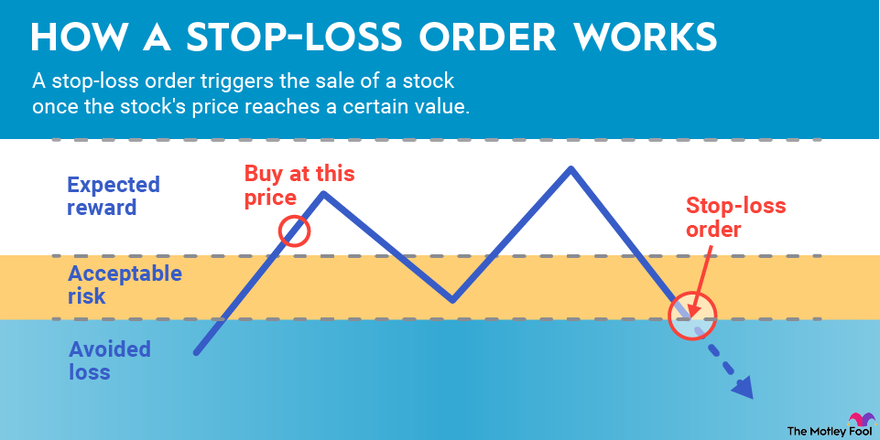

Brokerages execute a variety of stock order types for investors to buy and sell stocks. Most of these order types indicate to the broker an investor's preference to purchase or sell a stock at a desired (or better) price. Other order types enable investors to reduce their risk of losses on trades. A stop-loss order is a type of stock order that enables an investor to limit the potential loss on a stock position by setting a price limit that triggers the stock's trade.

A stop-loss order triggers the sale of a stock (or a purchase for investors buying to cover a short position) once the stock's price reaches a certain value. Investors create stop-loss orders to automatically sell stocks (or cover short positions) once the stock's price reaches the trigger price set by the stop-loss order.

Stop-loss order example

Stop-loss order example

Investors often use stop-loss orders to limit their losses on new positions. Let's say an investor purchases 100 shares of a hot new tech stock of a company that recently completed its initial public offering (IPO) at $25 per share. To limit the potential loss on this stock purchase, the investor sets a stop-loss order at 20% below the purchase price, which equals $20 per share.

If the price of the red-hot tech stock declines to $20, then that triggers the investor's stop-loss order. The investor's broker proceeds to sell the stock at the prevailing market price, which may be exactly at the $20 trigger price but can be much lower, depending on the the nature and timing of the stock's price movements.

Advantages of the stop-loss order

Advantages of the stop-loss order

Investors use stop-loss orders as part of disciplined strategies to exit stock positions if they don't perform as expected. Stop-loss orders enable investors to make pre-determined decisions to sell, which helps them avoid letting their emotions influence their investment decisions.

Other advantages of a stop-loss order include:

- Brokers don't charge for setting up stop-loss orders (although some still charge commissions on the actual trades), making them essentially a no-cost insurance policy to limit losses on investments.

- Routine use of stop-loss orders helps investors become more disciplined about selling losing stocks.

Disadvantages of the stop-loss order

Disadvantages of the stop-loss order

There are disadvantages to using stop-loss orders. First, establishing a stop-loss order doesn't limit an investor's loss to the difference between the purchase price and the pre-determined sale price. If a company reports disappointing earnings after the market closes, for example, then its share price by the start of the next trading day could be well below an investor's stop-loss price.

Another potential pitfall of stop-loss orders is that they can trigger a stock sale even if the stock's price dips only slightly below the trigger price before quickly recovering. If a stock's price is volatile or another event occurs that causes a brief sell-off by other investors, that can trigger an investor's stop-loss order.

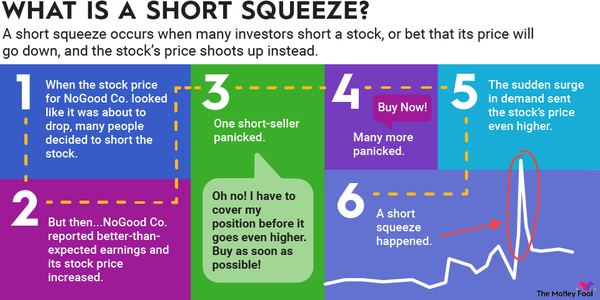

Finally, during sharp market declines, sophisticated investors like hedge fund operators sometimes try to take advantage of the existence of stop-loss orders. Known as "stop hunting," traders short stocks already in decline in order to push prices lower in an attempt to trigger a flood of stop-loss orders. These investors subsequently start buying those same stocks to profit from an expected rebound.

Why do investors use stop-loss orders?

Why do investors use stop-loss orders?

Investors primarily use stop-loss orders to limit their losses on stock positions and reduce their portfolio risks. While stop-loss orders can be useful, it's important to realize they don't always work as intended. Stop-loss orders can also lock in avoidable losses, which is why The Motley Fool favors buying and holding quality stocks to build wealth over long periods of time.