What happened

Shares of gold and silver miner Coeur Mining (CDE 8.45%) rose just about 10% on May 3. However, by roughly 2 p.m. EDT the stock had given back some of its gains and was sitting with an advance of about 8%. There wasn't any material news out of the company today, which likely means that the driver of the gain was a bit more basic.

So what

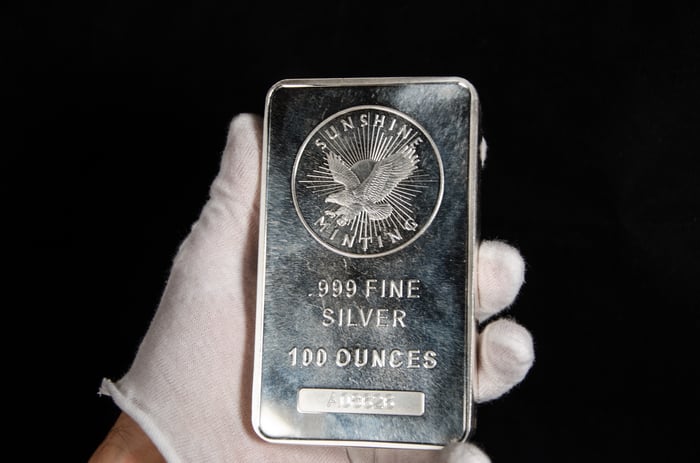

Coeur is, as its name implies, a miner, which means that its top and bottom lines are driven by the products it brings up from the ground. In the first quarter, roughly 68% of the company's top line was tied to gold, with the remainder driven by silver. It's common for precious metals miners to produce more than one metal, as gold and silver (and other metals, like copper) are often found in the same location. However, Coeur's exposure to silver (roughly 32% of sales) is fairly material for a precious metals miner, and that likely played a big part in today's gain.

Image source: Getty Images.

To put some numbers on that, gold prices were up around 1.4% at 2 p.m. EDT, which is a notable move. However, silver is often a lot more volatile, and that was the case today, with the precious/industrial metal higher by 4.3% -- a move that was roughly three times the size of gold's advance. Thus, Coeur, with notable exposure to the metal, also saw a notable price move relative to miners with less silver in the mix. This is what you would expect and is actually a pretty important issue to keep in mind with Coeur. Indeed, the stock can exhibit elevated volatility that might come as a surprise if you didn't know about the notable silver component here.

Now what

Generally speaking, a precious metals miner like Coeur isn't the type of stock that long-term investors should be buying because of one day's move, up or down. It is a far better idea to look at gold and silver miners as diversification instruments, which completely changes how you should consider them within your portfolio.