What happened

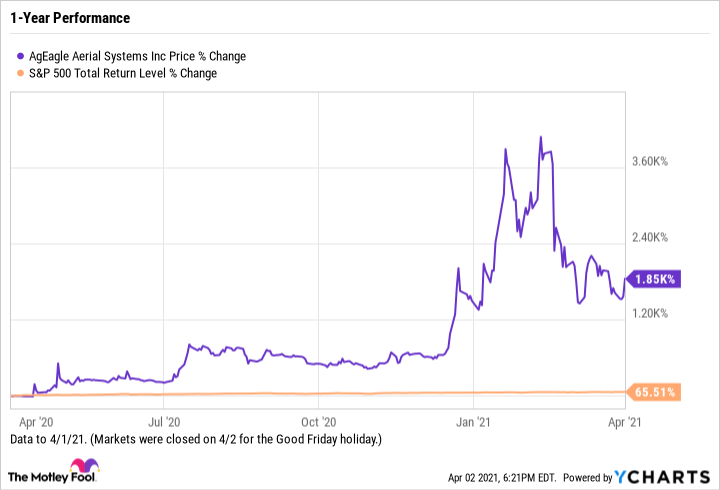

Shares of AgEagle Aerial Systems (UAVS -2.90%), a drone solutions provider, fell 22.7% in March, according to data from S&P Global Market Intelligence.

For context, the S&P 500 index returned 4.4% last month.

Image source: AgEagle.

So what

March performance

We can probably attribute AgEagle stock's weak performance last month largely to market-related factors, rather than more company-specific ones. Shares of many highly valued so-called growth stocks, especially ones whose prices have soared recently, pulled back last month. AgEagle stock certainly fits the bill, as this chart shows.

Data by YCharts.

April performance

AgEagle stock kicked off April on a powerful note. It gained 16.8% on Thursday, April 1, following the company's release the prior afternoon of its 2020 results. Investors were likely pleased with the strong revenue growth and positive comments from management.

In 2020, AgEagle's revenue rocketed 333% year over year to about $1.3 million. The company attributed the increase primarily to "orders to manufacture and assemble drones and related drone delivery product" for its "large e-commerce client.'' It has not named this customer, resulting in wild speculation. Revenue also got a boost from new customers within the agricultural market licensing the company's aerial imaging and analytics solutions.

Bottom-line results deteriorated. In 2020, AgEagle posted a net loss of $14.0 million, or $0.35 per share, compared to a net loss of $2.7 million, or $0.17 per share, in 2019.

Now what

AgEagle is a very small company, and profitability is not in sight. Its stock is speculative and volatile. Risk-tolerant investors should do much due diligence before deciding to invest in this company.