What happened

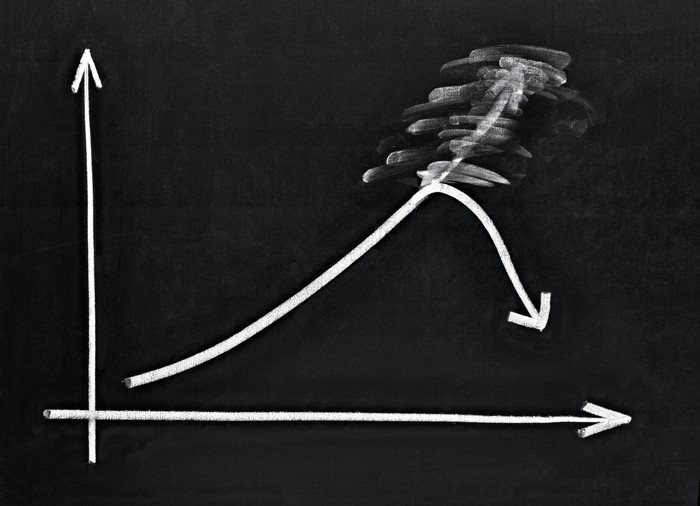

Shares of military drone-builder Kratos Defense & Security Solutions (KTOS 0.06%) collapsed in Friday afternoon trading, falling 12.1% through 2:25 p.m. EDT on no obvious bad news.

So what

No obvious new news, that is. But if you don't mind a bit of old news, take a stroll down memory lane with me to last week, when Kratos reported its second-quarter earnings, and warned investors that its "book-to-bill" ratio in the quarter fell below one (indicating slowing sales), and that its book-to-bill ratio in the company's all-important drone segment fell even further -- to 0.4.

Kratos also warned at the time that it wasn't going to even get close to hitting Wall Street targets for $216 million in sales this current third fiscal quarter, and that sales would probably max out at $205 million or less.

Image source: Getty Images.

Now what

That bad news cost Kratos 12% on earnings day, but in the days since, the shares had climbed back steadily through the middle of this week, cutting Kratos' post-earnings losses roughly in half.

But here's the thing: Kratos' news last week was bad. In addition to the weak order bookings, and weak revenue guidance, Kratos admitted that free cash flow for the second quarter had turned negative, reversing a two-quarter streak of generating strong cash profits. And the company hasn't reported any good news in the days since, such as might have justified the rebounding stock price.

Seems to me, all we're really seeing today is gravity reasserting its hold, and Kratos stock falling back toward the levels it was (rightly) reduced to last week.