Growth stocks have been on fire over the past year as the pandemic has unlocked disruptive market opportunities all over the world. And some of the changes we've seen will change the way we work and interact forever.

Three companies that I think still have upside for growth investors are Snap (SNAP -2.72%), Peloton (PTON -2.24%), and Okta (OKTA -0.65%). Here's why their growth stories are just getting started.

Image source: Getty Images.

The next-generation social network

Snap is the neglected social network play, having taken a back seat in many investors' minds to Facebook , LinkedIn, and TikTok . But the Snapchat app is still a favorite among young people , and Snap itself has become a pioneer in augmented reality. And operationally, the company has quickly improved financial results that once looked pretty shaky.

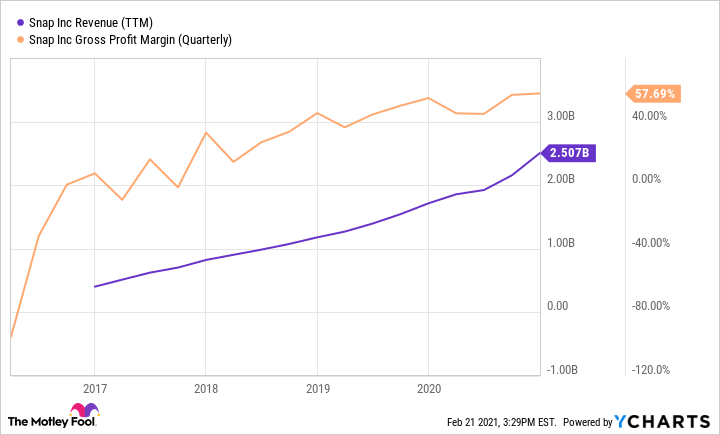

SNAP Revenue (TTM) data by YCharts

To show these improvements on a slightly more granular level, here are some critical operating metrics for Snap:

- Daily active users increased 22% over the past year to 265 million.

- Revenue per user increased 33% over the past year to $3.44.

- Adjusted EBITDA increased from $24 million in Q4 2019 to $166 million in Q4 2020, with margin improving from 8% to 18%.

Results have been volatile, so the improvements I highlighted aren't consistent each quarter -- but directionally, the company is moving the right way. The next step will be transitioning from a net loss to a profit each quarter, which may not be too far away given Snap's current trends.

As we look at what Snap will look like five or 10 years from now, I think we need to look beyond the current use cases for the Snapchat app. Snap has built a suite of tools for developers and advertisers to create even more compelling content: The Camera Kit, Bitmoji for Games, and Lens Studio, along with many other tools, are going to make the app much more compelling and flexible. And that's even before considering the impact of Spectacles, the company's glasses, which are slowly adding AR capabilities. The future is bright for Snap.

Rethinking exercise

It's hard to overstate how quickly Peloton has turned the traditional workout business on its head. The company's bikes were popular pre-pandemic, but the company's hardware and streaming workouts have become essential for millions of people during the pandemic (myself included).

Consider these numbers: In the fiscal second quarter, which ended at the end of 2020, Peloton's connected fitness subscriptions had increased 134% to 1.67 million, and workouts had increased 303% to 98.1 million. So subscribers were up, and usage per user was up nearly double.

There's no question that Peloton is growing like crazy, but shares are expensive, giving the company a market cap of $41 billion and a revenue run rate of only $4.3 billion. But that could look cheap if Peloton doubles its revenue again next year and continues to add on high-margin subscription revenue.

Investors will have to ask themselves how sticky Peloton's business is. If people abandon their Peloton subscriptions to go back to the gym as COVID-19 numbers fall, the stock could indeed be expensive. But if Peloton's business model is the future of fitness and at-home workouts replace gyms for millions of people around the world, this could be a growth stock that's just getting started. I'm bullish on Peloton's future, and think this is a stock that has a long way to grow for long-term investors.

Online security's growth machine

When it comes to securing access for businesses and individuals, Okta has become an industry standard. The company's Okta Verify product can be used with most major apps today, and it can integrated across an organization's services. Its ease of use for developers and users has been critical to the company's growing adoption.

You can see that financial results have improved rapidly for Okta -- and in fiscal 2021 the company expects revenue of $822 million to $823 million, a growth rate of about 40% versus a year ago.

OKTA Revenue (TTM) data by YCharts

Managing passwords and access to different pieces of software across an organization is getting more difficult each year. But Okta is making it easy, and the subscriptions customers sign up for end up being very sticky because they become part of users' everyday sign-in processes. I think Okta is a company that can grow for the foreseeable future -- and with it just now starting to generate a small non-GAAP profit, it has the opportunity to supercharge the bottom line as revenue grows.

Long-term growth stocks

Snap, Peloton, and Okta are all companies that are high-growth today. Furthermore, they're expanding into very large potential markets with opportunity for even further growth. Because they're set up for many years of growth, they could be great investments today.