Shareholders should certainly get a say when companies are making transformational changes. And it's obvious that all of the involved parties need to agree to move forward with acquisitions or mergers. But it's easy to forget that companies can only proceed with their plans to purchase one another or merge if they have the consent of regulatory authorities, too.

Much to management's chagrin, the giant of gene sequencing hardware, Illumina (ILMN 2.40%), recently got a sharp rebuke in the form of an administrative complaint and federal lawsuit from the Federal Trade Commission (FTC) regarding its intended acquisition of GRAIL, a cancer screening company. The FTC's lawsuit alleges that the deal "will diminish innovation in the U.S. market for multi-cancer early detection (MCED) tests." That's a bit odd, considering that in 2017, Illumina originally spun off GRAIL from itself without any prompting from regulators. Regardless, it will fight the FTC's challenge however it can, and the saga is far from over.

In the meantime, it's understandable why the problems with regulators might give potential investors pause. Is Illumina going to be in trouble if the acquisition falls through?

Image source: Getty Images.

GRAIL was never going to be Illumina's centerpiece

For a company whose bread and butter is making tools that clinicians and scientists use for general-purpose gene sequencing, cancer diagnostics is a logical place to look for future growth opportunities. Thus, the acquisition was originally conceived as a way for Illumina to reintegrate GRAIL. If approved, the transaction would cost $8 billion in cash and stock, and it wouldn't add any new capabilities to Illumina's core product offerings. That's because GRAIL's appeal is in screening and diagnosing 50 different cancers with its all-in-one Galleri blood test. A completed project like Galleri could be a lucrative addition to the Illumina portfolio in 2021, even if it wasn't in operating condition when the pair split ways in 2017. Reincorporating GRAIL would thus open up the possibility of diversification and thereby hedge against the risk of smaller sequencing companies stealing market share.

GRAIL is hardly a must-buy for Illumina's continued success, however. In fact, if GRAIL had followed through on its planned initial public offering (IPO) in 2020, it might never have tried to reunite with Illumina. Nor is Illumina short on juicy growth initiatives to invest in. In 2020, the company made a slew of advances in nanotechnology pertaining to the throughput of its equipment. Management estimates that the breakthrough could eventually reduce the cost of goods sold for some of its sequencing hardware by about 90%. That will doubtlessly help Illumina continue to achieve its longstanding goal of driving down the cost of highly accurate sequencing of whole human genomes, potentially by a factor of six over the next few years.

Breakthroughs aside, Illumina's finances look good. Despite the pandemic, it registered record orders for new sequencing equipment in the fourth quarter of 2020. It predicts that revenue could grow by up to 28% in 2021.

Illumina is still top dog in the sequencing market

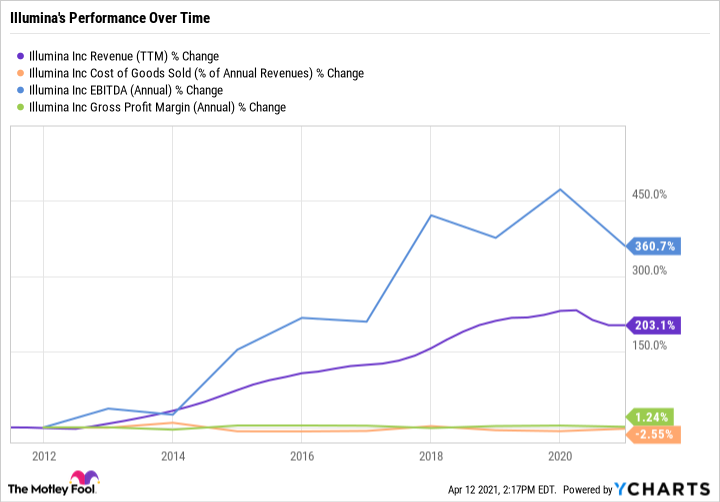

Perhaps the most compelling reason that investors should still consider buying Illumina if the GRAIL acquisition fails is that the business is reliably improving over time while maintaining its lead over competitors. In the past decade, the company has grown its revenue, earnings, and gross profit margin while shrinking its cost of goods sold as a percentage of revenue. All the while, its research and development (R&D) groups have made successively more sophisticated sequencing hardware, giving customers in-demand features while preventing sequencing costs from significantly rising.

ILMN Revenue (TTM) data by YCharts

Even amid difficulty with regulators, Ilumina's stock is performing powerfully as a result of a better-than-expected sneak peek into its upcoming earnings report in which management revised its 2021 revenue forecast upward. Investors will get the full rundown in the full report on April 27, but until then, it looks like it'll be a strong year.

The next few years will see several new product launches, not to mention ongoing improvements to operating efficiency. In short, I'd be completely comfortable with buying Illumina's stock even if the FTC sinks the GRAIL purchase. While GRAIL might be a nice addition to the company's capabilities, Illumina hardly needs the extra revenue to be a worthwhile pick.