Shopify (SHOP 4.52%) recently posted first-quarter numbers that easily beat Wall Street's expectations. The e-commerce platform's revenue rose 110% year over year to $988.6 million, accelerating from its 94% growth in the fourth quarter and beating estimates by $130 million.

Its merchant solutions revenue grew 137% to $668.0 million, and its subscriptions solutions revenue increased 71% to $320.7 million. Its GMV (gross merchandise volume), or the value of all goods sold on its platform, skyrocketed 114% to $37.3 billion.

Image source: Getty Images.

Adjusted net income jumped from $22.3 million year over year to $254.1 million, or $2.01 per share. On a GAAP basis, which includes a $1.25 billion unrealized gain from the Affirm IPO in January, it posted a net profit of $1.26 billion -- compared to a loss of $31.4 million a year ago.

Shopify didn't provide exact guidance for the full year, but it doesn't expect to top its pandemic-driven growth in 2020. However, analysts still believe revenue and adjusted earnings can rise 51% and 7% this year, respectively.

These numbers all suggest Shopify is still a great growth stock, but it already trades at nearly 250 times forward earnings and over 30 times sales. The bulls will claim the company's strengths support that premium, but the bears will argue its valuation is unsustainable. Let's see who's right.

The bullish take on Shopify's valuation

The bulls will claim disruptive companies like Shopify deserve higher valuations.

The company's decentralized approach to e-commerce, which empowers small businesses to open their own online stores instead of relying on big online marketplaces like Amazon, is certainly powerful. Its tools make it easy for merchants to set up their e-commerce websites, process payments, fulfill orders, and manage their own marketing campaigns.

The bulls will also point out that while Shopify's price-to-sales ratio is historically high, it has risen at a much slower rate than its stock price.

Data by YCharts.

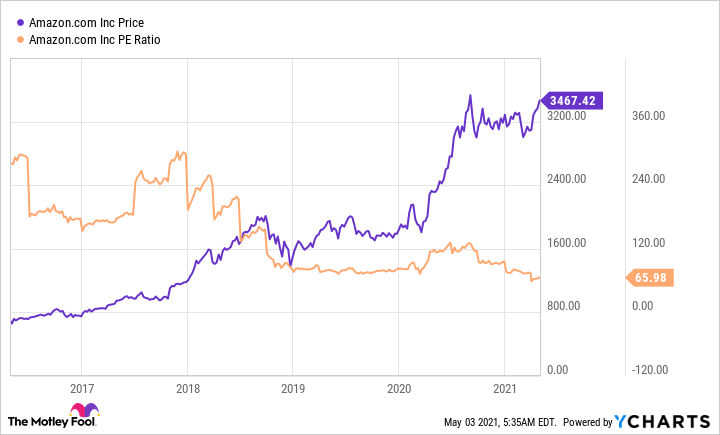

In other words, investors who wrung their hands over Shopify's high valuation missed out on its massive gains since its IPO in 2015. Profits are also climbing, which indicates its frothy P/E ratio could cool off in the same way Amazon's P/E ratio has contracted even as its stock price has risen over the past five years.

Data by YCharts.

The bearish take on Shopify's valuation

On the other hand, the bears will point out Shopify is far from the only contender in e-commerce services. Adobe's Magento, BigCommerce, WooCommerce, and Square all provide similar offerings for businesses to set up online stores, process payments, and fulfill orders.

Shopify is one of the market leaders, but it doesn't comfortably dominate the entire e-commerce services sector yet. Therefore, tougher competition could throttle Shopify's ability to raise prices and cross-sell new services to stabilize its bottom-line growth.

The critics also claim Shopify ignores problems with merchants that sell fake products and defraud consumers. Last December, FakeSpot -- which designs a browser extension that helps shield shoppers from fraudulent sellers -- raised red flags on 21% of its analyzed Shopify sites.

Rivals likely face similar challenges, but bad PR of this nature can tarnish Shopify's brand and erode its competitive defenses. Moreover, Shopify's share count has consistently risen over the past five years as it raised cash through new share offerings and subsidized its employees' salaries with big stock bonuses.

Data by YCharts.

That ongoing dilution makes it even tougher for Shopify's valuation to cool off. And in the near term, investors could keep selling out of frothy growth stocks as rising bond yields spark a rotation into value.

Just ignore it?

Shopify stock is expensive, but it's arguably wiser to focus on its long-term growth potential than its current multiples.

The company can keep growing as more merchants avoid crowded third-party marketplaces like Amazon and eBay. Meanwhile, its subscription-based services will likely lock in more merchants and widen its competitive moat.

It will inevitably suffer growing pains along the way, but investors who overanalyze price-to-earnings and price-to-sales metrics have already missed out on the company's multibagger gains, not to mention the upward trajectory that could very much continue long term. If all goes well, buying Shopify today might not be all that different from buying Amazon about five years ago.