Virtual reality (VR) has been around since the 1990s, but it’s only recently starting to deliver on the promises made 30 years ago. While VR is primarily used for gaming and entertainment right now, there’s great potential for the technology in several industries and professions, such as engineering and design, healthcare, defense, and education.

What’s more, virtual reality is only just starting to catch on among both consumers and enterprises. Analysts expect the industry to grow considerably over the next decade. Various research groups forecast a compound annual growth rate of anywhere from 14% to 31% between 2024 and 2030 or beyond.

For those looking to start investing in VR, here are seven of the best stocks to consider.

The best virtual reality stock contenders

The best virtual reality stock contenders

| Company | Ticker | Market Capitalization | Description |

|---|---|---|---|

| Meta Platforms | (NASDAQ:META) | $904.54 billion | A social network company with a leading VR platform called Oculus. |

| Sony | (NYSE:SONY) | $112 billion | An entertainment company whose gaming segment created a VR headset to go with its consoles. |

| Microsoft | (NASDAQ:MSFT) | $2.73 trillion | An enterprise software company working on enterprise applications of VR. |

| Apple | (NASDAQ:AAPL) | $2.81 trillion | A consumer electronics manufacturer with a substantial market share in PCs, smartphones, tablets, and smartwatches. |

| Universal Display Corporation | (NASDAQ:OLED) | $8.36 billion | A developer and licensor of organic light emitting diode (OLED) technology and supplies. |

| Nvidia | (NASDAQ:NVDA) | $1.21 trillion | A chipmaker specializing in graphics processing units for PCs. |

| Unity Software | (NYSE:U) | $14.35 billion | A leader in 3D image creation software. |

1. Meta Platforms

1. Meta Platforms

Meta Platforms, formerly known as Facebook, acquired leading VR technology company Oculus in 2014. It’s since helped the company develop and market its virtual reality headsets and software. In 2017, CEO Mark Zuckerberg said he wanted to get 1 billion people using virtual reality.

The latest iteration of its flagship product, the Meta Quest 2 (rebranded from its previous Oculus Quest name), has received positive reviews and makes getting into VR even more affordable with a lower price point than its predecessor.

The company changed its name to Meta Platforms in late 2021 to emphasize its focus on building the infrastructure to support the metaverse. “We're focused on the foundational hardware and software that are required to build an immersive, embodied internet that enables better digital social experiences than anything that exists today,” CEO Mark Zuckerberg said on the company’s fourth-quarter 2021 earnings call.

As the leader in VR technology and with a CEO who’s very excited about its potential, Meta is a good choice for investors interested in the trend.

2. Sony

2. Sony

Sony developed its own virtual reality headset compatible with its popular PlayStation video-game consoles, the PlayStation VR or PSVR. It was one of the best-selling VR headsets after its 2016 launch, albeit not quite as good as when the Meta Quest 2 launched in 2020. But in 2023, Sony finally updated the more than six-year-old design with the PlayStation VR 2.

PlayStation VR 2 launched in February 2023 at a starting price of $550 -- way higher than the starting price of $400 for the original PSVR. The higher price, however, doesn't appear to be a hindrance to adoption at all. According to an investor presentation, sales during the first six weeks were 8% higher for PlayStation VR 2 compared to the first six weeks for the original PSVR.

PlayStation VR 2 upgrades several items, including the display. And the strong start for sales suggests that consumers may be willing to pay higher prices for higher-quality VR experiences.

3. Microsoft

3. Microsoft

While other hardware and software companies are focused on the consumer space, Microsoft has taken its VR technology directly to enterprise customers. It describes its HoloLens device as an “untethered self-contained holographic device with enterprise-ready applications.” It’s marketing its device to manufacturers, healthcare providers, and educators. The company has its own suite of industry-specific apps and more than 200 partner applications for the device.

Now on HoloLens 2, Microsoft is encouraged by the traction it's gaining. Factory workers at Toyota (TM 0.96%) use HoloLens 2 for training and for hands-free guidance while working. Similarly, Japan's Hokkaido Electric Power Company uses the device to get new workers to do inspections on their own sooner.

Despite some encouraging signs of adoption, Microsoft's HoloLens isn't a total win yet. In 2021, Microsoft signed a contract with the U.S. Army worth up to $22 billion over 10 years. However, in 2023, Congress reportedly denied the military's request for more HoloLens headsets and will wait until Microsoft fixes some issues that led to soldiers getting headaches and feeling nauseous.

4. Apple

4. Apple

Apple was rumored to be working on virtual reality hardware for more than a decade, based on its patent filings. In 2023, rumors became reality as the company finally announced the Apple Vision Pro, igniting an absolute media frenzy.

With a starting price of $3,500, Apple is clearly trying to give consumers a premium computing experience. The Vision Pro overlays digital images on top of the real world. And the device tracks eye and hand movements to avoid using controllers.

Apple typically does a good job of winning significant market share with consumer electronics, even when it’s not the first to market. It's trying to do the same here by announcing the Vision Pro long before it's available for purchase. It won't launch until early 2024, giving app developers time to create things specifically for the Vision Pro. Apple hopes that having apps ready to go at launch will help spur adoption from its base of more than 1 billion iPhone users.

5. Universal Display Corporation

5. Universal Display Corporation

When it comes to VR headsets, investors can't overlook just how important it is to have realistic displays. After all, images are displayed very close to the eyes, which can cause users to notice things they'd overlook at greater distances. This is what motivated Sony to give PlayStation VR 2 four times the image resolution of the original PSVR -- consumers complained about the image quality with the first version.

This is a good reason for investors to like under-the-radar VR stock Universal Display Corporation. The company holds over 5,500 patents related to OLED -- a higher-resolution display technology. The company generates high-margin revenue from licensing OLED technology and supplying the necessary components for manufacturing.

Sony's PlayStation VR 2 uses OLED technology, as will Apple's Vision Pro. And if VR really starts taking off, it's easy to see revenue growing for Universal Display from this source.

Of course, delivering a premium VR experience comes with outsized power requirements -- perhaps you noticed that bulky battery pack for Apple's Vision Pro. Well, Universal Display might be helpful here as well. In 2024, the company anticipates the launch of the blue component for phosphorescent OLED (PHOLED). This is the final step to commercializing PHOLED, which management says is up to four times more energy-efficient than OLED. This could be a massive selling point for companies building VR headsets.

6. Nvidia

6. Nvidia

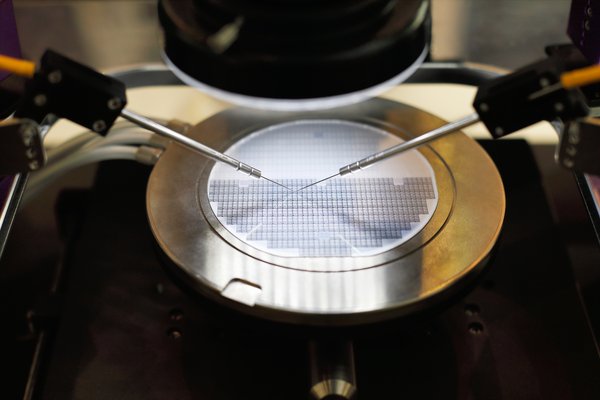

Just as important as the companies building and selling finished products are those that supply essential technology to the hardware manufacturers. Nvidia is the leading graphics processing unit (GPU) designer for PCs and game consoles.

For more advanced VR applications -- not just video games where realism is less essential -- a PC with a high-end Nvidia graphics card is usually doing a lot of the work. The chipmaker has VR-specific designs of its GeForce GTX GPUs, and it’s created a software developer kit (or SDK) for its chips called VRWorks. The SDK helps developers deliver the best performance, produce the highest-quality images, and keep latency (the time from human input to system response) low.

Given the graphic-intensive nature of virtual reality, Nvidia is poised to benefit regardless of which company’s hardware its chips end up in.

Artificial Intelligence

7. Unity Software

7. Unity Software

With VR, there's no point in having high-resolution displays and powerful processors unless there are also quality images to go with it, which is why Unity Software makes this list of best VR stocks.

Unity Software creates tools for 3D image creation that are used by video-game developers, movie studios, industrial companies, and more. But since realism is so important, Unity has real promise in the world of VR.

Indeed, Apple announced a partnership with Unity when it announced its Vision Pro. The two companies are collaborating to make it easier for developers to use Unity when making things for Apple's VR headset.

As adoption grows, it's likely more developers will look to Unity's image-creation tools when building quality VR content.

Related investing topics

Adding virtual reality to your portfolio

Adding virtual reality to your portfolio

There are several ways to invest in the future of virtual reality. From consumer hardware to enterprise computing, software companies, and chipmakers, all present various opportunities to invest in this fast-growing industry.

The seven companies above represent just a handful at the top of the field. There are many others working to develop and further the adoption of VR, which should fuel growth across the industry.