Shares of freelance marketplace company Fiverr International (FVRR -1.81%) have fallen over 50% from their 52-week high, and a relatively weak earnings report earlier this month didn't help matters. The company is still growing, but as more companies return to the office, the need for freelancers is falling and investors don't know when higher growth rates will return.

We knew the pandemic-related growth at Fiverr would subside eventually, but investors didn't seem ready for the growth train to end quite yet. Despite the pullback, there's a lot to like under the hood at Fiverr.

Image source: Getty Images.

The freelance business is booming

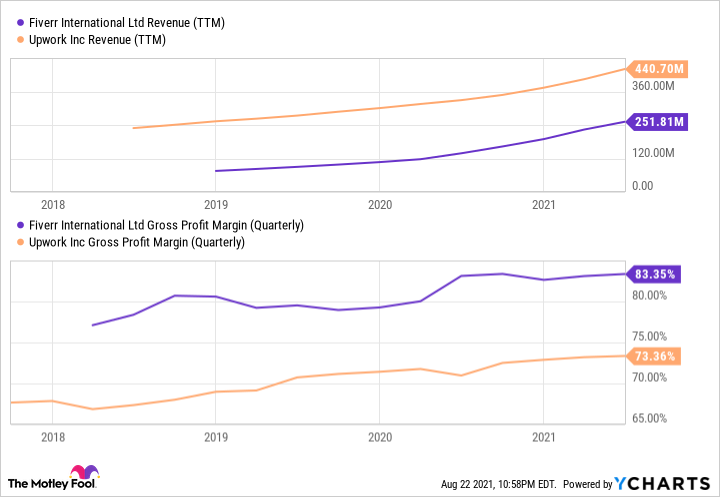

The leaders in the freelance marketplace business haven't been public for long, but they're showing tremendous growth. For example, you can see below that Fiverr has more than tripled revenue since the start of 2019 and Upwork (UPWK 1.17%) has nearly doubled revenue over that time.

FVRR Revenue (TTM) data by YCharts.

The pandemic certainly helped with growth, but tailwinds were already behind the freelance business. The internet has allowed companies and consumers to connect with subject matter experts around the world. They just need a marketplace to make the connection, and that's what Fiverr and Upwork have built.

What's encouraging long-term is that freelancing isn't going anywhere. Freelancing allows financial flexibility for businesses and the ultimate work flexibility for workers. I think we're just starting to see companies fundamentally built around this freelance model. Instead of hiring workers, small, nimble start-ups will simply contract out work, and the fees going to freelancers, and ultimately Fiverr and Upwork, will be larger and more sustainable.

Questions to be answered

As much as I like the long-term trajectory at Fiverr, there are some questions that need to be answered. Management said that Q3 2021 revenue will land between $68 million to $72 million, down slightly from $75.3 million in the second quarter. I'm not going to lose sleep over one down quarter as the pandemic tailwinds ease, but I will be watching whether revenue picks up later in the year and early in 2022 as businesses and freelancers get into a more regular cadence.

Fiverr is also trying to go upmarket with higher-value buyers and freelancers. That includes larger businesses and more valuable service providers. On that note, the company recently announced partnerships with Salesforce.com and Wix.com. The Fiverr Business platform is now 5% of the marketplace business. We know Fiverr can win in the small-scale freelance business, but if it can grow in larger projects, that could open up a new growth phase.

If the answers to these questions are positive over the next few quarters, Fiverr could be a great growth stock.

Why Fiverr is the best freelance stock today

Why is Fiverr the best stock in freelancing? You can see above that Fiverr's gross margin is better than Upwork's. It's also growing more quickly. I think that's evidence that Fiverr's network is working like a flywheel.

I will note that operating expenses have been rising nearly as fast as revenue, and that's why the company is still losing money. In the second quarter of 2021, research and development expenses nearly doubled to $20.1 million, while sales and marketing costs jumped 65% to $38.2 million. Investors will want to watch operating spend going forward, because if it grows more slowly than revenue, the company could be highly profitable.

What really intrigues me about Fiverr is how simple it is to use and how the company uses its growing user base to integrate with partners. I mentioned the Salesforce and Wix partnerships as opportunities to grow the network and get into bigger businesses. And I like a company that is established with smaller users and then goes upmarket from a position of strength.

Positive network effects in a marketplace business like this are hard to stop once they get going. And Fiverr's growth is attracting more buyers and sellers, showing the network effect is working. That's a big reason why I like Fiverr's business and think it's the best stock in the freelance arena right now.