Qorvo (QRVO -2.86%) looked all set to crush Wall Street's expectations going into its fiscal fourth-quarter earnings report on the back of the 5G smartphone revolution and the resounding success of Apple's (AAPL -1.23%) iPhone 12 lineup, and it didn't disappoint.

The supplier of radio-frequency (RF) wireless solutions delivered eye-popping revenue and earnings growth during the quarter. The guidance, not surprisingly, turned out to be fantastic as Qorvo seems to be reaping rich dividends from the booming sales of 5G smartphones that have gained critical mass in 2021.

It isn't too late for investors to buy this high-flying tech stock, given its attractive valuation and the potential to deliver sustained growth in the long run. Let's look at Qorvo's quarterly numbers and check why this 5G stock is built for long-term growth.

Image source: Getty Images.

Qorvo is unstoppable right now

Qorvo's Q4 revenue shot up 36% year over year to $1.07 billion during the quarter, clearing the consensus estimate of $1.04 billion. Earnings jumped to $2.74 per share from $1.57 per share a year ago, registering year-over-year growth of nearly 75% thanks to higher revenue and improved margins. Qorvo exited the quarter with a non-GAAP gross margin of 52.6%, an increase of three percentage points over the year-ago period.

For the full year, Qorvo's revenue increased 23% to $4 billion. Qorvo management credited these terrific gains to an increase in demand for chips used in 5G smartphones, as well as new connectivity standards such as Wi-Fi 6 and 6E. The good news is that the company expects these trends to get stronger in 2021 and drive multi-year growth, as CEO Robert Bruggeworth remarked on the latest earnings conference call. About 5G smartphones, Bruggeworth said:

For calendar 2021, we expect 5G smartphones to double versus last year. Within these phones, we expect the RF content to increase $5 to $7 per phone when compared to 4G, including in the mid-tier.

This bodes well for the company, as the mobile business is its largest source of revenue, producing 75% of the total revenue last quarter. The segment's revenue shot up 45% year over year in the fourth quarter to $808 million on account of "higher content 5G smartphones."

Smartphone titans would give Qorvo the edge in the 5G market

Qorvo supplies chips to the leading players in the 5G smartphone space. Apple is Qorvo's largest customer, accounting for a third of its total revenue. The iPhone maker is dominating the 5G smartphone market on the back of the iPhone 12, which catapulted Apple to the top of the sales rankings in the first quarter of 2021.

Strategy Analytics reports that Apple shipped 40.4 million units of its 5G devices during the quarter, accounting for just over 30% of total 5G smartphone shipments of 133.9 million units. The company has opened a sizable lead over the second-place Oppo, which sold 21.5 million units during the quarter. Apple looks capable of sustaining its terrific momentum thanks to a massive installed base of users in an upgrade window.

Not surprisingly, Apple is expected to boost smartphone production in 2021. The iPhone upgrade cycle is still in its early stages as the 5G-equipped iPhone 12 hit the market at the end of 2020, and Qorvo stands to win big if Apple could hold on to its current lead.

Apple, however, is not Qorvo's only 5G smartphone play. The company enjoys a close relationship with Samsung, the South Korean smartphone giant deploying Qorvo chips in its Galaxy smartphone lineup. The good part is that Samsung is also making its mark in the 5G smartphone market. It sold 17 million 5G devices in the first quarter, doubling its sales over the year-ago period. The good thing for Qorvo is that Samsung's 5G smartphone sales are expected to get better in 2021, and it is looking to boost sales by moving into affordable 5G devices.

All of this indicates that Qorvo can keep getting better as 5G smartphone sales increase over the short and the long run.

Time to buy

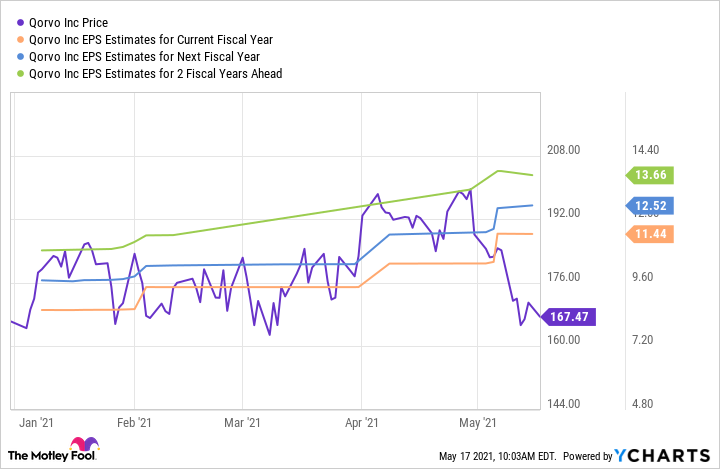

Qorvo stock has pulled back of late, opening a great opportunity for savvy investors looking to add a top growth stock to their portfolios at an attractive valuation.

QRVO data by YCharts

The stock's forward earnings multiple is just 13. More importantly, Qorvo has the potential of delivering consistently strong earnings growth in the coming years (as shown in the chart above), which makes it an ideal pick for investors looking to take advantage of the rapidly growing 5G smartphone market that has gained critical mass and still has a lot to offer.