Life science and diagnostics company Danaher (DHR -0.52%) is one of the big winners from the COVID-19 pandemic. Its diagnostic tests help detect the coronavirus, and its life sciences tools help medical bodies research and develop vaccines and therapies for it.

That said, what happens to the company's growth rate after the pandemic is over? Are investors in the stock about to be left holding a stock trading on a high valuation that's just about to see earnings growth prospects deteriorate?

Image source: Getty Images.

Three reasons Danaher can keep on delivering

I think there's reason to believe that Danaher can keep growing at a very healthy clip, even in a post-pandemic environment.

- Current earnings momentum is robust across all its businesses, COVID-19 related and non-COVID-19 alike.

- Management's guidance for non-COVID-19 related revenue growth in 2021 has been upgraded and demonstrates underlying strength in the business.

- The pandemic has strengthened the company's core business and growth prospects.

Strong earnings momentum

The company recently delivered its second-quarter earnings, and it managed to sail past management's previous guidance. For example, management had previously forecast second-quarter core revenue growth would come in within the mid-20% range, but it came in at 31.5%. As such, management upgraded its expectation for full-year core revenue growth from "high teens" to "approximately 20%."

As you can see below, the life sciences and diagnostics segments continue a powerful run, boosted by the pandemic (more on that in a moment), and the environmental and applied solutions (EAS) business is also back in growth mode. For reference, life sciences contributed $2.3 billion of operating profit in the first half compared to $1.3 billion from diagnostics and $565 million from EAS.

EAS is a collection of water quality and product ID businesses. During the earnings call, CEO Rainer Blair noted that both business platforms grew strongly in the quarter as the reopening of the economy increased sales and order rates as customers were investing in "larger projects" again.

Data source: Danaher presentations. Chart by author. YOY = year over year.

Non-COVID-19 growth is strong too

The burning question on everybody's lips is, what kind of growth rate can investors expect after the pandemic? To help answer it, Danaher's management breaks out its guidance into COVID-19 related revenue and its "base business." As noted earlier, the full-year core revenue growth guidance was raised to "approximately 20%."

Going into more detail on the matter, Blair said "We anticipate that COVID related revenue tailwinds will be an approximately 10% contribution to the core revenue growth rate, and in our base business, we now expect that core revenue will be up 10% for the full year, an increase from our prior expectation of high single-digit."

In other words, the ramp up in the guidance primarily comes down to an increase in the guidance from the base business. That bodes well for Danaher's post-pandemic growth prospects.

The pandemic has structurally enhanced Danaher's growth

This is a subtle and critical point to understand. It's not just that the pandemic provided a temporary boost to Danaher's prospects. In life sciences, the investment made worldwide in vaccine and therapeutic science to combat the coronavirus is likely to spill out into broader-based research that can benefit Danaher for years to come.

Meanwhile, Blair outlined that monoclonal antibody-based therapies in development have increased 50% "from just five years ago." Turning back to COVID-19, there's always the possibility that a third booster shot and wide-scale vaccination of children will provide a near-term boost to Danaher's sales.

Image source: Getty Images.

Danaher has increased its installed base of diagnostic platforms by over 40% since the pandemic started. That's important because the diagnostics business works based on the "razor/razor blade" business model. In other words, more platform sales lead to more opportunities for Danaher to sell new tests into the installed base. For example, Blair pointed out that assays (tests) for sexual health and hospital-acquired infections were up 30% in the second quarter. Also, Danaher is continually working on new assays.

Danaher is ramping up capital spending from $790 million in 2020 to around $1.5 billion in 2021, partly to build on the growth in assay development and fuel growth in the Cytiva biopharma business bought from General Electric in 2020.

Is Danaher a buy?

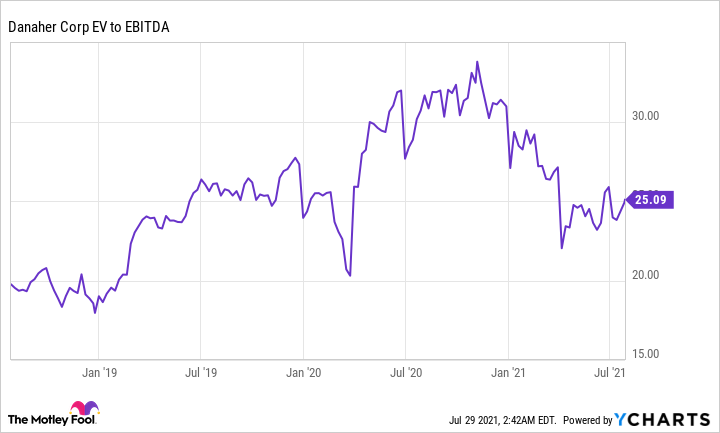

The exciting thing about Danaher's valuation is that it trades on roughly the same enterprise value (market cap plus net debt)-to-earnings before interest, taxation, depreciation, and amortization (EBITDA) valuation as it did before the pandemic started.

Data by YCharts

Therefore, if you believe in relative valuations, then Danaher is an attractive stock because the pandemic has enhanced its long-term growth potential. On the other hand, it's still a pretty hefty valuation to trade on, and cautious investors might want to wait for a dip to buy into a very attractive company.