They say it takes money to make money, and there's some truth to that. Investing, for example, is a great way to grow wealth, but to get started, you need to pump some money into a brokerage account and buy stocks.

But what if you're low on funds? The good news is that you don't need a ton of money to begin investing. But if you're looking to stretch a modest budget, it pays to consider fractional shares for your portfolio.

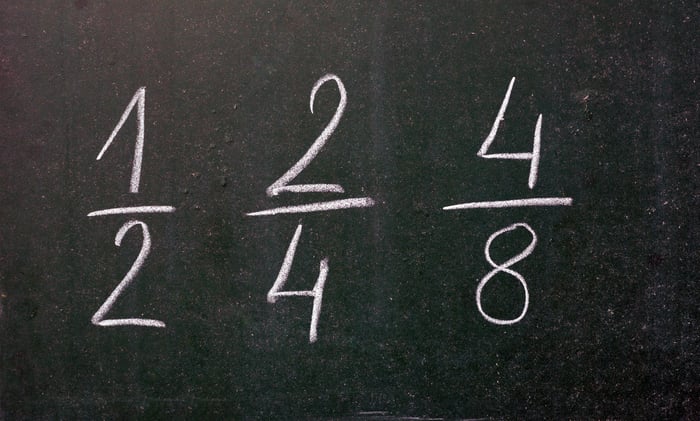

Not familiar with the term? Fractional shares allow you to buy a portion of a share of stock if you can't swing a full share. Keep in mind that stock prices can run the gamut from a few dollars to a few thousand dollars for a single share. As such, while $100 might buy you two shares of one company, it might only buy you a quarter of a share of another.

Image source: Getty Images.

Not all brokerages let you buy fractional shares, and some stocks aren't available in this format. But fractional shares have become increasingly available in recent years. Here are a few reasons why they could be a very good fit for you.

1. They're affordable

If there's a company you really have your eyes on, you may be tempted to raid your savings if you don't have enough money to buy a full share. But that's a dangerous move -- you need money in savings for a rainy day and shouldn't be tapping your emergency fund in order to invest. The great thing about fractional shares is that they're affordable -- you can use whatever funds you have at your disposal to invest in the companies you're interested in without having to go to unhealthy extremes to scrounge up more cash.

2. They allow you to diversify

A diverse portfolio can help you grow wealth over time, while offering you some protection during periods of stock market volatility. In fact, as a general rule, you should aim to own at least a dozen different stocks.

If full shares are out of your budget, fractional shares are a great alternative. This way, you get the same diverse mix at a price point you can afford.

3. They're much safer than penny stocks

Investors on a budget are often drawn to penny stocks, which are companies with shares trading for under $5 apiece. Penny stocks may seem like a good deal -- after all, they're cheap enough that you can scoop up a bunch of them and diversify your portfolio.

But penny stocks can be a dangerous investment. For one thing, many of the companies behind penny stocks don't trade on a public exchange. As such, they're not bound to the same reporting and disclosure requirements as stocks that trade on major exchanges. The result? You may have a hard time researching those companies to figure out if they're worth investing in.

Furthermore, the companies behind penny stocks are often newer, less established companies. While "new" doesn't always mean "bad," there's something to be said for investing in a company that's been around for several decades or longer. Fractional shares make it possible to opt for the latter so you're not stuck resorting to penny stocks.

If you want to build a successful portfolio but are low on funds, fractional shares are a good place to start. Even if you do have a decent chunk of money to invest, you might still consider turning to fractional shares for companies with stock prices too high for your taste. That way, you get a piece of the action without having to commit to going all in.