The summer is heating up, and so is the economy as more things start to look like they did in 2019, versus a brutal 2020. Can we keep up the momentum and avoid a summer slowdown as the delta variant of the coronavirus spreads? Frankly, that's hard to predict (though full lockdowns like we saw last year are highly unlikely).

But even if we do see a summer swoon in the stock market, there's one thing we can predict with a lot of confidence: Investing in top stocks is almost a lock to be the best way for individual investors to create wealth. The key? Not getting caught up in what will happen next month, next quarter, or even next year, and instead focusing on finding great companies you can buy now and own for years to come.

To help you get started, we asked a panel of top Motley Fool contributors for their top stocks to buy that can deliver many years of big returns. Keep reading below to find out their best ideas right now.

Image source: Getty Images.

This insuretech start-up is no lemon

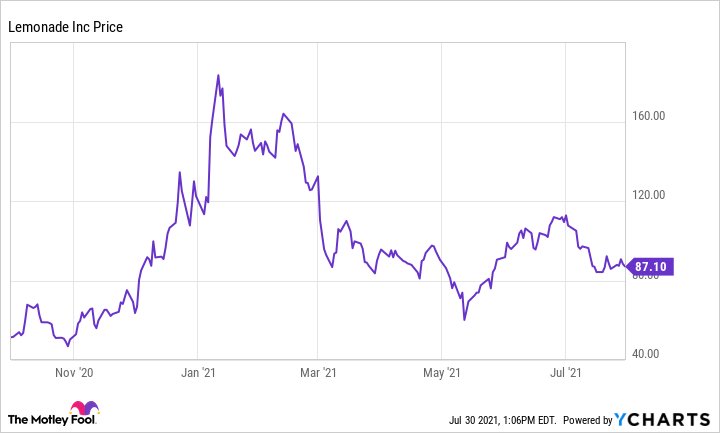

Jason Hall (Lemonade): If you already own shares of insurance start-up Lemonade (LMND 0.83%), there's a broad range of outcomes you might have experienced, including being up as much as 70%, or being down more than half:

That's because, by and large, investors aren't really sure what to make of the company, which only went public late last year. Is it an insurer? Is it a tech company?

Frankly, it's both. But there's something Lemonade is doing that's even more important than the technology it's building. In short, Lemonade's biggest disruption is creating better alignment between its own financial incentives and those of its customers.

As a result, the company says it has less incentive to delay paying or to reject claims, resulting in faster payments and improved customer service, while customers don't feel pressure to exaggerate claims. As a certified B Corporation, Lemonade is also a socially responsible company, something that's attractive to many of its customers, who skew younger.

As a result, I think Lemonade has enormous staying power. Customers show up to get insurance in minutes, or even seconds. But I expect they will stay for many years to come -- and in growing numbers -- due to the company's disruption of the traditional model, and rebuilding the financial incentives so that it, and its customers are more aligned than any other insurer on earth.

A winning movie theater stock? For real?

Anders Bylund (Imax): When larger-than-life cinema technologist Imax (IMAX 0.12%) reported second-quarter results near the end of July, the analyst-stumping business update cemented my earlier view of this company. If you want to find a long-term winner in the movie theater sector, Imax is your best bet.

Imax saw second-quarter sales of $51 million, up from $8.9 million in the coronavirus-burdened equivalent period of 2020. The company reported an adjusted net loss of $0.12 per share, much stronger than the year-ago period's $0.44 loss per share. Your average analyst would have settled for a deeper net loss near $0.30 per share on revenue in the neighborhood of $40.6 million.

Ninety percent of all Imax theaters are back in operation. Gross profit margin bounced back to 50.2%, up from a negative 87% in the second quarter of 2020 and roughly comparable to Imax's gross profit margin in the pre-pandemic era.

That's the beauty of Imax's asset-light business model, where most of the revenue comes from high-margin technology license payments. This company generally doesn't own the super-sized screens and surround sound systems you experience in an Imax theater. The massive costs of building and maintaining those expensive assets fall to Imax's customers, usually as part of their normal multi-screen theater venues.

I find it kind of funny that Imax shares are underperforming the S&P 500 market index over the last two years while the financial house of cards known as AMC Entertainment Holdings more than tripled over the same period. Imax is a high-quality business that should be able to move on and form new partnerships to fill the customer-shaped void if and when AMC finally goes bankrupt.

In short, Imax is spring-loaded for great returns when market makers realize how rare it is to find a rock-solid business in the crumbling movie theater sector. The stock is a great long-term investment right now.

A REIT that could be a big winner of the reopening

Matt Frankel, CFP (EPR Properties): As we head into August, one stock I'm keeping a close eye on is EPR Properties (EPR -0.03%), a real estate investment trust, or REIT, that invests in experiential properties. Think movie theaters, ski resorts, waterparks, golf attractions, and more. The company owns 354 properties, leased to more than 200 tenants in 44 U.S. states and Canada.

EPR's future profitability was looking a little uncertain earlier this year, as movie theaters account for 46% of its contractual rental income and AMC Entertainment is EPR's top tenant. But thanks to the massive Reddit-fueled run up in AMC's stock price, the company has been able to raise about $2 billion in fresh capital, and its future (and ability to pay rent) is no longer in question.

In fact, EPR recently announced the resumption of its monthly dividend payments due to the increasing stability of its tenant base, and the stock now yields nearly 6%. Going forward, EPR plans to resume growth as it has nearly $1.5 billion in liquidity (including $538 million in cash), a large amount for a company whose entire market cap is less than $4 billion. Management sees a massive $100 billion investable universe of properties it could add to the portfolio to take advantage of Americans' desire to get out and have experiences. And I'd have to imagine that given the stress of the pandemic, EPR is looking forward to increasing exposure to non-theater properties. In short, there are many real estate stocks that stand to benefit as the pandemic continues to wind down in the U.S., but with the most experiential focus of any REIT, EPR could be one of the biggest winners.

A winner in every outcome?

Dan Caplinger (Moderna): Rising biotech star Moderna (MRNA -0.58%) has been on a big roll over the past year, as the rapid development of its mRNA-1273 COVID-19 vaccine was a game changer in the fight against the pandemic. The success of the vaccine has helped Moderna's stock more than quadruple over the past year, and that earned the biotech company an invitation to join the S&P 500 Index.

Going forward, some investors had worried that once the pandemic was under control, Moderna's biggest revenue driver would disappear. However, many U.S. investors have underestimated the global demand for Moderna's vaccines in areas that will be slower to get access. Moreover, the emergence of the delta variant has made it more likely that vaccine booster shots might be necessary in the future, which would be a new source of revenue for Moderna.

Most importantly, Moderna's experience with COVID-19 has been a massive proof of concept of the science underlying its mRNA treatment development strategy. Going forward, Moderna will have plenty of opportunities to make medical advances with other diseases. The sky's the limit for Moderna, and even once the pandemic is under control worldwide, the biotech's prospects aren't going away anytime soon.

The structural shortage of housing is real

Tyler Crowe (Green Brick Partners): The scars of the financial crisis over a decade ago still run deep in this economy, particularly in Wall Street's attitude toward homebuilders. There is constant chatter about whether we are in a housing bubble right now, but that may not be the question we should be asking.

The question we should be asking ourselves right now is: How can we make up for over a decade of underinvestment in the housing sector?

There is only one answer, really: Build more houses. For investors, this could be an incredible time to buy an up-and-coming homebuilder such as Green Brick Partners (GRBK 0.71%).

Despite its smaller size -- a market cap of about $1.2 billion at the time of this writing -- Green Brick posts some incredibly impressive operating numbers with one of the best gross margins in the business as well as a low amount of debt. This gives it ample room to continue to grow at its recent blistering pace. Over the past five years, fully diluted earnings per share is up 478%.

There is always a reason why investors aren't big on homebuilders. It is a tough business with relatively low margins and can be sensitive to commodity costs and economic cycles. With the underlying rend of a decade-long housing shortage supporting its growth, though, Green Brick looks like a fantastic business to consider this month.