I know it's rude to say "I told you so" -- but I kind of did.

Three years ago, when Northrop Grumman (NOC 0.10%) predecessor company Orbital ATK announced a program to build its very first heavy lift rocket -- the "OmegA" -- I predicted that the rocket "may not get built."

First Orbital's, and later Northrop's desire to grab a piece of the lucrative market for launching large satellites into orbit was certainly understandable -- especially with billions of dollars worth of new Pentagon launch contracts coming up. But the truth was that, between United Launch Alliance's Atlas V, Delta IV, and upcoming Vulcan Centaur rockets, SpaceX's Falcon 9, Falcon Heavy, and envisioned Starship, Blue Origin's planned New Glenn, and the multiple heavy lift rockets being operated abroad by Ariane, by Roscosmos, and by China -- the world was simply awash in big rockets.

There wasn't room for one more.

And now OmegA is once and for all dead.

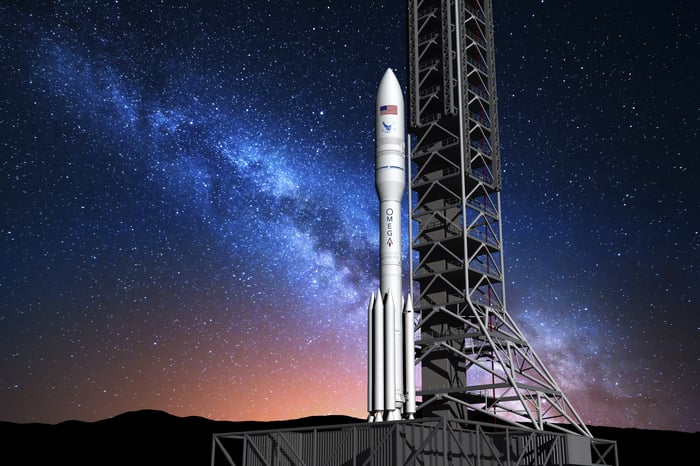

Take a good look. This may be the last time you see a Northrop Grumman OmegA rocket. Image source: Northrop Grumman.

History of a doomed rocket

This story began nearly three years ago, when the U.S. Air Force announced it would pay three rocket companies -- Jeff Bezos' Blue Origin, Boeing (BA 0.01%) and Lockheed Martin (LMT 0.01%) joint venture United Launch Alliance (ULA), and Northrop Grumman -- a combined $2.2 billion to develop new "Launch System Prototypes" for the Pentagon's "Evolved Expendable Launch Vehicle" program.

Blue Origin would use the Pentagon funding to complete development of its planned "New Glenn" heavy lift rocket, ULA would invest its money in "Vulcan Centaur," while Northrop Grumman would try to break into the market with its very first heavy lift vehicle -- "OmegA." Then all three would bid on a second set of "Launch Service Procurement" contracts to use these new rockets to launch U.S. government satellites into orbit.

Two years later, the other shoe dropped: Despite initially winning financial support from the Pentagon, neither Blue Origin nor Northrop Grumman would win any of this second batch of contracts. All $5.5 billion worth of launches over the next six years would go to ULA (which also received funds in the first round), and to SpaceX (which didn't).

Result: By the time 2028 rolls around, and it's time for the Pentagon to award another set of launch contracts, the only rockets that are still flying, and able to compete, may be ULA and SpaceX rockets. Northrop Grumman is out of the big rocket-building game, and despite plenty of positive press, even Blue Origin's success is not assured.

You don't need to tell us twice

Giving credit where credit is due, Northrop Grumman tried to prepare for this eventuality. Hoping to diversify its business to survive a possible Pentagon contract loss, in late 2019 Northrop signed a launch contract with Colorado-based Saturn Satellite Networks to launch a pair of commercial NationSat small GEO satellites into orbit on OmegA's inaugural launch.

Perhaps, if Northrop had succeeded in signing up additional commercial customers, it could have developed a big enough book of business to survive the loss of the Pentagon business. Commercial customers proved hard to come by, however, and so within weeks of learning it had lost the competition for Pentagon launch contracts, Northrop announced it would halt development of OmegA.

Last month, Space Force put the final nail in the coffin, confirming it has officially terminated funding through Northrop's (and Blue Origin's, too) development contract. Of the $792 million initially awarded to Northrop, the government says it had paid out only $532 million by the date of termination. Blue Origin received $256 million of its awarded $500 million, before it too was cut off.

What's next for Northrop Grumman and Blue Origin?

In the absence of both commercial contracts and federal funding, the OmegA program is now history. Going forward, Northrop's space business will comprise primarily (1) building solid rocket boosters for other companies' spaceships (ULA's Vulcan Centaur for example, and the NASA Space Launch System, for which Boeing is prime contractor); (2) launching smaller payloads aboard medium-lift Antares and small Minotaur rockets; and (3) building nukes for the military.

As for Blue Origin, it's keeping hope alive, pressing forward with the development of New Glenn on its own dime, and hoping to bid for upcoming NASA launch business. More successful than Northrop in the commercial market, Blue Origin has also secured launch contracts for customers including Eutelsat, Mu Space, OneWeb, Sky Perfect JSAT, and Telesat, giving it a diversified revenue stream that may keep it in business long enough to bid again once the Pentagon reopens bidding on new lucrative defense contracts several years from now.

That's assuming, of course, Blue Origin can get New Glenn built and tested. Its first launch is now scheduled to take place late in 2021.