One year ago, the coronavirus disrupted equity markets to a degree never before seen. The benchmark S&P 500 ultimately lost 34% of its value in less than five weeks before commencing what's been an 11-month mega-rally.

In 2021, it's been retail investors who have disrupted the stock market. Short-term-focused and emotion-based traders on Reddit's WallStreetBets chat room, along with an army of Robinhood retail investors, have descended on dozens of heavily short-sold companies or penny stocks in an effort to send their share prices skyrocketing. In some instances, it's worked.

But the Reddit and Robinhood retail frenzy has created a growing list of publicly traded companies that are wildly detached from their underlying fundamentals. Despite being ultra-popular, you couldn't give me free money to buy the following seven stocks.

Image source: Getty Images.

Sundial Growers

No marijuana stock is flashing more warning signals at the moment than Canadian licensed producer Sundial Growers (SNDL -4.00%). Even though Sundial has drastically improved its balance sheet following a number of share offerings and debt-to-equity swaps (the company holds approximately $610 million in cash at the moment), it's done so by drowning its investors in share issuances. The company's outstanding share count has increased by more than 1 billion since Sept. 30, and its board just OK'd a mixed-shelf offering that could allow it to sell up to $1 billion worth of additional shares. The dilution here is off-the-scales bad.

Additionally, Sundial is transitioning from lower-margin wholesale cannabis operations to higher-margin retail sales. Though it's a smart move for the long run, it's nonetheless well behind other Canadian licensed producers. Following multiple writedowns in 2020, Sundial's operating results confirm this is a stock worth avoiding.

Image source: Getty Images.

GameStop

Video game and accessories retailer GameStop (GME -6.59%) is the poster child of the Reddit frenzy. At one point, retail investors were able to send shares to within a whisker of $500 in pre-market trading in late January. Today, GameStop sits at close to $41, down more than 90% from its intraday high. Nevertheless, it still has plenty of room to fall further.

The issue with GameStop is that it waited far too long to tackle digital downloads. Sure, the company's e-commerce sales are growing by triple digits, but they make up a small percentage of total sales. GameStop has always been brick-and-mortar based, and it's been busy closing some of its stores to reduce costs and backpedal its way back into the profit column. In other words, GameStop is not operating in a position of strength, like its recent share-price appreciation would indicate. That makes it wholly avoidable.

Image source: Getty Images.

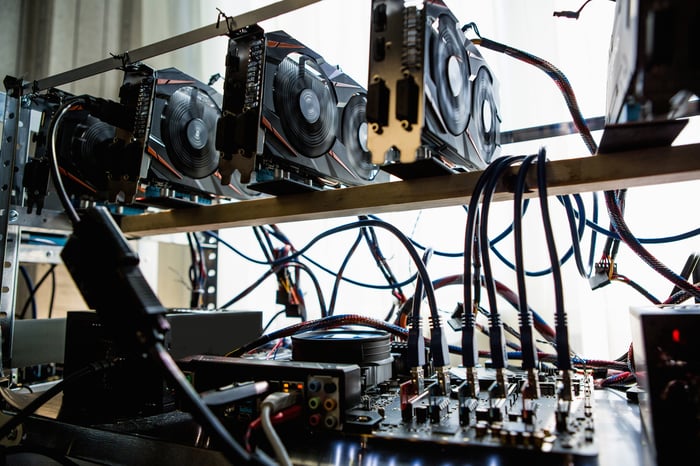

Riot Blockchain

It's no secret: I'm not a fan of Bitcoin (BTC -5.19%). But I'm even less of a fan of Bitcoin mining operations like Riot Blockchain (RIOT -5.82%). Cryptocurrency miners are people or businesses that use high-powered computers to solve complex mathematical equations to validate groups of transactions known as blocks. For validating a block, the miner is rewarded in crypto tokens. The current block reward for Bitcoin is 6.25 tokens, which is worth almost $320,000.

This might sound like a great business model, but the start-up costs are high, and the electricity/maintenance costs of operating a mining farm are sizable. Rather than relying on innovation, Riot Blockchain's shareholders are at the whim of Bitcoin's price movements. If investors are so eager to bet on Bitcoin heading higher, buy Bitcoin. A company like Riot deleverages your potential gains due to its high operating costs and unproven operating model.

Image source: Getty Images.

Bit Digital

To double down, buying cryptocurrency mining stocks is a really bad idea. Even though Bit Digital (BTBT -8.74%) is one of the top-performing stocks over the trailing year, it suffers from many of the same shortfalls at Riot Blockchain. Specifically, shareholders are crossing their fingers and hoping for Bitcoin to go higher, rather than relying on their company to innovate and grow its top and bottom lines.

But there's an added degree of danger that makes Bit Digital potentially more dangerous than Riot Blockchain. In responding to fraud allegations that were levied against the company in January, a press release from Bit Digital contained the following statement: "[T]he Company as a foreign issuer is not required under home country practice to publicly announce its quarterly results." This essentially reads that Bit Digital isn't guaranteed to publicly and transparently allow investors to see what's going on under the hood. That's a big red flag.

Image source: Getty Images.

Osprey Bitcoin Trust

Another popular security I wouldn't buy with free money (and you shouldn't, either) is the Osprey Bitcoin Trust (OBTC -4.43%). As the name implies, this is a trust that holds Bitcoin, which presumably provides an easier way for investors to buy into the crypto frenzy without having to purchase anything on a cryptocurrency exchange or store it in a digital wallet. The Osprey Bitcoin Trust also undercuts its chief rival, the Grayscale Bitcoin Trust, on management fees, 0.49% versus 2%.

But get this: The Osprey Bitcoin Trust ended Feb. 18 with a net asset value (NAV) of $17.75. This NAV accounts for the value of all the Bitcoin Osprey owns, relative to its outstanding shares. However, the Osprey Bitcoin Trust closed at $41.45 on Feb. 18. That's a premium to the actual value of the Bitcoin held by the Trust of 134%! If you're set on buying Bitcoin, this is an absolutely awful way to do it.

Image source: Getty Images.

Blink Charging

Electric vehicles (EVs) may be the future of the automotive industry, but EV charging and network services provider Blink Charging (BLNK -7.66%) looks to have warped many years into the future with its current market cap of nearly $2 billion.

On the bright side, the company completed a public share offering in mid-January that raised $221.6 million in net proceeds. That should be more than enough capital for the company to reinvest in EV charging technology and boost its deployment of EV charging stations.

On the other hand, we're talking about a company that might only have produced $5 million in sales in 2020 and is on track for perhaps double that amount in 2021. EV charging stations are likely to be a highly competitive space, and Blink Charging will have to invest aggressively to stand out. That's a formula for big losses in the years to come.

Image source: Getty Images.

AMC Entertainment

Lastly, you couldn't give me free money to buy into the hype surrounding movie theater chain AMC Entertainment (AMC -6.79%). It's part of the heavily short-sold group of stocks that skyrocketed weeks ago as part of the retail-investor-based Reddit rally.

The issues with AMC are twofold. First, the company isn't guaranteed to survive beyond 2021. It was lucky to be able to raise $917 million through a combination of share and debt issuances, but doesn't appear to have enough capital to make it through the year if the coronavirus pandemic continues to hurt traffic or close venues.

Second, AMC Entertainment's operating model is being disrupted by streaming services. For instance, AT&T subsidiary WarnerMedia plans to release its movies on HBO Max the same time they are slated to hit theaters in 2021. Even if AMC does survive, it'll be a shell of its former self.