On the surface, the U.S. economy seems to be doing okay. Consumer spending is up, savings are up, and household debt is going down. People are starting to fly more, drive more, and go out more as vaccines are distributed and the economy slowly reopens.

Peel back the veil, and it's not as good as it seems. It has taken a lot of government intervention to prop up the economy. And that intervention comes at a price. Here's why the stock market could be overvalued and what to do about it.

Image source: Getty Images.

1. Economic concerns

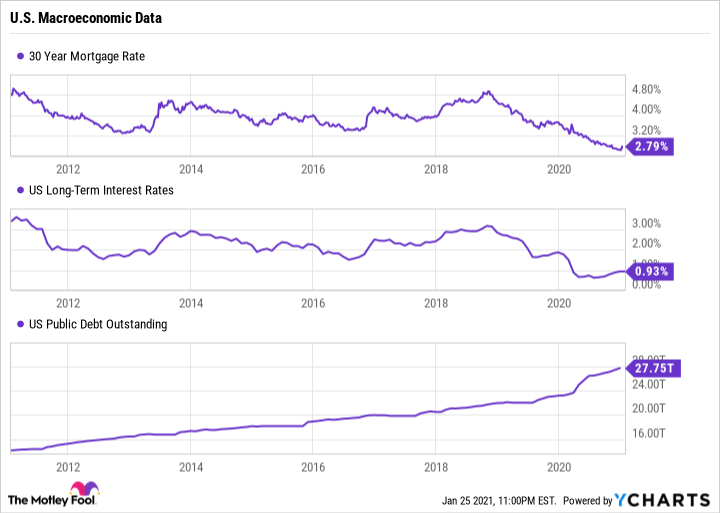

The housing market is booming, and that boom is carrying over to 2021 for one key reason: Interest rates. Consider that the 30-year mortgage rate is near a 10-year low. Fed Chairman Jerome Powell recently said that short-term interest rates are likely to remain around zero until 2023. This all sounds great, but it comes at a price. U.S. public debt has doubled in 10 years, including by 14% in the last year alone.

30 Year Mortgage Rate data by YCharts

To put into perspective the power of a low 30-year fixed mortgage interest rate, note that a $320,000 mortgage loan ($400,000 home with 20% down) at a 4% interest rate results in $230,000 of interest payments over the life of a loan. The same loan at 2.8% results in total interest payments of just $153,000.

So, what do people do when they aren't spending money on vacations, mortgage interest rates are at jaw-dropping low levels, and their employer told them they can work from home for the foreseeable future? Many of them are buying new homes, even though average sale prices of existing and new homes are at 10-year highs. Those prices have risen a staggering 66% in 10 years and 13% in the last year alone.

US Existing Home Average Sales Price data by YCharts

We've seen this cycle before. If anything happens to interest rates, it could hurt home prices and crush demand for home purchases. Moreover, once people start spending on other things again, it'll reduce their ability to buy new homes. A lot of the money that is being poured into the economy could stop if interest rates rise. And if interest rates don't rise, then U.S. public debt will keep going up.

2. Stock valuations are at a 10-year high

Cheap debt can do wonders for an economy in the short term. And it certainly has helped vulnerable sectors (like airlines, oil and gas, restaurants, and entertainment). But even high-quality companies in struggling sectors are now in their worst financial shape in years. And it's unlikely their earnings will return to 2019 levels anytime soon. Yet despite this reality, many of these stocks are now valued as much or higher than they were before the pandemic.

There's a disparity, however, between the economy and the record-high stock market. As former Fool Morgan Housel wrote in early January:

There are nine million fewer jobs today than a year ago, a decline of around 6%. But for those earning more than $28 per hour, the job market has fully recovered, like the recession never happened. For those earning less than $16 per hour, one-quarter of the jobs are still gone, which is on par with the 1930s.

Despite higher debt and uncertain earnings, the average stock in the S&P 500 now has a price-to-earnings (P/E) ratio of 34, the highest since the Great Recession. That's a potential danger for the stock market.

3. Dividend yields are at a 10-year low

Stocks that rise faster than earnings can grow tend to sport high valuations. Stocks that rise faster than they can grow their dividends see their yields fall. This is exactly what has happened. The average dividend yield in the S&P 500 is now at its lowest level in 10 years -- just 1.55%.

S&P 500 P/E Ratio data by YCharts

Dividends provide an added incentive for investors to hold stocks over the long term. A dividend yield above 2% is important because it protects investors from inflation (which has averaged around 2%). High equity valuations and low dividend yields mean there's less incentive for investors to buy stocks.

What to do about it

The status of the economy and the stock market warrants skepticism. But it does not mean it's a good idea to sell all your stocks and hide your money under your mattress. As investing legend Peter Lynch once said, "Far more money has been lost by investors preparing for corrections, or trying to anticipate corrections, than has been lost in corrections themselves." No one knows when a correction will come or how severe it will be. But what we do know is that the stock market has been one of the best ways to grow wealth over time.

Image source: Getty Images.

Now more than ever, make sure to stick to timeless investing lessons that can help you stay even-keeled no matter what the market throws at you. Every company belongs to a different sector. It's important to understand how that sector has performed historically and is likely to react to future scenarios. Whether you're a rookie investor or a seasoned veteran, only own stocks that you believe have long-term upside. And decide ahead of time how you will adjust if the investment thesis changes. Doing this will give you invaluable conviction and confidence in the companies you own. Warren Buffett put it well when he said: "Buy a stock the way you would buy a house. Understand and like it such that you'd be content to own it in the absence of any market."

A good place to find value is in the industrial sector. The sector is fairly easy to understand. And premium industrial companies like Honeywell (HON 0.30%), Caterpillar, and UPS tend to pay stable and growing dividends and remain cheap even at present valuations. Honeywell, in particular, has one of the best balance sheets in the sector, growth prospects, and continues to increase its dividend.

So, despite the fact that the market is probably overvalued, you should still own stocks based on the reasons discussed -- and on the condition that you don't need the money over the short to medium term.