You can divide COVID-19 healthcare stocks into three broad categories: vaccines, diagnostics, and treatments. Three Fool.com contributors have each picked one sector they believe will be strong going forward, as well as one stock in that sector.

Taylor Carmichael still likes the vaccine space, and Novavax (NVAX 2.06%) remains his favorite investment in that sector. Patrick Bafuma has his eye on the diagnostic side, and he believes CareDx (CDNA 2.97%) is the winner going forward. And George Budwell offers his top pick for COVID-19 therapeutics: Gilead Sciences (GILD 0.91%). Read more to see why this trio is bullish on these stocks.

Image source: Getty Images.

1. Novavax's CEO is about to smack one out of the park

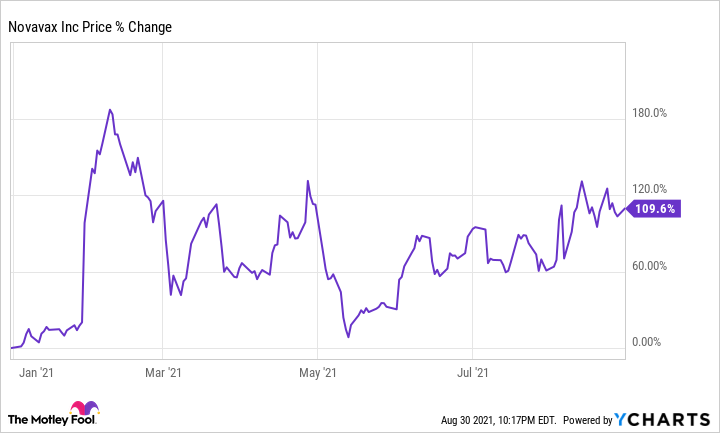

Taylor Carmichael (Novavax): Some investors are frustrated with Novavax CEO Stan Erck. We've been waiting for the company to file its Emergency Use Authorization request for months and months. There has been delay after delay. Erck has overpromised and underdelivered. Despite all this disappointment, the stock is up 109%.

You know you're doing a good job when people are complaining about the stock doubling. Yes, the delays are annoying. But as Novavax files for authorizations around the world, in Europe and Asia and in the U.S., too, contemplate the massive opportunity the company has in front of it.

Novavax's market cap is $17 billion. The high estimate for next year is $7.9 billion in revenue. The low is $2.8 billion. If you put a price-to-sales ratio of 10 on those numbers, the market cap should fall somewhere between $28 billion and $79 billion.

That's what I'm expecting. The stock might hit both of those numbers, maybe in the same week. I'm expecting Novavax stock to be volatile, to run up on the first EUA, and the next one, and the one after that. I'm expecting a massive crash in the stock price, too. It's going to be crazy. By the end of the year? Stan the Man has two more doubles.

2. This diagnostic company will thrive regardless

Patrick Bafuma (CareDx): When it comes to biotech investing, pure plays can be rather volatile. The diagnostic market is no different. It can be dizzying to wade through the details of PCR testing, antigen testing, and at-home kits, not to mention sensitivity against variants. Add in the potential of combination testing with seasonal flu and respiratory syncytial virus, and predicting the COVID-19 diagnostics arena becomes a minefield. That, and I suspect betting against industry heavyweights like Abbott Laboratories or Roche Holding is a losing proposition in the long term.

Therefore, I turned to a diagnostics company that has grown through the pandemic; one that aided a vulnerable patient population along the way. A company that offers testing that is mission-critical for determining the health of a transplanted organ and one that an entire segment of the population would suffer without. CareDx and its bevy of testing and management services for patients before and after they receive an organ transplant is my choice for diagnostics.

CareDx looked at the COVID-19 black swan event as an opportunity to better serve its patients and emerged stronger because of it. In fact, more than 9,000 patients have signed up for the company's mobile blood draw service, RemoTraC. This entire process was created and implemented on March 17, 2020. For perspective, COVID-19 was declared a national emergency in the U.S. on March 13, 2020, and California became the first state to enact a stay-at-home order on March 19, 2020. Patients clearly want to continue using the mobile service, as the company reported approximately 40% of RemoTraC patients were still utilizing the program in each of the last two quarters -- suggesting RemoTraC may have some staying power. For perspective, the company ran about 36,000 tests in the most recent quarter, so while the mobile phlebotomy segment represents a small portion of total tests run, it's not the test volume I'm impressed with -- it is management's ability to find innovative ways to meet patient and clinician needs.

Speaking of growth, the second quarter was the transplant biotech's fifth consecutive quarter of both double-digit revenue and volume growth sequentially. With Q2 total revenue increasing 77% compared to the year-ago quarter and adjusted gross margin for Q2 at 70%, plus raising guidance for the second consecutive quarter, this company is firing on all cylinders. With COVID-19 testing slowing faster than some companies were expecting, and cancer diagnostic growth companies like Guardant Health growing revenue at a lesser clip than CareDx (39% year over year in the most recent quarter) and being somewhat reliant on an in-person sales force, this transplant diagnostics company seems to be immune from the adverse effects of the coronavirus. Despite the pandemic, CareDx topped its initial 2020 full-year revenue estimates by 16%, and is projecting just over 50% increase in revenue in 2021 -- its fourth straight year of 50% or more revenue growth.

And the $4 billion company has plenty of room for growth. Its testing for lung transplant patients for rejection has recently been approved and it is in the research phase of screening liver and stem cell transplantations for rejection. CareDx has also just recently started reaching out beyond large academic centers to local dialysis clinics. The company aids in the management of kidney transplant waiting lists for the community setting and is helping to set up testing protocols to help transition post-transplant patients from the transplant center back into their community dialysis centers. In short, it has lots of levers for future growth.

How a company reacts to uncertainty and challenges is telling; long-term winners often emerge from black swan events stronger. When it came to COVID-19, CareDx was not in survival mode, it looked at the pandemic as an opportunity. It asked how it could best serve patients. By keeping this focus, CareDx looks like a winning diagnostic stock with or without a pandemic.

3. Veklury: A proven commodity

George Budwell (Gilead Sciences): Most healthcare companies focusing on cutting-edge COVID-19 diagnostics and/or vaccines have benefited tremendously from the ongoing pandemic. But therein lies the problem for potential investors. Namely, the bulk of COVID-19 diagnostic and/or vaccine stocks are presently trading at sky-high valuations. Biotech heavyweight Gilead Sciences and its COVID-19 therapeutic Veklury (remdesivir) offer a compelling alternative for biotech investors on the hunt for considerable growth opportunities in the space.

Isn't Veklury on the wrong side of its growth trajectory? While it is indeed true that Veklury's sales have dropped from a jaw-dropping $1.9 billion in the fourth quarter of 2020 to a far more modest $829 million in the second quarter of 2021, the drug is still the therapy of choice, in most cases, for patients hospitalized with COVID-19, according to Gilead's management team. So, with the delta variant causing another wave of cases across the world, Veklury should remain an important cash cow for Gilead over the course of the next six months. That being said, the most attractive feature of this blue chip biotech stock is its overall value proposition.

Aside from Veklury, Gilead is seeing a healthy level of sales growth across its cohort of newer therapeutics, such as the megablockbuster HIV medicine Biktarvy, CAR-T therapy Tecartus, and breast cancer drug Trodelvy. What's more, the biotech's stock is currently trading at a paltry 3.7 times 2022 projected sales. That definitely qualifies as a low-end valuation within the realm of large-cap biotech stocks, especially for one that comes with an annual dividend yield of nearly 4% at current levels. All told, Gilead's stock comes across as a solid growth, value, and dividend play, thanks in no small part to Veklury.