What happened

Shares of uranium miners Energy Fuels (UUUU 0.26%), Denison Mines (DNN 0.01%), and Uranium Energy (UEC -0.15%) stocks resumed falling Thursday, dropping 7.6%, 9.7%, and 10.2%, respectively, through 12:50 p.m. EDT after rebounding in price earlier in the week.

According to The Wall Street Journal, investors are reacting (or perhaps overreacting) to news that a nuclear power plant in southeast China is seeing an increase in "noble gases in one of its reactors' primary circuits, which is part of the reactor's cooling system."

Image source: Getty Images.

So what

Now, Electricite de France SA, which co-owns the nuclear plant, says these gases are not "dangerous in small quantities," and crucially, we're not talking about any sort of a radiation leak -- yet. In the Journal's estimation, the sell-off we're seeing is an "unnecessary investor meltdown" because, as it goes on to explain, "uranium mining companies tend to operate on multiyear supply contracts with utilities, so there is little risk that a nuclear power plant would immediately pull back buying from these mining companies."

But in reporting on the incident, CNN described this as creating at least the potential for "an imminent radiological threat."

Now what

And that could be a concern.

Not necessarily because we're about to see a nuclear meltdown in southeastern China, mind you, but because when the press starts spreading around words like "imminent" and "radiological threat," it creates the potential to panic investors who may have the Fukushima disaster still fresh in their minds, and remember how that one didn't just cause Japan (where the incident occurred) to pull away from nuclear power, but sparked denuclearization drives across Europe as well.

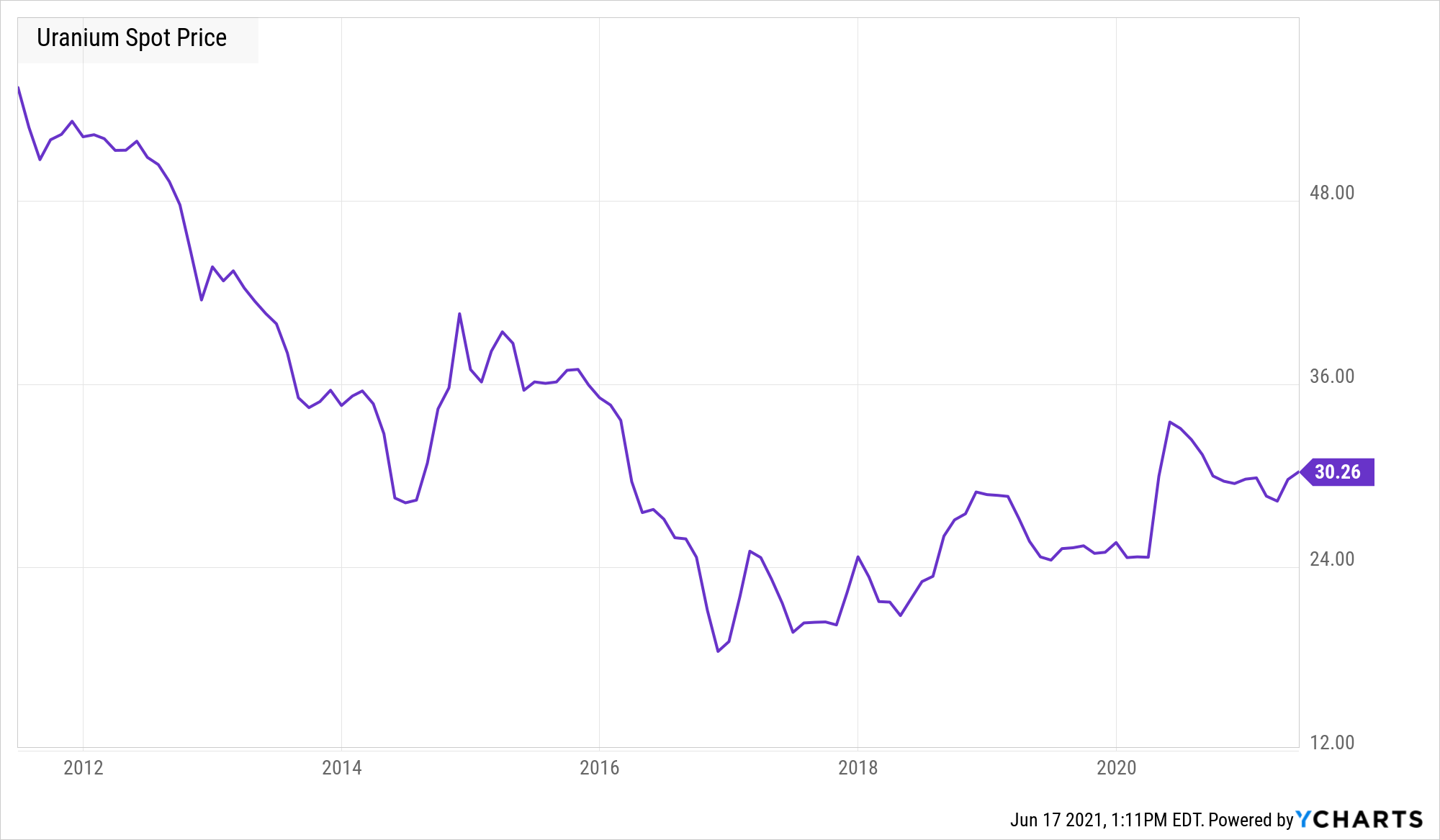

As I pointed out earlier this week, the uranium mining industry really isn't in a good place to withstand any kind of sentiment that might depress demand for its product. With uranium prices still hovering around half the $60-per-pound level that experts say is necessary to sustain profitability, only good news is what these stocks need today, to drive both demand for their product and higher prices for their stock.

No matter how tempest-in-a-teacup the latest news out of China might be, it's not good news -- and so you can expect that to be bad for uranium stocks.

Uranium Spot Price data by YCharts.