The average 529 college savings plan is opened once the beneficiary has already celebrated their seventh birthday, according to Morningstar research. And that's actually a late start. A 529 plan gives you a limited number of mutual funds, often target-date funds, that are designed for an 18-year time horizon.

But suppose when your child is 7, you opted to forgo a 529 plan and invest instead in a high-growth exchange-traded fund, like the Vanguard Growth Index Fund ETF (VUG -0.61%). You'd be taking on a lot more risk with your child's college money, though the potential returns are astronomically higher.

If you invest $7,000, then kick in another $200 a month, and the fund delivers returns on par with what it has over the last decade, you could have more than enough to pay for your child's college tuition 10 years from now.

Image source: Getty Images.

What is Vanguard's Growth Index Fund ETF?

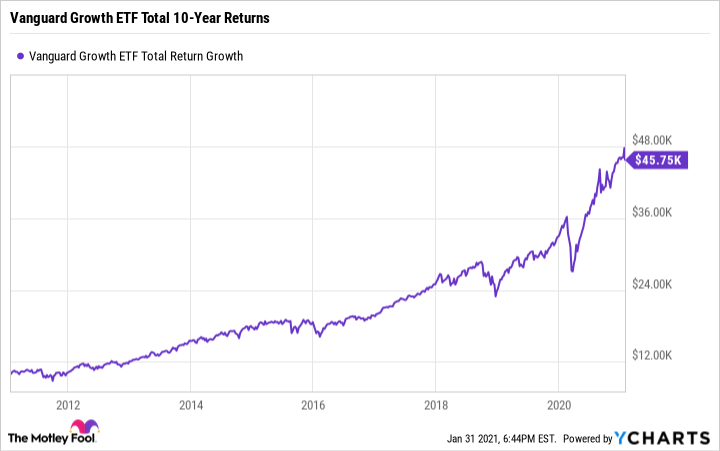

Vanguard's S&P 500 Growth Index Fund ETF invests in 257 U.S. growth stocks. Its benchmark index is the CRSP U.S. Large Cap Growth Index, which is very similar to the S&P 500 Growth Index. A $10,000 investment made a decade ago would be worth more than $45,000 today. That works out to an annual return of about 16.4%. It also has an ultra-low expense ratio of 0.04%, meaning that just $4 of a $10,000 investment goes toward fees.

How could $7,000 send your kid to college?

If you invested $7,000 up front and then added another $200 a month for the next 10 years and earned 16.4% per year, you'd have a little less than $88,000 after a decade. Of course, this number will vary hugely based on your actual annual returns, along with your return sequence. And past results offer zero guarantee of future returns.

We're assuming your child will attend a four-year, in-state public university. We're also only covering the costs of tuition and leaving out other expenses, like room and board. The average cost of in-state public university tuition for 2020-21 is $9,580 a year, according to the education research website EducationData.org.

College tuition has increased at about three times the annual inflation rate over the past 20 years. So if you assume tuition will increase at 7% over the next decade, a parent whose child is 10 years away from college can expect to need $83,672 to cover four years of tuition at an in-state university.

If you want your child to attend private school and you're planning to pay for it, be prepared to shell out a lot more. The average private school tuition for 2020-21 is $37,200.

VUG Total Return Level data by YCharts.

Is a growth fund right for college savings?

Because the Vanguard ETF's investment style is aggressive (meaning high risk, high-return), it may not be the place you want to park your child's entire college fund. It's also not a good choice if your child is less than 10 years away from their college years. The closer your child is to college, the more conservatively their tuition money should be invested.

Timing can be even trickier for education funds than it is for retirement. You can often work an extra year or two if the stock market doesn't cooperate with your retirement plans. But you probably don't want your kids to delay college for a couple of years so that their college funds can recover.

It's OK if throwing $7,000 into an ETF for your child's future education expenses isn't an option right now. Financial aid is a possibility for most students. Your child could also work part time, earn scholarships, and take out a reasonable amount of student loans. Even if your child's college funds are coming up short, their education isn't doomed.