Few investors would have predicted the stock market's astounding 70% rise between the crash of March 2020 and today. But it's amazing what future expectations and low interest rates can do for an economy. Industrial stocks have outperformed the market during plenty of booms before. And industrials that pay dividends are even better because they generate guaranteed income no matter what the stock market is doing.

With that in mind, we asked some of our contributors which dividend stocks they think are good buys for a 2021 bull market. They came up with 3M (MMM -1.05%), Caterpillar (CAT 0.07%), and Emerson Electric (EMR -0.14%). Here's why they believe these three stocks are poised to run higher.

Image source: Getty Images.

3M looks undervalued

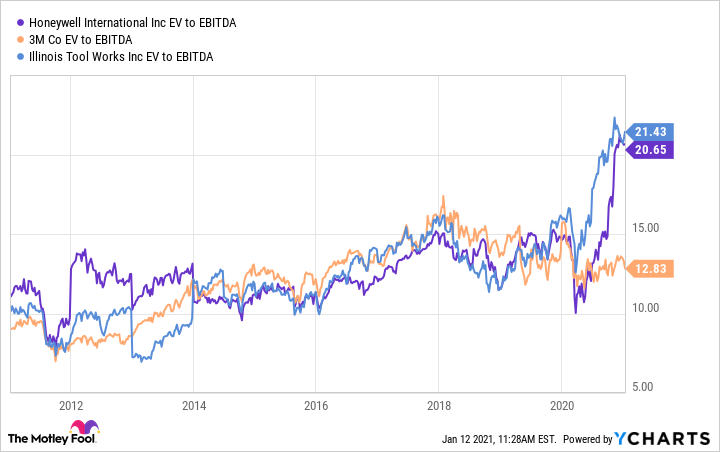

Lee Samaha (3M): The multi-industry industrial has fallen out of favor with the market in recent years, largely due to a history of missing guidance, PFAS liability risk, and poor execution. However, there is a strong case for arguing that the de-rating has gone too far. Whether it's an earnings-based valuation, or one based on free cash flow, 3M now looks like a good value compared to its peers.

Data by YCharts

Throw in a well-covered dividend (currently yielding 3.6%) and a management team committed to cutting the cost base, making administrative changes, and restructuring the portfolio through corporate activity, and you have a recipe for the stock to have a good 2021.

Indeed, the company started the year in good shape with all its segments now generating some underlying growth. Moreover, analysts expect 3M to benefit from a recovery in the economy leading to 6% sales growth in 2021.

While there's no guarantee that CEO Mike Roman will be successful in his restructuring aims, the point is that he has the free cash flow (some $5.8 billion worth in 2020) at his disposal to restructure the company. Meanwhile, the stock trades on an attractive valuation and pays a good dividend. If you can tolerate the PFAS risk then the stock looks like a very good value.

Awaken the sleeping giant

Daniel Foelber (Caterpillar): The stars are aligned for Caterpillar to capture a 2021 bull market, but it has been a rocky road to get there.

After reporting its best annual revenue in the company's history in 2012, Caterpillar slogged through four years of declining sales. Just when it was about to enter into another growth trend, the U.S.-China trade war derailed its upward mobility. Then the COVID-19 pandemic threw a wrench in its 2020 goals and resulted in one of Caterpillar's worst quarters on record. But sales started rebounding in the third quarter, and the company believes it is on track to have a much better year in 2021.

Caterpillar's strong balance sheet allowed it to make timely oil and gas acquisitions in 2020. Most folks recognize Caterpillar for its big earth-moving construction equipment, but the company's energy and transportation division generates about the same amount of revenue as its construction segment does. Surging oil prices paired with an overall economic boom should help drive this division's sales higher.

Even if this year doesn't turn out as planned, Caterpillar plans to increase its annual dividend for the 28th consecutive year, just like it has done through several downturns.

However, the market is already pricing Caterpillar's stock for a strong earnings year. Trading at an all-time high with a P/E ratio above 30, Caterpillar's stock would look expensive if it can't deliver on its highly anticipated growth. But given the strength of its dividend, this cyclical stock could be one of the best ways to take advantage of a 2021 bull market.

A regal approach to charging up your passive income stream

Scott Levine (Emerson Electric): Soaring more than 16% in 2020, the S&P 500 has extended its rise so far in 2021, climbing more than 1.4%. And many investors believe that the market won't be reversing course anytime soon. Between this belief and the knowledge that dividend-paying stocks, for the most part, outperform non-dividend payers, it's unsurprising that investors are paying particular attention to stocks that offer recurring distributions -- stocks like Emerson Electric, which provides investors a 2.4% yield.

Since 1890, Emerson Electric has grown into a global powerhouse that provides solutions to a wide swath of industries including food and beverage, oil and gas, mining, and water treatment -- to name a few. Dividend investors, however, are likely more familiar with the fact that Emerson Electric is a Dividend King. A more elite group than Dividend Aristocrats, which have increased their dividend for at least 25 consecutive years, Dividend Kings have a track record of raising their dividends for an eye-popping 50 years in a row. Did Emerson Electric just join this select group? Not exactly -- Emerson Electric has been hiking its dividend for 65 straight years.

While a company's commitment to rewarding shareholders with a dividend is great, it means little if the company is jeopardizing its financial health in order to placate investors. In the case of Emerson Electric, this is hardly the case. Over the past 10 years, the company's average payout ratio is 59%. Furthermore, the company generates a considerable amount of cash flow, averaging annual free cash flow of $2.4 billion over the past three years according to Morningstar. This suggests that the company's dividend is sustainable; in addition, Emerson can also continue its trend of making strategic acquisitions such as the recent acquisition of Progea Group, strengthening Emerson Electric's position in the internet of things.

Another thing I find interesting with Emerson Electric is its exposure to hydrogen, an area that has gained tremendous interest over the past year. On the company's fourth-quarter 2020 conference call, for example, Lal Karsanbhai, executive president of Emerson Automation Solutions, noted the company's opportunity stating that Emerson Electric has "a significant role to play here [in helping customers reach carbon neutrality] particularly in that hydrogen value chain from production to distribution and utilization."

While shares aren't currently found on the discount rack -- it's trading at 16.3 times operating cash flow, a premium to its five-year average multiple of 15.4 -- I'd gladly pay a slightly steeper price for a distinguished Dividend King like Emerson Electric. Between the company's lengthy track record of returning capital to shareholders and its impressive ability to generate free cash flow, Emerson Electric is a stock that investors should strongly consider as a way to power their portfolios.