCell make it look more vulnerable. The first is a recent tiff with the state of Connecticut. The company reportedly threatened to alter its hiring plans in the state. However, since it has a total employee base of around 300, I don't think the threat is very effective. More importantly, the state's decision to not reinstate previously granted awards could impact the company's growth there.

Separately, for nearly eight years, FuelCell partnered with a South Korean energy company, POSCO Energy, for its growth plans in Asia and South Korea. The partnership included agreements on manufacturing and technology transfer. However, FuelCell realized that it could expand its business there better on its own, because POSCO wasn't providing it with any major new projects. So in 2017, it entered into a memorandum of understanding with POSCO that allowed it to directly develop its business in the Asian market.

Things changed when POSCO Energy spun off its fuel cell business into a new entity in 2019. FuelCell believes that this resulted in a misuse of its intellectual property. The company is evaluating its options relating to this breach by POSCO and has terminated its agreement with the company. Irrespective of the outcome, the incident highlights the kind of risks that FuelCell faces. It also impacted the company's revenue growth in the Asian region.

This is not to say that Plug Power doesn't face similar risks. It's just that FuelCell is already dealing with the implications.

The better buy is...

Higher revenue growth so far makes Plug Power look like a better buy than FuelCell. While hydrogen fuel cells could finally see increased adoption and become commercially viable, both Plug Power and FuelCell face significant risks to benefiting from that growth, if they even survive that long. Plug Power is trading at a price-to-sales ratio of 37, while FuelCell is trading at a ratio of 43.

They can surely rise higher from their current levels, but like in the past, the rally won't be supported by their fundamentals. For that reason, I think investors would do better by avoiding both for now and finding other options in renewable energy.