The renewable energy industry is booming as wind and solar power plants are built around the world at costs that compete with fossil fuels, even without subsidies. And there are technologies that could drive another phase of growth as energy storage, fuel cells, electric vehicles, and smart homes emerge in the market.

With as much growth as there's been, renewable energy stocks have had a hard time gaining traction over the past decade. But there are opportunities for long-term investors looking for values, and our Foolish contributors have identified Canadian Solar (CSIQ -4.27%), Brookfield Renewable Partners (BEP 1.93%), and Hannon Armstrong (HASI 1.80%) as deals that are too good to pass up.

Image source: Getty Images.

The solar manufacturing giant

Travis Hoium (Canadian Solar): Solar panel manufacturers have had a rough ride the last decade as price fluctuations and falling costs have put pressure on margins and profitability across the industry. And that's led to multiple bankruptcies and restructurings, giving investors some hesitancy to value solar manufacturing stocks too highly. But in the case of Canadian Solar, the value is now too good to pass up.

In the recently reported first quarter, the company reported $1.1 billion in revenue on a 17.9% gross margin and $23 million in net income, or $0.36 per share. In 2020, the company had $3.5 million in revenue and net income of $147 million, or $2.38 per share. This is from a company with a market cap of just $2.4 billion.

Earnings are volatile depending on when project sales occur and how margins are trending in the solar manufacturing business, but Canadian Solar's market cap is under one times sales and its P/E ratio is only 16.5 at the moment.

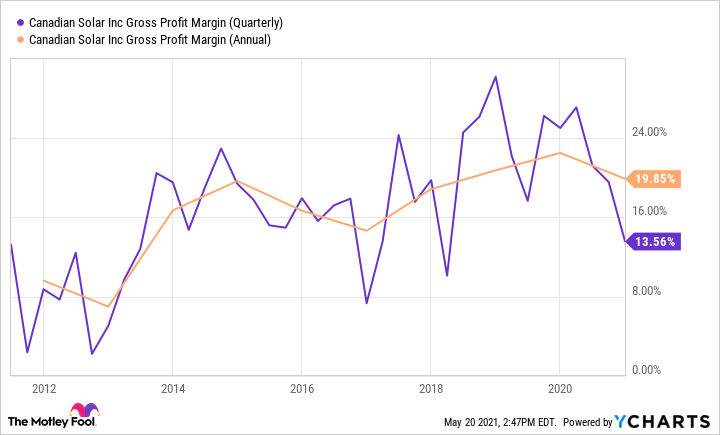

What's really intriguing about this company long term is its strengthening position in the marketplace. Canadian Solar has enough manufacturing capacity to supply about one in every nine solar panels installed in 2021, and that market share has been rising. That gives it more pricing power in the market, which management said this year will lead to an increase in solar panel prices -- almost unheard of over the last two decades. That ability to raise prices when costs go up should help Canadian Solar's slow and steady improvement in margin over the last decade.

CSIQ Gross Profit Margin (Quarterly) data by YCharts

Solar markets can be volatile and profitability is unpredictable, but Canadian Solar's stock is cheap enough to be a value for investors given the company's market-leading position in manufacturing and deploying solar panels.

A chance for income and capital growth

Howard Smith (Brookfield Renewable Partners): The market rotation away from growth and alternative energy stocks has brought many down significantly from their highs. Investors can take advantage of that by buying businesses with strong growth opportunities and income from higher dividend yields. Shares of Brookfield Renewable Partners have dropped more than 20% over the past three months. That has brought the current dividend yield to about 3.5%.

Earlier this month, Brookfield Renewable reported funds from operations (FFO) -- a widely accepted measure of cash generation for asset-heavy businesses -- grew 21% in the first quarter of 2021 compared to the prior-year period. In the first quarter, Brookfield also said it invested or agreed to invest about $400 million of its own equity in transactions for onshore and offshore wind and utility-scale solar power generation assets in the U.S., Europe, and India.

That's because growth in those assets remains strong. In a new report released this month, the International Energy Agency (IEA) said renewables were the only energy source where demand increased in 2020. And renewable capacity additions increased 45% despite the pandemic.

Brookfield management also sees that growth continuing. CEO Connor Teskey told investors on the recent quarterly conference call that "due to our size and expertise across all major renewables technologies, we are increasingly seeing attractive large-scale opportunities to help businesses transition existing generation to cleaner forms of electricity production, as utilities and power producers begin a multi-decade decarbonization process."

As governments and industries around the world work toward decarbonization, Brookfield is in a prime position to participate in the growth of wind and solar capacity. The recent drop in the share price gives investors a good entry point that will also provide a high level of income from the current dividend.

A reliable renewable REIT for dividend investors

Daniel Foelber (Hannon Armstrong): Renewable energy stocks have taken a beating as of late, with the Invesco Solar ETF (TAN 0.40%) and the First Trust Global Wind Energy ETF (FAN 0.94%) down 30% and 10%, respectively, year to date. Despite a healthy balance sheet and a strong 2020 performance, shares of renewable infrastructure company Hannon Armstrong have also sold off by a brutal 26%.

If you follow the renewable sector, you're probably familiar with original equipment manufacturers (OEMs) like General Electric or Siemens, operators like NextEra Energy, or parts suppliers and technology businesses like Enphase Energy and SolarEdge. Hannon Armstrong doesn't compete with any of these companies. Instead, it provides the capital needed to make renewable projects possible. As a real estate investment trust (REIT), Hannon Armstrong is in the business of making quality loans and passing its returns along to shareholders through dividends. Its long-term contracts tend to last for a decade or more, making its business relatively stable compared to other renewable energy stocks.

After posting its highest quarterly revenue and net income in history, Hannon reaffirmed its goal of delivering annual distributable earnings per share (EPS) growth of 7% to 10% between 2021 and 2023 while growing the dividend between 3% and 5% over the next three years.

HASI Revenue (Quarterly) data by YCharts

Hannon Armstrong's earnings growth continues to outpace its dividend raises, leaving it more capital to invest and build its project pipeline.

With a price to earnings (P/E) ratio of 33 and a dividend yield just shy of 3%, Hannon Armstrong is one of the safer ways to take advantage of the renewable energy stock sell-off.

Values too good to pass up

Canadian Solar, Brookfield Renewable Partners, and Hannon Armstrong may not be household names or exciting high-tech stocks, but they're great values in the growing renewable energy industry. And that's why they're our picks if you're looking for values that are too good to pass up in energy today.