Although it's not a household name, Peercoin (CRYPTO:PPC) is a pioneer in cryptocurrency. Launched in 2012, it was the first coin to use a proof-of-stake system for processing transactions. This method of achieving network consensus requires relatively little energy consumption, making Peercoin the first green cryptocurrency.

In its early years, Peercoin was one of the top crypto coins. It has since become less popular, but a passionate development team is still working on Peercoin. Whether you're interested in Peercoin as an investment or a part of crypto history, keep reading to learn more about it and how it works.

What makes Peercoin unique

The most unique aspect of Peercoin is that it combines the proof-of-stake and proof-of-work systems to distribute new coins and process transactions. This hybrid system is much more energy efficient than a proof-of-work system alone.

Peercoin also rewards Peercoin holders who participate in staking -- lending their crypto -- and verifying transactions. Peercoin holders who participate in staking or verifying transactions earn Peercoin equivalent to 1% per year of the value staked or owned.

This reward system means that Peercoin has built-in inflation and that there is no maximum supply of Peercoins. Peercoin's inflation rate isn't exactly 1%, though, because those who don't participate in staking or minting transactions receive nothing.

How Peercoin works

Peercoin is a cryptocurrency that can be bought, sold, and used for money transfers. It uses blockchain technology for transaction records.

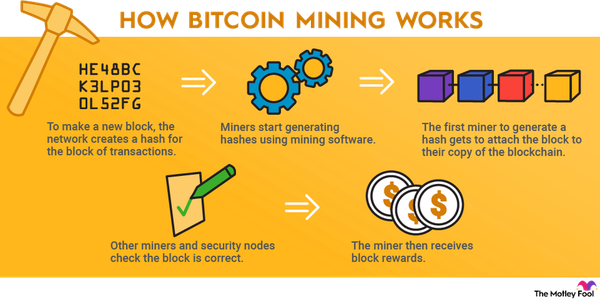

The blockchain is a public ledger that's available for anyone to view. Each block contains transactions, and when a block of transactions is verified, it's added to the blockchain.

Peercoin uses a proof-of-work system for coin distribution. Miners receive Peercoin for solving mathematical problems using mining devices. It's essentially a race to solve complex mathematical problems using specialized mining devices, so the entire process uses a significant amount of energy.

A proof-of-stake system is used for verifying transactions. Anyone who has Peercoin can stake their coins to participate in this process. When you stake Peercoin, you're pledging your coins to the network so they can be used for transaction verification. There's no risk to your coins, and you can unstake them later if you want.

The Peercoin protocol selects the next person to verify a block of transactions based on the number of coins held and how long they've held their coins. There's also randomization involved.

Peercoin technically calls this process "minting" instead of "staking." These terms mean the same thing, but in the time since Peercoin launched, "staking" has become the more widely used term for cryptos that use proof-of-stake systems.

Peercoin used proof of work more in its early days to better distribute coins and decentralize the network. Over time, it has transitioned to using proof of stake more. It will always use a hybrid system, but proof of stake is what it relies on the most.

How to buy Peercoin

It's difficult to get Peercoin because many of the major cryptocurrency exchanges don't list it. One of the larger exchanges that offers Peercoin is Bittrex, which is available for users in most of the U.S. It doesn't let you buy or sell Peercoin with fiat money, though. Instead, you need to trade Bitcoin (BTC 0.16%) for it.

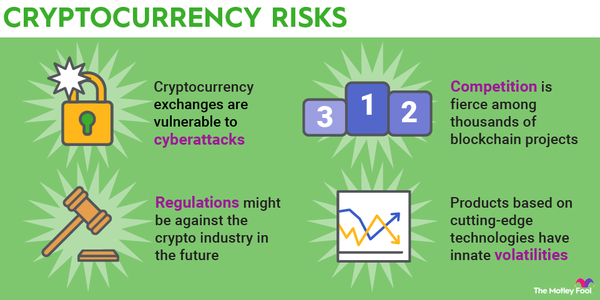

What are the risks of investing in Peercoin?

The main risks of investing in Peercoin are greater competition from eco-friendly cryptocurrencies and its lack of popularity.

Peercoin was the first cryptocurrency to prioritize sustainability, but it's no longer the only one. There are now many coins with smaller carbon footprints that are far more well-known than Peercoin. One example is Cardano (ADA 2.22%), which uses proof of stake. Ethereum (ETH -0.05%) is transitioning to a proof-of-stake system. Both those coins are much larger than Peercoin.

While other coins have been thriving, Peercoin hasn't done nearly as well. In 2013, it was in the top three largest cryptocurrencies. By 2021, it had fallen out of the top 500. Crypto enthusiasts rarely talk about Peercoin. Its small online community isn't very active, and it's hard to buy since so many exchanges don't offer it.

To be fair, Peercoin has been around a long time, and it still has a dedicated team working on it. This isn't a dead project. But it's questionable how much growth potential Peercoin has compared to other cryptocurrencies.

Peercoin vs. Bitcoin

Here are the differences between Peercoin and Bitcoin:

| Metric | Peercoin | Bitcoin |

|---|---|---|

| Release date | Aug. 12, 2012 | Jan. 9, 2009 |

| Maximum coin supply | No maximum | 21 million |

| Consensus protocol type | Proof of stake and proof of work | Proof of work |

| Mining algorithm | SHA-256 | SHA-256 |

| Average transaction time | 8.5 minutes | 10 minutes |

Data source: Peercoin.net and Bitcoin.org.

The most notable differences between those two coins are their maximum supplies and consensus protocols. Bitcoin is deflationary because it has a maximum supply of 21 million. The creators of Peercoin, on the other hand, didn't put a hard limit on the number of coins. And, because of Peercoin's consensus protocol, it uses a small fraction of the energy that Bitcoin does.

Should you buy Peercoin?

In some respects, Peercoin was ahead of its time. It focused on sustainability and environmentally responsible investing years before Bitcoin's rampant energy usage would get media attention. Even if it hasn't paid off as much as other coins, it's notable for introducing proof of stake in cryptocurrency.