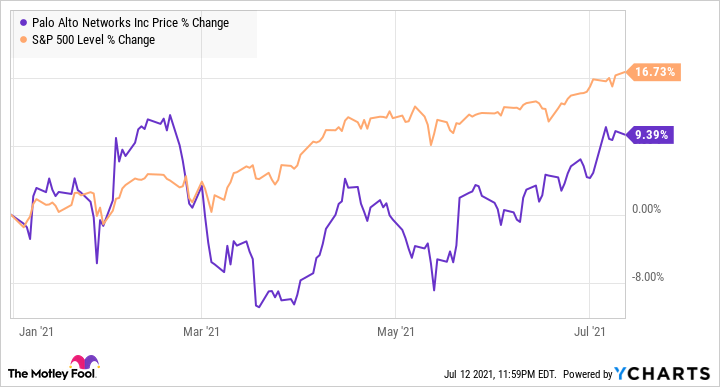

Palo Alto Networks (PANW 1.43%) stock has failed to set the market on fire so far in 2021, but that's a good thing for investors looking to buy a top cybersecurity play. That's because Palo Alto Networks looks like one of the best bets to take advantage of the cybersecurity market's secular growth, and a lagging stock performance means that savvy investors have an opportunity to buy it at a reasonable valuation before it takes off.

Let's look closely at the reasons why it is a good idea to go long Palo Alto Networks stock right now.

Image source: Getty Images.

Palo Alto Networks' growth has picked up the pace

Palo Alto Networks has been delivering impressive results quarter after quarter. The company's revenue increased 24% year over year to $1.1 billion in the fiscal third quarter that ended on April 30, 2021. Its non-GAAP net income jumped from $1.17 per share to $1.38 per share.

It is worth noting that Palo Alto's revenue growth last quarter was better than the 20% year-over-year jump it had reported in the prior-year period, driven by an increase in cybersecurity demand to address the threats arising out of remote work. The company points out that its billings climbed 27% year over year to $1.3 billion, beating its expectation of 20%-22% growth.

Palo Alto added 2,400 new customers during the quarter. Even better, CEO Nikesh Arora pointed out that many of them made "large commitments to Palo Alto Networks across our three major platforms." That's evident from the fact that customers who have spent at least $1 million on Palo Alto's services increased 29% year over year in Q3, up from 22% growth in the prior-year period.

Not surprisingly, Palo Alto's deferred revenue grew at a nice pace of 30% year over year to $4.4 billion, which was much better than its actual revenue increase. Deferred revenue is the money collected in advance from customers for services that will be delivered later. So the boost in this metric indicates that Palo Alto has built up a solid revenue pipeline as customers are increasing spending on its offerings.

Thanks to such impressive growth, Palo Alto has raised its full-year outlook. The company expects total revenue to increase between 23% and 24% this year to a range of $4.20 billion to $4.21 billion. It was projecting 20%-21% revenue growth at the beginning of this fiscal year. Adjusted earnings are expected between $5.97 and $5.99 per share as compared to the original range of $5.70 to $5.80 per share.

So Palo Alto has raised the bar as the year has progressed. Don't be surprised to see such a trend continue in the future as well, as the company is pulling the right levers to ensure that it sustains its high levels of growth.

Why things can get better

Palo Alto Networks is successfully taking advantage of the fast-growing niches in the cybersecurity space. For instance, the company's annualized recurring revenue (ARR) from its next-generation security (NGS) offerings is rising at a terrific pace as the segment targets lucrative markets like cloud security. Palo Alto's NGS ARR increased a whopping 71% year over year in Q3 to $973 million.

The company aims to end the year with ARR of $1.15 billion in the NGS business, which would represent an increase of 77% over last year. This bodes well for Palo Alto's long-term growth. ARR represents the revenue of all active contracts from the Prisma and Cortex cloud security offerings on the final day of the quarter, so the massive spike in this metric shows that the company is building a sustainable revenue stream for the long run.

What's more, the NGS segment accounted for 27% of Palo Alto's total billings last quarter after recording 70% year-over-year growth to $346 million. Third-party research predicts that the cloud security market's revenue could double to nearly $69 billion by 2025 as compared to last year's levels, so Palo Alto still has a lot of room to grow this business.

Meanwhile, the firewall-as-a-platform (FWaaP) market is turning out to be another catalyst for the company. This segment posted 26% year-over-year growth in billings last quarter, driven by a shift toward software-based offerings that accounted for 40% of FWaaP billings. The good news for Palo Alto is that the firewall-as-a-service market is projected to grow at an annual pace of 22% through 2026, according to third-party estimates, indicating that this business can keep getting better.

These tailwinds help explain why analysts expect Palo Alto's earnings to increase more than 22% a year for the next five years. Finally, Palo Alto is trading at a relatively lower price-to-sales ratio of 9.3 as compared to last year's average multiple of 9.6, and its forward earnings multiple of 54 represents a nice discount to 2020's average of 65. That's why investors looking to get in on a potential growth stock should take a closer look at Palo Alto Networks before it soars higher.