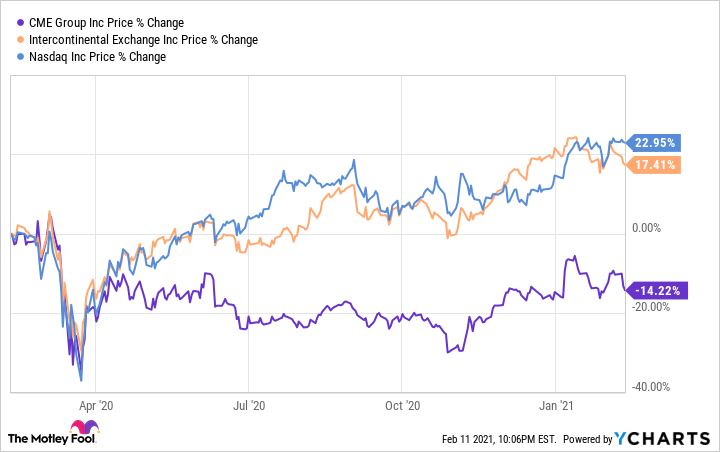

The past year has generally been good for market exchanges. However, CME Group's (CME -0.15%) stock performance has lagged the stock exchanges like Intercontinental Exchange (ICE 0.28%) and Nasdaq (NDAQ 0.28%). We have seen bull markets in stocks and bonds this year, so it would seem that CME would perform well. In fact, we have seen a tremendous bull market in bonds driven by Fed intervention in support of the economy. Yet instead of helping, it is actually hurting.

Why is that?

The global leader in derivatives trading

CME Group houses the biggest derivatives exchanges in the world, including the Chicago Mercantile Exchange (CME) and the Chicago Board of Trade (CBOT). It also owns the New York Mercantile Exchange (NYMEX) and the Commodities Exchange (COMEX). The group trades futures and options across almost all asset classes, including interest rates, equities, currencies, and commodities. The Group earns revenues from clearing and transaction fees, data, and connection fees.

Image source: Getty Images.

CME just reported its fourth-quarter and full-year earnings, with total revenue rising slightly compared to 2019 to $4.9 billion. Increases in data and interconnection/access fees offset a decline in clearing and transaction fees. The decline in clearing and trading revenues was tied primarily to interest rate products. Net income came in at $2.1 billion, or $5.87 per share, a slight decline from the $5.91 EPS that CME Group earned in 2019.

Interest rates at zero are a problem for CME

Interest rate products include Eurodollar futures, Treasury futures and options, and Fed Funds futures. When the Fed pushed interest rates back down to near zero in response to the COVID-19 pandemic, it also pushed the volatility (in other words, typical price movements) of interest rates down as well. Lack of volatility tends to depress volumes in general. However, in interest rates, it is more pronounced in that further downward moves are impossible, at least for short-term rates. They are zero and cannot go negative. While this is a possibility for longer-term bonds, it is not for the short-term money markets.

If your business theoretically has exposure to falling rates, would you still pay transaction costs to hedge against something that cannot happen? It doesn't make commercial sense. As a result, average daily volumes in the interest rate space (which accounted for about a third of CME's clearing and transaction fee revenue last year) are depressed compared to pre-COVID levels. CME Group has been introducing new products to increase volumes, including interest rate products like the Ultra 10-year futures and yield curve products. In addition, CME has new ethical and social governance (ESG) index products, cryptocurrency futures and options, and carbon derivatives. So, while interest rates may be depressed for the time being, new products will help increase average daily volumes.

CME has lagged the other exchanges like ICE and Nasdaq quite a bit over the past year. While both the stock and bond markets have been in bull markets, the bond market's bull market has been too good, with interest rates about as low as they can go.

Average daily volumes in the interest rate space fell 27% to 6.3 million, from 8.6 million in the fourth quarter of 2019. Average daily volumes peaked in the first quarter of 2020 at 13.8 million as investors reacted to the huge decline in rates.

CME Group is trading at 27 times expected earnings per share of $6.70 per share. This is at a premium to Intercontinental Exchange and Nasdaq, which are trading at 22 times expected 2021 earnings. For that reason, it is hard to get excited about CME while bond trading is depressed. If the prognosticators are correct and the economy recovers in the back half of 2021, then investors will start hedging against future increases in interest rates. But for the time being, CME Group will be the victim of the great U.S. bond bull market.