The start of a new year is always a good time to improve your finances Whether you outperformed the market in 2020, did OK, or had a year you'd rather forget, 2021 offers a clean slate to learn from your mistakes and the wisdom of others.

Books can be great resources for sharpening your investing skills. The following three titles are amusing and enriching with timeless investing lessons that will help you beat the market this year and for decades to come.

Image source: Getty Images.

For new investors: One Up on Wall Street by Peter Lynch

Timeless lesson: Regular people can beat the market by investing in businesses they understand better than Wall Street.

Lynch's thesis runs parallel to our beliefs here at the Motley Fool. We think you can outperform the market, and we want to help you do just that.

Written in 1989, the examples in One Up on Wall Street are outdated, but their sentiment is still applicable today. Lynch simplifies the stock market and reminds investors that stocks are companies with real businesses. His grassroots approach is grounded in the belief that regular people can make money in the stock market by investing in businesses they understand.

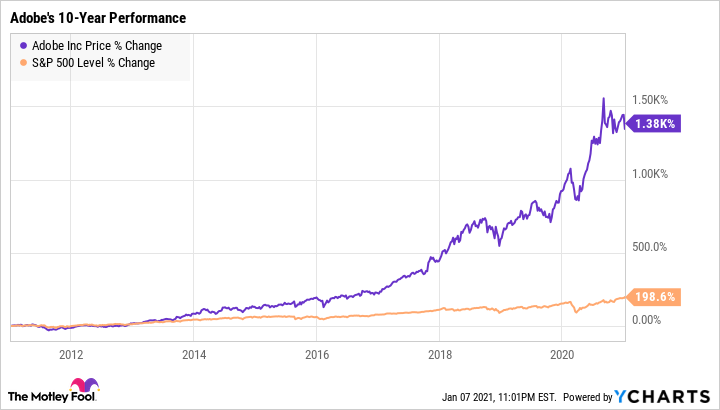

For example, a graphic designer is likely to have a better understanding of Adobe's (ADBE -0.27%) popular products like Photoshop and Illustrator than an analyst on Wall Street. Adobe was still a relatively small company in 2010. It introduced a software bundle known as Adobe Creative Cloud in 2011 which it then made available as a subscription in 2013. Adobe users could have seen firsthand the appeal and potential of this cloud-based offering in its early days. Now, we know the results are astounding -- Adobe stock has increased about 1,400% over the past 10 years, what Lynch would call "a 14 bagger." And the stock remains an excellent recession-ready stock to buy right now.

Data by YCharts.

Lynch-style opportunities are often hiding in plain sight. Another good example is Disney+. The long-anticipated release of Walt Disney's (DIS -0.45%) streaming service came in Nov. 2019, which just so happened to be a few months before one of the deadliest pandemics in U.S. history. Kids out of school and parents adjusting to social-distancing measures made the rise of Disney+ fairly predictable.

The stock was trading near a five-year low in March, because its theme park and feature film revenue evaporated in the wake of COVID-19. Lynch would note that you didn't need any special financial knowledge to realize that these revenue streams would probably rebound long term whereas Disney+ had the potential to explode in popularity with years of growth ahead of it.

For value investors: The Dhandho Investor by Mohnish Pabrai

Timeless lesson: The market isn't perfectly efficient, and it misprices assets all the time. Identifying and buying distressed assets at bargain prices is the essence of value investing.

2020 encapsulated the lessons in Pabrai's 2007 book, The Dhandho Investor. As a value investor, Pabrai is all about paying less for a business than what it's worth. He's a believer in waiting patiently for opportunities to arise and then making big bets.

The spring 2020 stock market crash priced several leading companies like they were distressed assets. Identifying the companies that dominate their industry and then betting heavily on them was a winning strategy. The meteoric rise of Tesla and Shopify, for example, was shadowed by the incredible rebound of other market-leading companies. Major airlines like Southwest and Delta have both more than doubled from their 2020 lows. After crashing to multiyear depths, several value stocks reached all-time highs in 2020.

However, Pabrai is also perfectly fine with buying a company at an all-time high if he believes its runway is much longer than the market gives it credit for. He was an advocate of Chipotle (CMG 0.17%), which had just 500 stores in 2006 and was gaining popularity for its fresh ingredients, low prices, and customizable menu. Pabrai chose it over any other Mexican restaurant in Southern California. And he discovered firsthand that others did too. Similar to Peter Lynch, Pabrai noted that it didn't take a genius to figure out Chipotle could seriously scale its business. Chipotle stock has increased by 3,000% since 2006, and the company now has over 2,500 restaurants.

Data by YCharts.

For growth investors: Zero to One by Peter Thiel

Timeless Lesson: The most successful businesses are monopolies that combine proprietary technology with network effects, economies of scale, and branding. Today's largest tech companies began as start-ups that identified and eventually dominated an emerging market with little to no competition.

Unlike Lynch and Pabrai, Thiel is a venture capitalist who finds high-growth businesses in new industries. Thiel was a co-founder of PayPal and an early investor in Facebook. He argues the success of both companies stemmed from their ability to start small in an untapped market. Facebook began by creating a social network for Harvard students. Only after that success did it branch out to other college campuses and eventually, throughout the world. PayPal started as a payment service that could process transactions over email. Its first big partner was eBay. A few high-volume sellers dominated most transactions on eBay and desperately needed PayPal's services. It was a perfect fit.

Thiel's views are somewhat contrarian, but they make a lot of sense, especially in today's tech-centric world. Technology has been the best-performing sector over the past 15 years and currently comprises over 25% of the S&P 500 index. Thiel notes that "it's always a red flag when entrepreneurs talk about getting 1% of a $100 billion market." Instead, he believes in creating new markets as Amazon did with its online bookstore, Microsoft with personal computers, and Apple with the iPhone.

In the real world outside economic theory, every business is successful exactly to the extent that it does something others cannot. Monopoly is therefore not a pathology or an exception. Monopoly is the condition of every successful business.

Theil's views apply to some of the greatest growth stories of 2020 such as CrowdStrike's rise in the cybersecurity industry and Zoom's leadership in videoconferencing, among others.

You can beat the market

Lynch, Pabrai, and Thiel are all very different investors, but they share the fundamental belief that (with the right tools and approach) you can beat the market. They also all believe the future is more important than the present or the past; long-term investing is better than trading; and future results are more important than short-term success or failure. Applying these fundamental principles to your investing strategy should lead you to become a better investor and help you ultimately beat the market.