Many investors, including myself, have been saying since last year that Wells Fargo (WFC 1.36%) has looked very cheap despite the regulatory issues at the bank and all the trouble it had run into from the pandemic. And that promise has delivered mightily, with shares up more than double since the end of last October. The bank recently traded at nearly $46 per share. It's been a great run, but with that kind of appreciation, is Wells Fargo still a bargain? Let's take a look.

Not so cheap anymore

With the recent big gains, it's true that Wells Fargo doesn't look as cheap as it once did -- especially on a price-to-earnings (P/E) basis looking at estimated earnings in 2022, as pointed out by analysts in recent days.

| Bank | Forward 2022 Est. P/E Ratio |

|---|---|

| JPMorgan Chase (JPM -0.40%) | 13.6x |

| Bank of America (BAC 1.59%) | 13.7x |

| Citigroup (C 2.02%) | 9.4x |

| Wells Fargo (WFC 1.36%) | 13x |

Data source: Analyst earnings estimates for 2022, based on stock prices May 22.

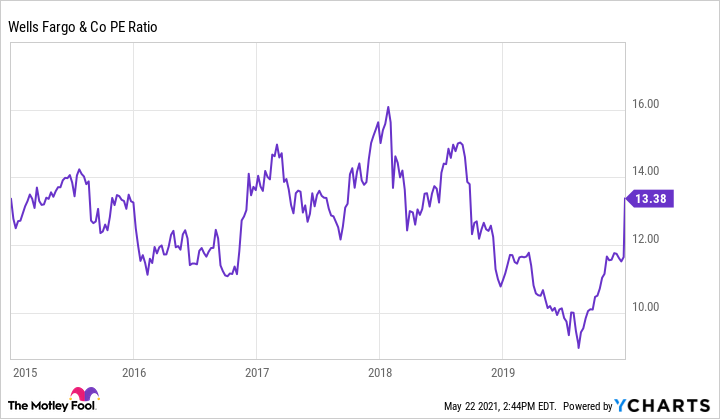

Wells Fargo has indeed caught up to JPMorgan and Bank of America, and now has a much higher P/E ratio than Citigroup. In the short term, this could certainly mean the stock has gotten back most of the discount it traded at, and analysts that have weighed recently have assigned a price target for Wells Fargo right around what it's trading at. And if you look at the bank's P/E ratio between 2015 and 2020, 13 is historically where Wells Fargo has traded at.

WFC PE Ratio data by YCharts

But long term, this likely doesn't matter and I still see plenty of upside for Wells Fargo, largely because I believe earnings are still projected to be depressed in 2022. As has been well documented, the bank has been operating under a $1.95 trillion asset cap since 2018 as punishment for its phony-accounts scandal, in which employees at the bank opened millions of fraudulent bank and credit card accounts without the authorization of customers. The asset cap really hurts the bank because it prevents Wells Fargo, one of the largest commercial lenders in the country, from growing its balance sheet with loans. Bloomberg estimates the asset cap is one of the costliest bank penalties of all time and has cost Wells Fargo billions in profits.

Major catalysts ahead

The average analyst estimate for Wells Fargo's earnings per share (EPS) in 2022 is currently $3.54. This is still low compared to Wells Fargo's EPS of $4.08 and $4.31 in 2018 and 2019, respectively, the first two years the bank operated under the asset cap. Now, the bank has changed a lot and one could argue it does not have the same earnings power as it once did. But I definitely think it has way more gas in the tank.

For one, the bank has made notable progress on getting the asset cap removed, and I would be very surprised if it couldn't get it removed at some point in 2022 at the latest. I feel like the bank will be much closer to removal by the end of this year. Either way, once the cap is removed, Wells Fargo will be able to grow loans again, which it is historically really good at.

Also, because Wells Fargo has a big lending operation, it benefits a lot when interest rates rise, so it is very well positioned once the Federal Reserve increases the federal funds rate. The bank is also making more efforts to ramp up its investment banking operations and make that segment a bigger part of its revenue stream to offer more revenue diversity. That work is happening right now.

Lastly, management is also hard at work stripping out expenses to make the bank more efficient and profitable. Wells Fargo CEO Charlie Scharf's goal with the bank's cost-cutting initiatives is to get Wells Fargo to consistently generate a 15% return on tangible common equity (ROTCE). In the first quarter of 2021, Wells Fargo's best quarter in a while, the bank performed much better thanks to a sizable release of reserves previously allocated for potential loan losses, and the bank still only generated a 12.7% ROTCE.

A bargain long term

While the P/E ratio discount has narrowed in recent months and Wells Fargo looks fairly valued right now, I still don't think this is an accurate price target for the bank long term because of all of the upcoming catalysts in future years. Earnings are bound to improve through expense initiatives, a growing investment bank, rising interest rates, and the eventual removal of the asset cap, which will let the bank get back to lending. And once earnings improve, even a similar P/E ratio will warrant a much higher stock price.