I believe that coffee giant Starbucks (SBUX -1.02%) is a great dividend stock. That might sound like a subjective opinion, but there are objective ways to measure what makes a dividend stock great. Specifically, we can look at its dividend yield, history of growth, and future earnings potential.

I believe Starbucks excels in all three of these categories and should be a top consideration for dividend-stock investors. Here's why.

Image source: Starbucks.

A rewarding history of dividend growth

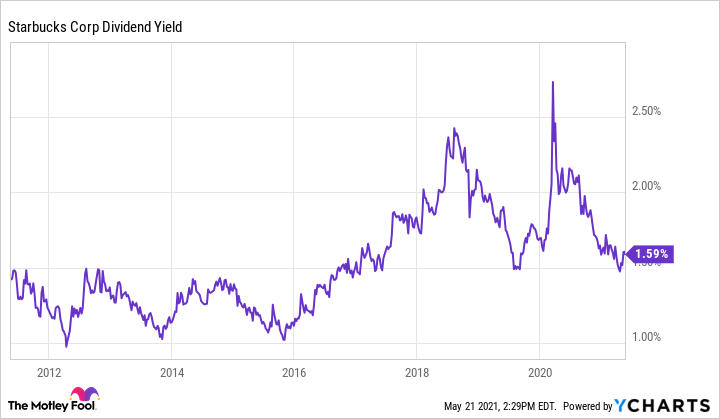

To start, Starbucks' dividend yield is currently 1.6%. Think of it this way: If you invested $100 today, you could expect $1.60 in annual dividends from this stock if it kept paying at its current rate. For context, investors typically divide dividend stocks into two categories: high-yield and low-yield. Generally, anything above 2% is considered high yield. The rest are low yield.

Therefore, Starbucks is a low-yield dividend stock, which some investors might not appreciate. However, in my opinion, this dividend yield is high for a high-quality company like Starbucks. Consider that often with high-yield dividend stocks, it's a symptom of a low-quality stock. The majority of investors don't want to own it, so shares fall and the dividend yield is high as a result. Often this is just before the dividend payment gets cut.

So Starbucks is technically a low-yield dividend stock. However, a dividend yield over 1.5% has historically been very good for this stock.

SBUX Dividend Yield data by YCharts

Not only that, but Starbucks has been a great stock for dividend growth. Its most recent quarterly dividend payment was $0.45 per share in May 2021. But in May of 2016, just five years ago, the quarterly dividend payment was $0.20 per share. During this time, the company more than doubled its dividend and didn't miss a quarterly payout.

Looking at its five-year growth and its dividend over the past year, we can say Starbucks has been a great dividend stock.

This dividend can go higher

Many dividend investors measure the health of the current dividend with a metric called the payout ratio. The payout ratio measures dividends per share against earnings per share (EPS). After all, it wouldn't really be sustainable for a company to pay out more than what it was earning. Generally speaking, investors like a payout ratio under 50%. Therefore, they might be turned off by Starbucks. Its current payout ratio is over 200%.

Starbucks' profit took a hit in 2020 but it maintained its dividend, expecting only a temporary setback for its business. In the end, that was true -- sales have already recovered. However, in the meantime, its payout ratio spiked because it chose to maintain its dividend.

SBUX Payout Ratio data by YCharts

Historically, Starbucks has a payout ratio closer to 50%. In 2021, expect this metric to come closer to historical levels as profits bounce back.

When a payout ratio is low, it suggests the company has room to grow its dividend in the future. But in Starbucks' case, it will also have room for future dividend increases because of its robust growth.

Starbucks has already completed two quarters for its fiscal 2021. For the full year, it anticipates generating revenue of $28.5 billion to $29.3 billion. For perspective, pre-pandemic, the company generated revenue of $26.5 billion in fiscal 2019. Therefore, this year's revenue is expected to be up between 7.5% and 10.5% on a two-year basis. That's not bad for a large-cap stock.

Starbucks' revenue growth has come from a mix of increasing sales at existing stores and opening new locations. Expect a whole lot more of this over the next five to 10 years. Right now, the company has just under 33,000 locations worldwide. By 2030, it expects to have 55,000. Between these new stores and sales growth at existing locations, management is projecting between 10% and 12% annual revenue growth long term.

Moreover, because it's also trying to become more efficient, Starbucks' management expects profit growth to exceed revenue growth. Considering its track record over the past 10 years, I'm very optimistic about its ability to deliver from now until 2030. And that profit growth will give it plenty of breathing room to keep upping the dividend for investors in the future.

Therefore, because of its past track record, its current respectable yield, and its future profit-growth potential, I'd say Starbucks is a great dividend stock today and worth a spot in your portfolio.