The number of U.S. households that buy pet products online has shot up big time in recent years. More than 13 million American households bought pet products online in 2018 compared to just 3.5 million in 2013, according to a third-party estimate. The American Pet Products Association (APPA) estimates that online sales of pet products jumped 53% year over year in 2019.

Reaction to the coronavirus outbreak gave this market a nice shot in the arm in 2020, as pet parents had to rely on online channels to procure supplies for their pets in the midst of shelter-at-home orders used to contain the pandemic. Chewy (CHWY -3.27%) was one company that won big from this shopping change. Share prices for the online pet products retailer tripled in 2020, driven by a massive spike in sales supported by strong customer additions and increased sales per customer.

However, Chewy's share prices have pulled back substantially over the past couple of weeks.

There are concerns that Chewy may lose momentum in a post-coronavirus world as people return to their normal lives, erasing the advantages that work-from-home stocks have enjoyed over the last year. But savvy investors should think of using the double-digit percentage price drop in Chewy shares to buy more, as the online pet retailer still has a lot of room to grow.

Chewy is sitting on a big opportunity

Around 67% of American households include pets, according to the APPA's National Pet Owners Survey for 2019-2020, up from 56% of households in 1988 when the survey was first conducted. APPA's latest survey also noted that there were nearly 85 million households with pets in the U.S. When you factor in that less than 20% of pet-owning households bought pet products online in 2018, there appears to be plenty of opportunities for the U.S. online pet retail market to grow.

What's more, pet parents have been spending more money with each passing year. Nielsen estimates that annual spending on pet food increased 36% between 2007 and 2017. Another thing worth noting is that the industry has shown remarkable resilience even in times of recession. Spending on pet products was up 7% and 5% during the recessions of 2001 and 2008, respectively.

All of this bodes well for Chewy, as the pet products industry is expected to generate $281 billion in revenue by 2023, according to a third-party estimate. Another report estimates that a fourth of that spending (roughly $70 billion) will happen online, which means that Chewy has significant room to expand its top line -- its trailing-12-month revenue is only $6.46 billion.

Image source: Getty Images

Chewy is already capturing a big chunk of the shift to online sales in the pet retail space, according to comments made by management on the company's September 2020 earnings conference call:

Industry data provider Packaged Facts predicts that online pet product sales in the U.S. will increase by $3.9 billion this year, with online sales gaining five points of market share year over year to reach 27% of all pet product sales. Against that backdrop, the midpoint of our 2020 guidance has us growing our revenue by approximately $2 billion year over year. In doing so, we would capture over half of the total forecasted growth of online pet product sales this year.

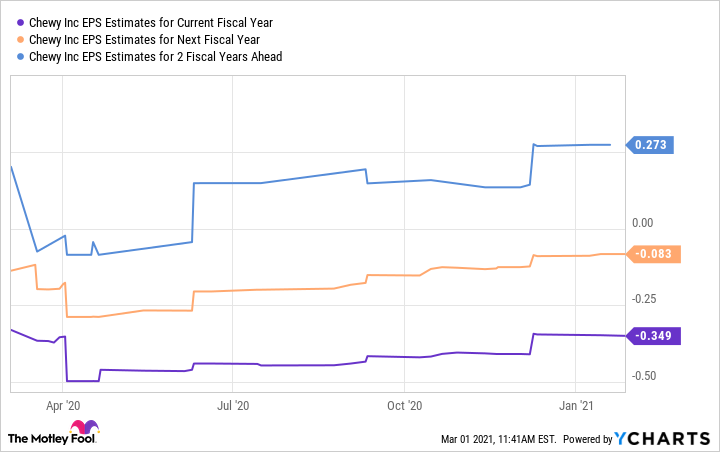

Not surprisingly, analysts expect Chewy to deliver huge sales growth over the next two years. Earnings are expected to clock triple-digit percentage annual growth rates over the next five years, and Wall Street expects Chewy to become profitable in a couple of years.

CHWY EPS Estimates for Current Fiscal Year data by YCharts

Time to buy the dip

If you have been waiting on the sidelines and have missed Chewy's hot stock market rally over the past year, now would be a good time to get into the act and buy this growth stock. Secular tailwinds in the online pet retail market should help Chewy sustain its terrific pace of growth in the coming years, especially considering that it is making a big dent in this market by cornering a substantial portion of new online sales.