What happened

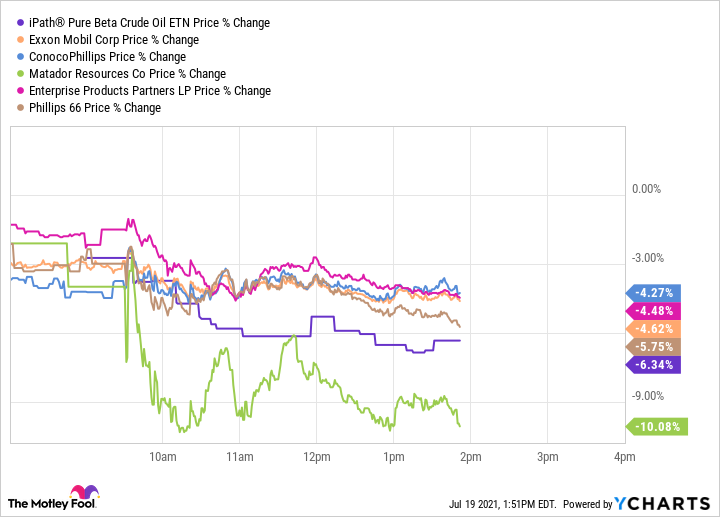

As of roughly 2 p.m. EDT Monday, shares of diversified energy giant ExxonMobil (XOM -0.57%) had fallen by as much as 5%. Exploration and production giant ConocoPhillips (COP -0.72%) was down by about the same percentage, while relatively tiny Matador Resources (MTDR -1.36%) was off by roughly 10%.

Image source: Getty Images.

But it wasn't just upstream drillers that got hit. Downstream-focused Phillips 66 (PSX -1.03%), which refines oil, also dropped as much as 5%. And so did midstream bellwether Enterprise Products Partners (EPD -1.86%). In other words, the entire energy sector took it on the chin Monday.

While there was a clear negative mood across Wall Street, the big-picture reason for the energy sector's pain was a drop in oil prices, as key U.S. benchmark West Texas Intermediate and global benchmark Brent Crude both were below the psychologically important $70 per barrel price at roughly 2 p.m. EDT. But this wasn't simply random price volatility. There's more to the story.

So what

The last couple of weeks in the energy market have been tense thanks to an OPEC meeting that didn't go quite as smoothly as hoped. Although the oil group and its partners seemingly all agreed that production would need to rise over the coming year or so to meet increasing demand, there were disagreements about how those increases should be enacted. The core problem was that some members wanted to produce more oil than they had historically been allowed to relative to their peers.

A solution, which appears to have been hammered out over the weekend, took a lot longer to reach than the market would have liked. Throughout that period of uncertainty, oil was pretty volatile, as onlookers considered the possibility that no agreement would be reached. If that had occurred, various OPEC members might have started boosting output in an uncoordinated fashion in their efforts to compete for market share, driving a production glut and sending oil prices plunging.

That would have been similar to what took place in early 2020, right before the COVID-19 outbreak erupted into a pandemic and sent oil demand into a ditch. That didn't happen this time -- which is good. Instead, OPEC members came to an agreement that pleased all parties, for now, and that will result in regular, though modest, production increases over the next year or two. However, it means that more oil will be hitting the market, and that's putting downward pressure on oil prices.

On top of that, there's renewed fear about the ongoing uptick in coronavirus cases as more contagious variants of the illness spread. That could lead to another dip in energy demand just as OPEC plans to start increasing production. While the situation is nowhere near as bad as it was in early 2020, there are similarities, and those probably increased investors' negative sentiments toward the energy patch.

So it's not shocking that oil-centric stocks like Exxon, ConocoPhillips, and Matador Resources were selling off Monday. (As a side note, Exxon also announced that it hired a new CFO, but that probably didn't have much impact on the stock price.) But the negative sentiment flowed through to other segments of the energy industry -- midstream and downstream names were also lower. Enterprise, which got about 90% of its gross margin from fees in 2020, is relatively less impacted by commodity prices, but falling demand amid rising COVID-19 cases could lead to a drop in the volume of hydrocarbons moving through its system. Similarly, demand for the refined products that Phillips 66 produces could also fall.

Now what

The energy sector is often volatile, so Monday's slump isn't really all that shocking in the grand scheme of things. Conservative investors looking at the space should probably stick to the largest and financially strongest names, like ExxonMobil or Enterprise Products Partners. That said, the news out of OPEC will have a lingering impact on oil-related industries, as will a surge in coronavirus cases. In other words, while Monday's dramatic stock price moves shouldn't be surprising, investors still need to carefully consider the reasons behind them. They might have an impact on your long-term thinking about the investments you own or are considering in the sector.