Energy independence is always on the mind of policy makers, and after a pandemic that's hit the supply chain for many products, it should be on the minds of businesses as well. And there are some companies helping to reach energy independence in the U.S. with renewable power.

We asked three of our Motley Fool contributors what their favorite renewable energy stocks for U.S. energy independence are, and First Solar (FSLR 0.43%), Enphase Energy (ENPH -2.46%), and TPI Composites (TPIC -0.37%) made the list. Here's why they're leaders in energy domestically.

Image source: Getty Images.

The U.S. solar manufacturer

Travis Hoium (First Solar): The U.S. solar industry wouldn't be what it is without First Solar, the thin-film solar panel manufacturer. The company started as a U.S.-based manufacturer and has doubled down on that strategy recently. Management announced in June that it would spend $680 million to add 3.3 gigawatts (GW) of manufacturing capacity in Ohio to bring its U.S. capacity to 6 GW.

The expansion of manufacturing in the U.S. has allowed First Solar to sell solar panels tariff-free over the last four years, while most other manufacturers have had to deal with tariffs. Another advantage First Solar has is that it isn't reliant on the global solar supply chain. Most manufacturers acquire polysilicon, wafers, and/or solar cells from other manufacturers, which are mainly in Asia. And that reliance on suppliers can put manufacturers in danger of commodity pricing as well as tariffs.

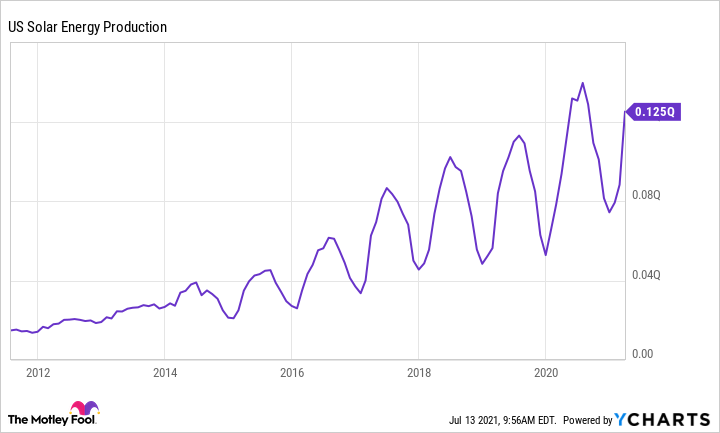

U.S. solar energy production data by YCharts.

You can see above that solar energy production (as measured seasonally in quadrillion BTUs) is booming in the U.S., and First Solar is a big part of that. With more capacity coming on line, the company will be providing even more solar panel capacity to developers and ultimately the grid. If you're betting on U.S. energy independence, this is a great place to start.

Captured and stored

Howard Smith (Enphase Energy): Nothing says energy independence like the ability to be off the grid and have your own supply of power. Until recently, California-based Enphase Energy could only partly help with that. The solar-technology system supplier has been producing microinverters since 2008. These are the devices that convert captured energy at the solar panel from DC power into the AC used in a home or business. But while the company's systems helped offset what was needed from the utility company, the user was still reliant on enough sunshine for panels to perform efficiently.

The company is on its eighth generation microinverter product, and in July 2020 began shipping a new battery storage system to customers in North America. The Encharge storage system uses the company's proprietary energy management technology, and automatically transfers supply from the grid to backup power when the grid is down, or to save money even when the grid is up. Enphase is expanding sales of the storage system globally as well, recently launching it in Germany in the first market outside the U.S.

Even prior to the expanded offering, Enphase was growing sales quickly. The company's revenue has almost tripled since 2017. Investors have noticed, and its stock price has grown much faster.

ENPH data by YCharts. TTM = trailing 12 months.

As Americans see power-grid disruptions -- whether from planned rolling blackouts or natural disasters like wildfires, hurricanes, or winter storms -- Enphase is in position to penetrate more of the market.

Much of that growth is already priced into Enphase stock, however. It is trading at a price-to-earnings ratio of over 90 based on average analyst earnings estimates for this year, and about 70 for 2022 estimates, based on data from MarketWatch.

But for investors with a longer-term outlook, or those who want to wait for a pullback, Enphase Energy is having success helping Americans get on the path to energy independence through renewable solar power.

American-made wind blades

Daniel Foelber (TPI Composites): The pandemic resulted in a slowdown across the energy and industrial industries. From oil and gas majors to industrial titans, sales slumped and balance sheets were strained.

One exception was in renewable energy, where solar and wind stocks vastly outperformed the broader indexes. Data from the U.S. Energy Information Administration shows that 2020 U.S. wind turbine capacity increased by a record 14.2 gigawatts (GW), bringing the nation's total to 118 GW. Wind energy now comprises 8.4% of America's total electricity generation, a remarkable achievement that has largely occurred over the last 15 years. Growth is expected to be even higher over the next decade as new onshore wind energy installations now have a lower average levelized cost of energy than their fossil fuel counterparts.

Arizona-based TPI Composites is the largest independent manufacturer of wind blades. Given the domination of the global wind energy market by European companies, TPI represents one of the few pure-play U.S.-based wind energy stocks. In fact, it might surprise investors to learn that over 70% of the U.S. onshore wind energy market is controlled by European operators like Vestas, Nordex, and Siemens Gamesa. TPI has long-term supply agreements with these leading companies, bringing independence to American renewable energy.

Existing contracts are expected to generate between $2.5 billion and $4.2 billion in revenue through 2024, but that doesn't include new contracts TPI could land in emerging markets. The company has successfully increased its manufacturing capacity in the U.S., Mexico, China, Turkey, and India, opening the door to land deals with other wind energy operators. With solid fundamentals, a fairly inexpensive valuation, and the potential to transition from hypergrowth to profit, TPI Composites looks like a promising American wind energy stock.

Stocks driving U.S. energy independence

All of these companies make products that make the U.S. more independent of energy imports and fossil fuels. As the government looks less favorably on imports -- and domestic and local energy generation become more important -- these companies should thrive.