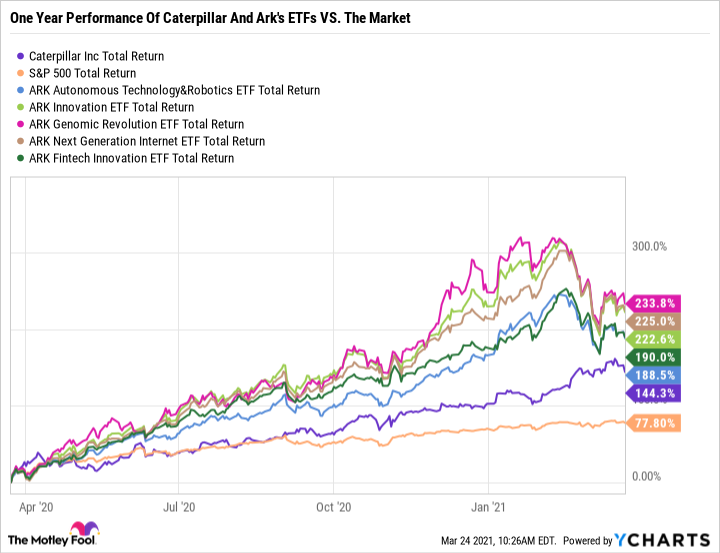

Cathie Wood's five actively managed ETFs all more than doubled last year, handily beating the respectable 16% gain in the S&P 500. As the CEO of ARK Invest, Wood gained international recognition for her steadfast bullish view on Tesla, but she's made plenty of other winning picks as well.

Coming on the heels of the successful passage of a $1.9 trillion COVID-19 relief package, President Joe Biden's $3 trillion infrastructure bill aims to reform social programs, create jobs, build a green electric grid, expand internet access, and more. Wood's Ark Autonomous Technology & Robotics ETF (ARKQ -0.30%) is chock-full of companies set to capitalize on an economic rebound, including Caterpillar (CAT -0.11%), Deere & Company (DE 0.94%), and Komatsu (KMTUY 1.28%). With that, we asked some of our contributors if they thought these three industrial stocks were buys. Here's what they said.

Image source: Getty Images.

Caterpillar's upswing has finally arrived

Daniel Foelber (Caterpillar): Pictures of Biden campaigning through the Midwest surrounded by legacy Caterpillar equipment and a "Build Back Better" banner set the stage for the world's largest construction machinery manufacturer to get to work. Caterpillar is a cyclical business that tends to boom and bust to the tune of the broader economy. To its credit, Caterpillar has done an impressive job diversifying its sales around the world. In fact, over half of its sales are now generated outside North America -- which has helped its performance throughout the pandemic. Caterpillar continues to expand its manufacturing capabilities and product offerings in China, which is one of its hottest growth regions right now.

Caterpillar is mostly known for its construction equipment, which has a clear-cut role to play in building back the economy. But the company's energy and transportation segment has grown significantly over the past few years and benefits from higher oil prices. Due to the strength of its balance sheet, Caterpillar was able to buy Weir Group's oil and gas division at an opportune time last year -- which fits nicely into Caterpillar's well service and drilling products portfolio.

CAT Total Return Level data by YCharts

Even without the infrastructure bill, Caterpillar is forecasting that 2021 will be a year of growth as dealer inventories begin to rise and the company prepares for an upswing in the business cycle. Interrupted by the U.S.-China trade war and then the COVID-19 pandemic, Caterpillar hasn't experienced a sustained boom in nearly 10 years. With over 25 years of consecutive annual dividend raises, Caterpillar has proved its resilience through difficult market cycles. Shares of Caterpillar are near an all-time high as Wall Street buckles in for what could be record revenue and earnings in the coming years. Cathie Wood seems to share this positive outlook. With a 1.9% dividend yield and plenty of growth prospects, Caterpillar's stock is one to watch. Considering its shares have risen over 140% in the past year (and Caterpillar has yet to book the great numbers everyone thinks it will), it may be best to take a wait-and-see approach to make sure Caterpillar can justify its high valuation.

John Deere is also an infrastructure play

Lee Samaha (Deere): Although the company is better known for its iconic agricultural machinery, Deere is also a global leader in road construction equipment and forestry. Back in the pre-pandemic year 2019, its construction and forestry segment was responsible for roughly half as much operating profit as its agriculture and turf segment.

Deere's road construction activities received a boost following the $5.2 billion acquisition of Germany's Wirtgen in 2017. The deal added Wirtgen's milling, processing, paving, compaction, and rehabilitation solutions to Deere's existing strength in excavators and earth-moving equipment. Consequently, Deere is now a leading beneficiary of infrastructural spending on road building and maintenance.

Deere's management already expects its construction and forestry segment sales to increase by 17% to 23% from $8.9 billion in fiscal 2020 to between $10.5 billion and $11 billion in 2021 on the back of a reopening of the global economy.

Meanwhile, its agricultural equipment sales should grow thanks to improving crop prices, a replacement cycle in equipment, and Deere's wildly popular smart farming solutions. All told, 2021 is going to be an excellent year for the company, and an infrastructure bill will be the icing on the cake.

Building a better America with help from the Land of the Rising Sun

Scott Levine (Komatsu): No, you're not experiencing deja vu. The current discussion surrounding the infrastructure bill likely seems familiar because it's a topic that politicians on both sides of the aisle frequently address, whether it's during a campaign or when they're in office. Former President Donald Trump, for example, espoused enthusiasm for infrastructure spending early in his presidency. While Trump's plans didn't come to fruition, though, Biden's recent success with the $1.9 trillion stimulus bill hints that another legislative victory may be possible.

Perhaps that's one of the reasons why Komatsu holds such a prominent position in the Ark Autonomous Technology & Robotics ETF. As of March 25, shares of the construction equipment manufacturer, headquartered in Japan, were the 10th-largest holding in the fund, representing about 3.3%. Should the infrastructure legislation make it to Biden's desk and receive his signature, Komatsu's equipment will undoubtedly be in high demand. From excavators to bulldozers to dump trucks, Komatsu's equipment will be an important element in potential modernization of our bridges, highways, and other infrastructure.

The second-largest construction equipment manufacturer (behind Caterpillar) in terms of global sales, Komatsu has already seen demand for its equipment improve throughout 2020. Whereas North American demand for its construction and mining equipment in the first two months of fiscal 2020, April and May, had plummeted 34% in each month compared to 2019, demand has risen steadily in the subsequent months. In November and December, for example, demand was only down 4% and 1%, respectively, year over year. (The company doesn't disaggregate data for the U.S. market.) Management and shareholders are undoubtedly paying close attention to the improving market demand. In 2019, North America represented the largest market, 26%, of construction, mining, and utility equipment sales. For context, the next two highest markets, Japan and Europe, accounted for 14% and 10% of similar sales, respectively.

For investors who are both interested in following Cathie Wood's lead and intent of finding an infrastructure-related stock, shares of Komatsu can be found in the bargain bin. The stock is currently trading at 8.3 times operating cash flow, a discount to its five- year average multiple of 11.9. Similarly, the stock seems inexpensive in terms of its price-to-sales ratio. Although Komatsu is trading at 1.5 times sales -- slightly higher than its five-year average ratio of 1.2 -- it still seems cheap in comparison to the S&P 500's P/S ratio of 2.8.