What constitutes a lot of money is relative. Investing $10,000 looks different depending on things like your annual income and the size of your stock portfolio. Therefore, this article will fall short of being a one-size-fits-all game plan or something that speaks to your particular situation. That said, there are solid, general investing principles that can guide a $10,000 investment no matter who you are.

Let's look at how to use $10,000 to further your investing journey. To preview, I believe investors should build some cash reserves, invest in established performers, and build small positions in promising companies that still have a lot to prove.

Image source: Getty Images.

Don't overlook holding cash

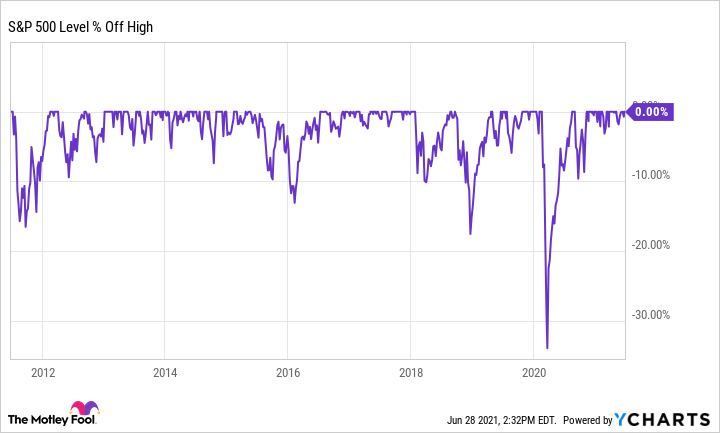

Let's start this discussion with two data points on the stock market: one general and one current. First, the stock market regularly drops sharply. Over the past decade -- one of the best decades ever for investors -- there have been five pullbacks of 10% or more. And during these drops, the stocks of many quality companies have fallen far more than the 10% market average.

Second, right now stocks are quantifiably expensive in general. Looking at valuation metrics like the price-to-earnings ratio and the price-to-sales ratio, the average for the S&P 500 is the highest it's been in over a decade. Granted, valuations shoot higher when earnings and sales go down. And over the past year, these are temporarily down due to the COVID-19 pandemic. But the valuations are still expensive nonetheless. That doesn't mean a crash is imminent. But I wouldn't be surprised if stocks pulled back 10% or more sometime soon, as they have done many times in the past.

S&P 500 P/E Ratio data by YCharts

"Antifragile" is a term coined by mathematician and author Nassim Nicholas Taleb, and it means something that doesn't break with problems -- by contrast, it gets stronger. By keeping cash on the sidelines, you put your portfolio in an antifragile position because you'll be able to benefit from market chaos by buying quality stocks at bargain prices.

There's no magic number for how much cash you should have on hand. But having 10% to 20% of your portfolio in cash will put you in an enviable position when opportunity knocks. Therefore, if you have $10,000 to invest, make sure your cash reserve is full. Someday, it'll come in handy.

For what it's worth, this strategy is how I built outsized positions in Square and Magnite -- I bought both in 2020 when they were down more than 50%. It may be a cherry-picked anecdote, but both are already multibaggers in the short time since, which demonstrates the potential reward of being prepared.

Image source: Getty Images.

Build on a strong foundation

Long-term investors need to build a diversified portfolio primarily with companies that have a history of past success because this is where you'll often find tomorrow's winners.

One company like this to consider is United Rentals (URI -0.93%). This company rents out equipment used in projects from building to manufacturing. Since equipment like this is expensive to buy, it's often in a party's best interest to rent, which keeps business rolling in for United Rentals. But management is also constantly aware of aging inventory and will sell certain items when there's more to gain from its sale than from maintaining it as a rental.

United Rentals has a long history of earnings growth. And because of this earnings growth, the stock is a 12-bagger over the past decade. In the near term, the company's prospects look good as well with Congress' infrastructure bill boosting spending in categories where it has a strong presence. And longer term, United Rentals has a large market opportunity. Consider that it is the largest equipment rentals player in North America but with just 13% market share, which suggests the market is highly fragmented. But with plenty of cash from operations (almost $2.7 billion in 2020), management can grow via acquisitions. This was on display when it bought out General Finance in May for almost $1 billion, a company offering storage solutions on job sites.

Image source: Zoom Video Communications.

With $10,000, there's a good case to build a bigger position in United Rentals. Another strong company to consider right now is Zoom Video Communications (ZM 0.05%). If the company was a purely consumer-facing business, then perhaps I would question its longevity in a (hopefully) soon-to-be post-pandemic world. But Zoom is mainly a corporate solution, with 63% of first-quarter revenue coming from companies with 10 or more employees. Corporate customers will likely keep their subscriptions active if they have a hybrid workforce (part at home, part in the office), even if they use Zoom less going forward than they did in 2020.

However, with one foot in the door, Zoom has the opportunity to upsell its customers, which it's already doing quite successfully. Among the customer base of 10 or more employees, its Q1 net dollar expansion rate was over 130% for the 12th consecutive quarter. That's four years of spending growth among these existing customers, which tells me this company has staying power.

Because of its bumper year in 2020, Zoom now has around $4.7 billion in cash and marketable securities, giving it lots of optionality when it comes to creating or acquiring other products and services for its corporate customers. What's particularly intriguing to me is that these new offerings will require new employees. And now may be a great time to find these new workers. Some reports estimate millions of workers are currently looking for a new job in a trend called The Great Resignation. And according to Glassdoor, most people love working at Zoom, meaning it should attract top talent wherever needed.

For these reasons and more, I believe investors should consider building a position in Zoom. However, remember you don't have to make full-fledged investments in Zoom or United Rentals all at once. With core portfolio positions like these, buying shares at set intervals -- called dollar-cost averaging -- can help make sure you're not buying everything at highs.

Image source: Getty Images.

Make some small bets too

By having cash on the sidelines and building core positions in proven winners like United Rentals and Zoom, you're in a great position to finally make some smaller bets on high-potential companies that still have a lot to prove. Real-estate technology company Latch (LTCH) fits this description perfectly.

Landlords sign multi-year contracts with Latch to provide connected hardware like electronic door locks for their rental spaces. And the company provides ongoing software to tenants. This renewable revenue stream provides a high degree of revenue visibility, making financial results easier for management to forecast. For example, Latch's management bolstered its guidance credibility by nailing its first quarterly financial report since going public via a special purpose acquisition company (SPAC). Importantly, it reaffirmed its bookings guidance of $290 million to $325 million for 2021, which represents a 76% to 97% year-over-year increase. That's good news considering many questionable SPACs pulled guidance soon after going public.

Latch still has a lot to prove, but management is building credibility. Longer-term, this team has looked at its existing contracts and its ongoing opportunity and has concluded it can generate $249 million in free cash flow (FCF) in 2025. Just for perspective, many investors consider a price-to-FCF ratio of 20 to be a good value. Right now, Latch has a $1.8 billion market cap. Therefore, assuming it hits its 2025 FCF guidance, this could be a $5 billion company by then -- up over 2.5 times in just four years. That would assuredly beat the market.

Thus far, my advice has tried to use your $10,000 investment to make your portfolio more antifragile. But an antifragile portfolio should also make asymmetric bets. Regarding asymmetry, Taleb says, "If you make more when you are right than you are hurt when you are wrong, then you will benefit, in the long run, from volatility." That's the reasoning for starting a position in a company like Latch. If you invest a small portion of your portfolio in a company like this -- say 1% -- you won't get burned if it fails. But if it succeeds, it could become a core portfolio position. And it would have earned it with fundamental results, making it a worthy long-term holding.

Ultimately, I think this is how investors should be thinking about their portfolios, no matter how much money they have to invest right now. Keep cash on the sidelines to take advantage of rare bargains, build core positions in proven companies with a bright future, and place small bets that could pay off big if things go right. In this way, I believe you're setting your portfolio up for long-term success.