We're only a few days in and 2021 is already being called the year of hope. It remains to be seen just how far back to normal we'll get this year, but vaccine progress gives reason to be optimistic.

No matter how well you have done in the stock market, or if you're just getting started, now is the perfect time to assess the playing field and start laying the groundwork for your investing strategy moving forward. But where to begin?

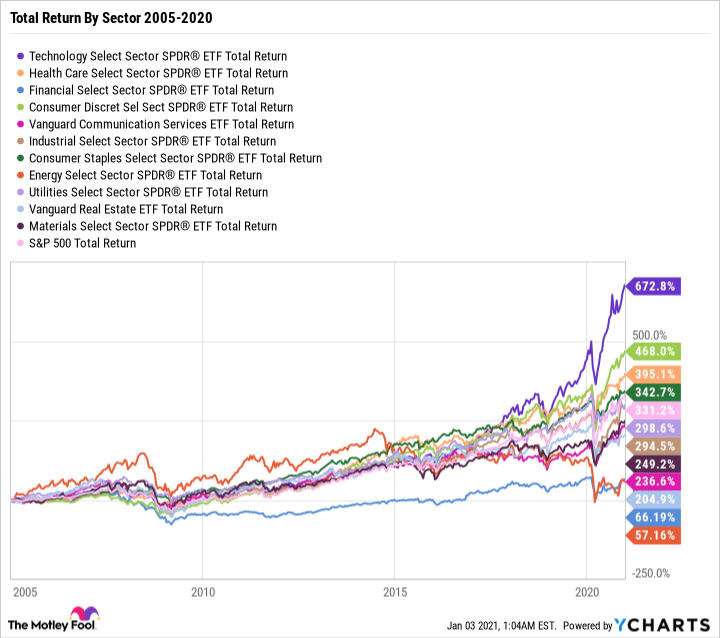

Broadly speaking, there are 11 sectors in the S&P 500. We'll use leading Exchange Traded Funds (ETFs) as proxies for the performance of each sector. Each ETF contains large and relevant companies that act as a yardstick for measuring the sector's performance.

Although individual stock performances vary, each sector has certain characteristics that can make it a good, OK, or bad investment at different times. Here's a breakdown of some of the best sectors for 2021 -- and how they have performed since 2005 (including the financial crisis) -- so you can structure your portfolio to meet your goals for the new year.

Image source: Getty Images.

The popular choice: technology

Weight in the S&P 500: 27.6%

Technology Select Sector SPDR Fund (XLK 1.29%) total return 2005–2020: 672%

Top five largest U.S.-traded companies by market capitalization:

- Apple

- Microsoft

- Taiwan Semiconductor

- NVIDIA

- Adobe

Unsurprisingly, the technology sector has been the best performing sector since 2005. Tech stocks have more than doubled in the past two years, making it the best performing sector in both 2019 and 2020. However, before 2017, technology was more of an average performer and was often outperformed by consumer discretionary, industrials, communication services, and other sectors.

But times have changed. Tech stocks continue to dominate the headlines and reward investors with some of the best returns, biggest breakouts, and most game-changing paradigm shifts. Characterized by high growth with some risk, technology stocks are at some of their highest valuations in history. Although expensive, some of these stocks could be good options for aggressive investors in 2021.

Another growth choice: consumer discretionary

Weight in the S&P 500: 12.7%

Consumer Discretionary Select Sector SPDR (XLY 0.99%) total return 2005–2020: 468%

Top five largest U.S.-traded companies by market capitalization:

- Amazon

- Tesla

- Alibaba

- The Home Depot

- Nike

Consumer discretionary companies are cyclical because they tend to have higher sales during good economic times but can become strained during economic declines. However, leading consumer discretionary companies like Amazon, Nike, and Starbucks continue to exhibit recession-proof characteristics thanks to strong customer loyalty and growing sales.

Unlike the services, entertainment, and travel industries, discretionary spending on goods like cars and clothing has actually increased throughout the pandemic because people don't know what else to spend their extra money on. During the height of the pandemic in the second quarter, spending on durable goods declined by less than 1% and nondurable goods spending declined 4%, but services declined 13%. Then in the third quarter, durable goods rebounded 16% and nondurable goods increased over 6%, putting both metrics at a higher level than when the year began. The simple concept that the pandemic is leading Americans to spend money on stuff, not experiences, helped propel the sector up 30% in 2020.

The balanced choice: industrials

Weight in the S&P 500: 8.4%

Industrial Select Sector SPDR Fund (XLI 1.21%) total return 2005–2020: 293%

Top five largest U.S.-traded companies by market capitalization:

- Honeywell

- United Parcel Service

- Union Pacific

- Boeing

- Raytheon Technologies

The industrial sector produced a near-300% total return since 2005. Often thought of as a boom-and-bust sector, industrials are actually more balanced than they're given credit for. The sector outperformed the market in five out of the 16 years since 2005. And other than 2008, when it declined about as much as the market, its worst three years produced total returns of negative 13%, negative 4%, and negative 1%. Industrials are attractive investments because they tend to pay generous dividends and can be less volatile than other dividend-paying sectors like energy, materials, and financials.

XLK Total Return Level data by YCharts

A big tailwind for industrials heading into 2021 is the Federal Reserve's commitment to keep short-term interest rates near zero through at least 2023 as a means to bolster spending in the wake of the pandemic. This tailwind benefits any company looking for access to cheap capital, including tech and consumer discretionary. But it's even more meaningful for capital-intensive businesses like industrials.

The safe choice: consumer staples

Weight in the S&P 500: 6.5%

Consumer Staples Select Sector SPDR Fund (XLP -0.02%) total return 2005–2020: 340%

Top five largest U.S.-traded companies by market capitalization:

- Walmart

- Procter & Gamble

- Coca-Cola

- PepsiCo

- Costco Wholesale

If you're worried about a recession, look no further than consumer staples. Arguably the most recession-proof sector in the market, consumer staples companies garner consistent demand for their products despite market cycles. During the financial crisis of 2008, consumer staples outperformed all other 10 sectors and the overall market.

Chock-full of stodgy dividend investments, consumer staples companies also benefit from a growing economy. After all, Walmart and Costco are likely to sell more TVs and other discretionary products during boom times. So, despite its rather low-growth reputation, the consumer staples sector is one of just four sectors that has outperformed the market since 2005 (the other three being tech, consumer discretionary, and healthcare).

The contrarian choice: energy

Weight in the S&P 500: 2.3%

Energy Select Sector SPDR Fund (XLE -0.23%) total return 2005–2020: 59%

Top five largest U.S.-traded companies by market capitalization:

- ExxonMobil

- Chevron

- Royal Dutch Shell

- Total S.A.

- PetroChina

Despite being the best performing sector in 2005, 2007, and 2016, the energy sector has been the worst-performing sector overall since 2005. 2020 marked the third consecutive year where energy was the worst-performing sector. Energy stocks have produced an abysmal 59% total return compared to the market's 328% since 2005.

High oil and gas supply coupled with low demand brought the energy industry to its knees in 2020. The long-term headwinds are concerning, too. Renewables, namely solar, have come down in cost. Oil and gas is capital intensive (high debt). There's global competition -- and with it, geopolitical risk. And of course, there are environmental concerns.

There are plenty of terrible energy stocks, but reduced share prices have also paved the way for opportunities. For investors willing to accept a little bit more risk, the energy sector could be a great place to hunt for value in 2021.

The best choice

2021 could very well be another bull market where technology, consumer discretionary, industrials, and communication services perform well. But given high valuations in the tech and consumer discretionary sectors, the consumer staples sector seems to have the best mix of risk and reward in 2021.

Consumer staples will likely outperform a bear market. And contrary to popular belief, consumer staples have proven they outperform the market over the long term, too. With the stock market near an all-time high, it seems best to ease into 2021 with caution. However, a low-interest rate environment and economic stimulus could very well result in another great year for stocks. Keeping some cash on the sidelines will allow you to take advantage of discounted prices during a crash, where it could serve you well to snag companies with attractive long-term prospects from a variety of sectors.