Growth stocks can be great investments over the long haul. But finding ones that are still relatively cheap and that have lots of upside can be a challenge. And gambling on penny stocks can be more risky than it is worth. However, there are a couple of low-priced but promising options out there for investors to consider: Village Farms International (VFF 8.13%) and Zynga (ZNGA).

Both of these companies have been generating some strong numbers of late, and with their shares trading in the $8 to $9 range, there's definitely plenty of room for them to rise in value. Both are also trading on the lower end of their 52-week ranges. Here's why they could make for some great additions to your portfolio.

Image source: Getty Images.

1. Village Farms

You'll like Village Farms because it's more diverse than your typical marijuana stock. The company is first and foremost in the produce business; the bulk of its revenue still comes from that area of its operations. But like many businesses that have ventured into cannabis, it's pot that is contributing to much of the growth and that gives the stock the potential to generate some great returns for investors.

For instance, Village Farms has generated $80 million in revenue from its produce segment over the past two quarters, which represented year-over-year growth of just 1%. . Cannabis, meanwhile, added $42 million in revenue that wasn't there a year ago. That's because Village Farms didn't have a cannabis segment until it fully acquired Pure Sunfarms' operations (it owns 100% today, but prior to November 2020 it was owned as part of a joint venture with Emerald Health Therapeutics).

And make no mistake, what makes Village Farms a hot buy is Pure Sunfarms. The low-cost greenhouse is often the highlight of the company's press releases, with words like "record" and "consecutive" reminding investors why this is an exciting business to invest in. And true to form, in Village Farm's second-quarter report for the period ending June 30, Pure Sunfarms had broken yet another record for revenue. It was also the fourth consecutive period in which retail branded sales were up 20% or more from the previous quarter.

The company also claims that, according to the Ontario Cannabis Store, it was the top-selling producer of dried flower products in Ontario for the period. In addition, Pure Sunfarms also posted a positive adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) for the 11th period in a row.

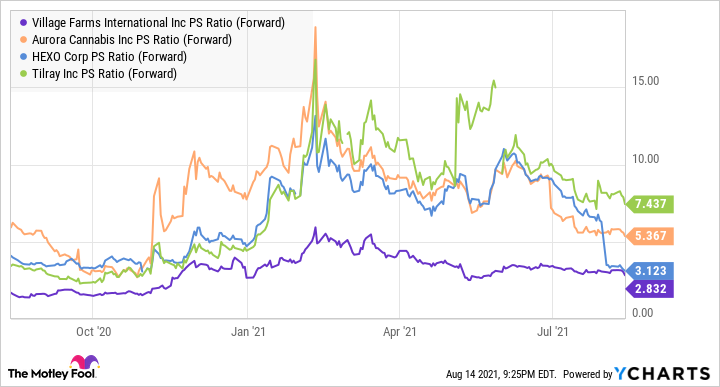

Village Farms as a whole posted an adjusted EBITDA profit of $1.6 million across all of its businesses in Q2 (produce actually weighed on its bottom line, with an adjusted EBITDA loss of $3.9 million). Even though the company has been generating some great growth numbers overall, Village Farms is still incredibly cheap compared with its peers on a forward price-to-sales (P/S) basis:

VFF PS Ratio (Forward) data by YCharts

What makes the stock look even better is that Pure Sunfarms' top line still has plenty of room to get even bigger as the company only launched its first cannabis-infused gummies earlier this year, following in the footsteps of many cannabis producers that have been expanding into the relatively new segment of the market -- edibles were legalized in Canada in 2019, one year after dried flower products. Given its cheap valuation and the attractive opportunities that lay ahead, Village Farms is a growth stock that can produce some solid returns for investors in the long run.

2. Zynga

Gaming stock Zynga took a blow this month after the company admitted that the outlook for the business may not be so strong now that people are spending more time outdoors and simply not playing as much.

During the three-month period ending June 30, the company's revenue was its best ever for the second quarter, with a total of $720 million marking growth of 59% year over year. And Zynga did this while posting a profit of $27.8 million (versus a loss of $150.3 million in the prior-year period). However, investors were likely concerned about CEO Frank Gibeau's comments on the earnings call, in which he noted that people were playing games less frequently as economies open back up and governments lift COVID-19 restrictions.

It also doesn't help that management anticipates revenue for the next quarter to come in a bit lower, at $665 million, although that would still mean year-over-year growth of 32%. And that includes contributions from recently acquired mobile advertising company Chartboost, which Zynga officially incorporated into its business on Aug. 4. However, it does not include contributions from mobile game developer StarLark, a more recent acquisition that won't close until the fourth quarter.

With positive free cash flow of $296 million over the trailing 12 months and more than $1 billion in cash on its books as of the end of last quarter, Zynga is in a good position to continue growing and taking on more acquisitions. The stock trades at a forward P/S of just 3, which is incredibly cheap compared with smaller game developer Skillz, which trades at 12 times its future revenue. And it looks like a bargain versus popular gaming stock Roblox, which went public earlier this year and is commanding a forward P/S of 18.

Zynga is an attractive stock to buy right now as it is trading near its 52-week low and is still growing at a great pace.