What happened

Shares of Virgin Galactic Holdings (SPCE -11.74%) ran into turbulence this week, down 22% from last Friday as of midday Thursday. The stock rocketed higher last week after winning a key regulatory approval, but some on Wall Street seem to believe that climb was too high, too fast.

So what

Virgin Galactic shares have a history of turbulence, and this past week has been no exception. The company has an ambitious plan to launch tourists into space but has fallen behind on its timetable and is currently operating with little to no revenue.

Image source: Virgin Galactic.

The shares jumped nearly 40% last Friday after the Federal Aviation Administration (FAA) gave the company a license for passenger space flights. That's an important milestone, but Virgin Galactic still has a number of tests to complete before it begins scheduled service, and competition, including from Jeff Bezos's Blue Origin, is coming fast.

Wall Street analysts were focused on the risks this week. Bank of America Securities issued a double downgrade of the stock to underperform from buy, believing that following the 40% jump, the good news is more than priced in. And Alembic Global analyst Peter Skibitski downgraded Virgin Galactic to neutral from overweight, saying valuation is "now stretched to excess levels."

Now what

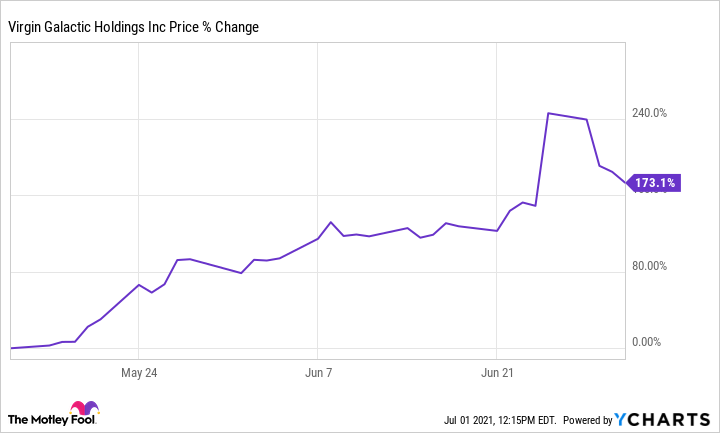

Last week's jump appears to be a rare case of investors buying the rumors and buying the news. The stock doubled in value between mid-May and mid-June, ahead of the FAA decision, on evidence the testing was proceeding as scheduled and regulatory approval would follow. The huge pop on Friday appears to be fueled by the same sentiment that led to the earlier doubling.

Even after the declines for the week, it has still been a pretty good run for the stock.

Investors should be warned that the volatility is unlikely to end any time soon. This is a stock driven by sentiment, not fundamentals, and sentiment tends to fluctuate -- especially when the company in question sports a $10 billion market capitalization.

For long-term holders, this is still a high-risk, high potential-reward venture. It is ok to buy in and ride out the turbulence, but this stock is best kept to a small part of a well-diversified portfolio.