Despite sky-high expectations, Netflix (NFLX -3.92%) still managed to shock Wall Street with its latest earnings report. The subscription video-streaming leader gained more new members than expected in late 2020. Its rapidly improving cash flow points to surging financial strength and gushing direct returns to investors, too.

However, while co-CEO Reed Hastings and his team projected a weak fiscal Q1 for subscriber gains and declined to issue a forecast for the full year, there are good reasons to believe that Netflix's achievement of a 200-million-member global audience represents just a small piece of its long-term potential. Let's take a closer look.

Image source: Getty Images.

1. Percentage of TV viewing time: 10%

A big worry on Wall Street is that Netflix has already booked all the growth it can from highly penetrated regions like the U.S. and Canada. Almost all of these households have already signed up for its service or decided that it isn't for them, essentially making it a saturated market.

The company still managed significant U.S. subscriber gains in 2020, though. And there's an even longer runway ahead when it comes to boosting viewing time. Netflix accounts for just about 10% of TV viewing engagement today and a similarly small percentage of pay-TV watching time.

Raising that number directly increases the value that subscribers get from the service and lays the foundation for further price increases. "We think we've got a lot of headroom in these markets," CFO Spencer Neumann explained in recent call with investors, "and we're just trying to get a little better every day."

2. Movie releases in 2021: 70

Netflix recently announced plans to release 70 major movies this year -- dozens more than Disney (DIS 0.18%) intends to launch in 2021. Sure, few of these titles will be blockbusters. But they'll likely help Netflix improve on its mixed content performance over the next few years. While the streamer dominated global TV show rankings in 2020, it had fewer breakouts in the film business.

Netflix has lots of room to keep growing in this area, including by working to challenge Disney's animation studio over time. Those quality animation productions take longer to produce, but you can bet that Netflix is already working on some potential blockbusters set to release over the next few years.

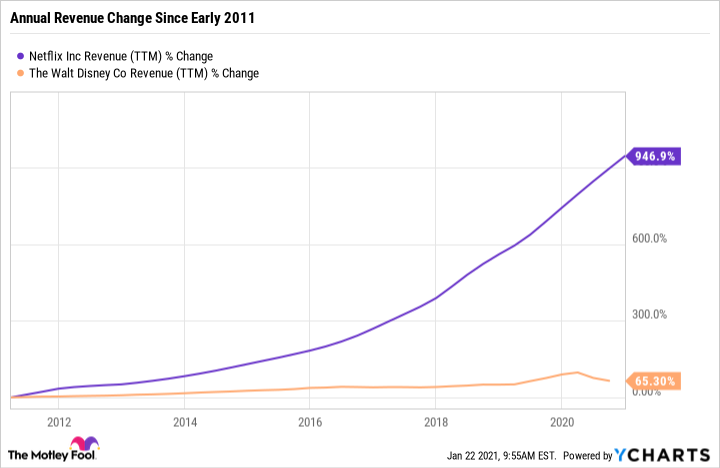

3. Annual revenue: $25 billion

Cash is the biggest asset you need to create content at scale. Netflix's lead on this score is massive, but it's still growing. Annual sales jumped 24% last year to $25 billion. Factors that can keep driving this figure higher include membership gains and those monthly prices, which rise over time along with average viewing hours.

NFLX Revenue (TTM) data by YCharts.

After almost a decade of funding its aggressive original content push with the help of debt, Netflix sees 2021 as the year that finally ends this streak. The streamer should break even soon, and its long-term cash generation potential could be as high as 30% of sales or more. Shareholders recently celebrated that development because it means stock buyback spending might start spiking as early as this year.

But the better reason to cheer is that it means Netflix has even more resources it can direct toward dozens of attractive content bets including films and local language shows. The blockbuster success it has had with original TV series in the last five years paves the path for comparable wins in other niches as Netflix becomes a bigger entertainment platform. Investors should stick around to watch that long-term growth story unfold.