At its current share price, pipeline operator ONEOK (OKE 0.55%) offers investors a dividend yield of close to 8%. And while that's significantly lower than the 15%-plus yield that it was sporting six months back, it is still extremely attractive. Also, few investors would complain about a stock doubling, which is what it did over that period to shrink the yield so dramatically.

So why is ONEOK paying such a hefty dividend, and what can investors expect from it in the future?

ONEOK's gathering and processing earnings are a bit volatile

At the beginning of 2020, ONEOK's stock price plunged by more than 75%, and it's still down by more than 35% from its peak. The company's earnings got impacted by the demand destruction resulting from the coronavirus. ONEOK's gas gathering and processing operations are the most exposed to fluctuations in demand and commodity prices. Another business area where ONEOK's earnings are exposed to commodity prices is its optimization and marketing segment, where the company seeks to earn income by exploiting location or product price differentials.

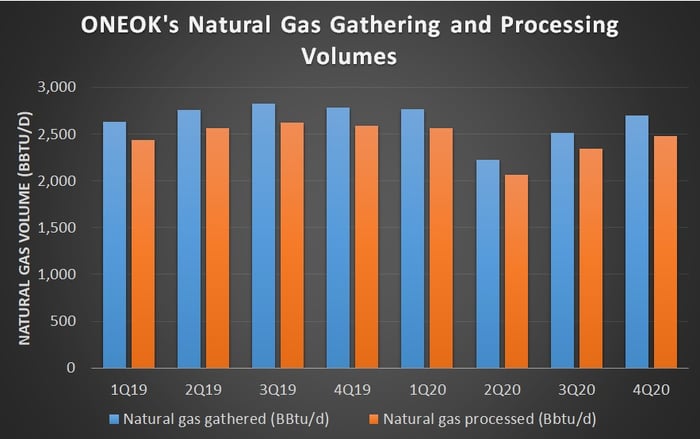

In 2020, lower oil and gas production impacted ONEOK's gas gathering and processing volumes, and its earnings.

Data source: ONEOK. Chart by author.

As the above graph shows, volumes are recovering, though they remain lower than in 2019. ONEOK expects its natural gas gathered volumes this year to land in the range of 2,475 BBtu/d (billion British thermal units per day) to 2,830 BBtu/d. At the midpoint, this implies a growth of 4% over 2020 volumes. Similarly, it expects its processed volumes to grow by 7% in 2021.

The good thing is that ONEOK's other segments more than made up for the declines in its gathering and processing earnings last year. That enabled company to post higher earnings for the year, despite the pandemic.

ONEOK's earnings are largely fee-based

ONEOK's adjusted EBITDA rose 6% last year. More than 90% of its 2020 earnings were fee-based. Higher natural gas liquids volumes and higher gas transport volumes drove its earnings growth. Those NGL and natural gas transport operations give the company's earnings resilience even during challenging energy market environments. At the same time, its vertically integrated operations from gathering to marketing allow it to generate higher earnings when the environment is favorable.

OKE Dividend data by YCharts

Its integrated midstream operations and strategically located assets have allowed ONEOK to grow its dividend payouts faster and more consistently than its peers.

OKE Total Return Price data by YCharts

That also explains ONEOK's higher total returns over the last 10 years.

Tacking on new debt

ONEOK's long-term debt rose from $12.5 billion in 2019 to $14.2 billion at the end of 2020. Higher interest expenses partly contributed to a decline in its 2020 distributable cash flow, even though its EBITDA was up for the year.

Still, the company's net-debt-to-EBITDA ratio improved from 4.8 at the end of 2019 to 4.6 at the end of last year, because its EBITDA rose faster than its net debt did. ONEOK is targeting a net-debt-to-EBITDA ratio below 4 in the long run. It intends to use any additional cash that it generates to pay down debt.

Image source: Getty Images.

Additionally, the company plans to cut down its capital expenditures by 70% in 2021 to conserve cash. ONEOK's distributable cash flow last year covered its dividend payments by 1.2 times. All in all, the company's higher debt shouldn't be too concerning to investors right now.

An attractive buy

ONEOK expects increased energy producer activity this year. That, coupled with its recently completed projects, is forecast to boost its EBITDA by roughly 12% in 2021. If demand and commodity prices don't fall back to last year's levels, ONEOK looks well-positioned to meet its expectations.

ONEOK's fee-based earnings, its vertically integrated and strategically located assets, and its capital projects should allow it to continue generating peer-leading growth in the long term. Overall, not only does the stock's yield look to be sustainable, but the company looks poised for long-term growth as well.