What happened

The world's most valuable cryptocurrency by market capitalization is bitcoin, and its price just kept climbing on Thursday. As of 1 p.m. EST, the price of a bitcoin token was $39,700 and still rising.

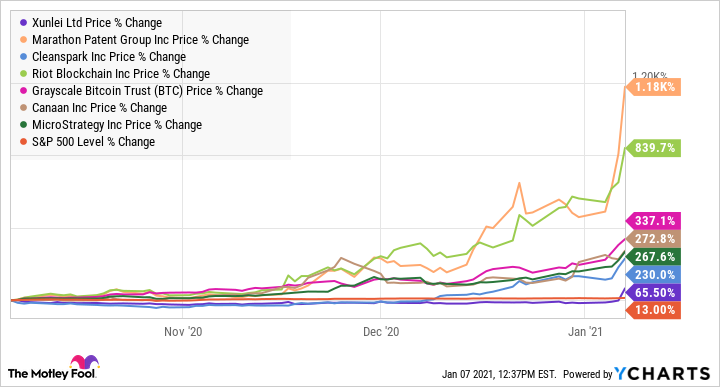

As has often been the case for much of the past couple of months, when bitcoin rises, a handful of stocks also perform well. Here are seven such stocks making big moves today:

- Xunlei (XNET 0.68%), up 65%.

- Marathon Patent Group (MARA 9.78%), up 37%.

- CleanSpark (CLSK 5.98%), up 15%.

- Riot Blockchain (RIOT 10.13%), up 23%.

- Canaan (CAN -18.25%), up 12%.

- Grayscale Bitcoin Trust (GBTC 1.29%), up 7%.

- MicroStrategy (MSTR -2.82%), up 14%.

Bitcoin's rise is leading to surging prices in other cryptocurrencies as well (collectively known as alt-coins), and the website CoinGecko has indexed over 6,000 of them. On Wednesday evening, the combined capitalization of the entire cryptocurrency market surpassed $1 trillion for the first time, according to CoinDesk.

Image source: Getty Images.

So what

Cryptocurrency stocks continue to see outsize trading volume, leading to high volatility, as bitcoin and other alt-coins keep pushing to new highs. But there is also a spattering of company-specific news that investors should know about today.

First, there's a new CEO in place for Grayscale -- a company with tools that allow traditional investors to invest in assets like bitcoin and Ether, the token native to the Ethereum blockchain. According to Fortune, managing director Michael Sonnenshein will take over CEO duties from founder Barry Silbert.

Silbert will still run Grayscale's parent company, Digital Currency Group, but is transferring leadership of Grayscale to Sonnenshein because of the robust growth the company is experiencing. Apparently it's already too much for Silbert to handle alone.

In other news, CleanSpark started a joint energy project with Bay Area Energy Solutions in California. CleanSpark was picked up on most investors' radars in recent days due to its acquisition of a bitcoin mining operation. However, the company is primarily an energy technology company trying to demonstrate its ability to better run micro-grids, which are small-scale, self-sufficient electricity infrastructure.

Bitcoin mining is an energy-intensive process that can clearly demonstrate CleanSpark software's capabilities. But the company will also look to show off its software by used it in a 14,000-square-foot luxury estate just north of San Francisco, per today's press release.

MicroStrategy didn't issue a press release today, but the increasing value of its balance sheet is something we should nevertheless examine. The company's CEO recently decided to convert all unused cash into bitcoin, and even issued debt to buy more. As of Dec. 21, MicroStrategy had 70,470 bitcoin tokens. With bitcoin at $39,700 as of this writing, the total value of these tokens is nearly $2.8 billion. For perspective, the company bought bitcoin for $1.1 billion just weeks ago.

Over the last three months, all seven of these stocks have crushed the market average. XNET data by YCharts

Now what

Company-specific news can move the needle for any one of these stocks from time to time. But investors should keep in mind that many cryptocurrency stocks are penny stocks and incredibly easy for traders to manipulate. For example, Xunlei is surging by a ludicrous amount today and there's no fundamental reason to explain the move. But the stock's trading volume is almost 44 million, according to Yahoo! Finance, rivaling that of some of the largest publicly traded companies.

Xunlei's move today is reminiscent of the surge Bit Digital had during the past week. The stock more than doubled in just a couple of days but is losing steam now that the pump is over, and is barely up 2% as of this writing.

Herein lies the problem with stocks surging on trading volume that's out of sync with business fundamentals: There's no way to tell when the music is going to end. That's true of Xunlei and Bit Digital stocks, but also others like Marathon, Riot Blockchain, and Canaan. These three now have market caps over $1 billion each, trading with price-to-sales ratios in the hundreds.

Despite my belief in cryptocurrencies like bitcoin and Ether, these cryptocurrency stocks are too risky for my liking and not a place I would look to invest right now. In my opinion, there are simply better investing ideas for 2021: mainstream companies with proven business models, riding strong macro-trends, and possessing exponential profit potential.