While not the fastest-growing name in the data management software space, Splunk (SPLK) is still far and away the leader among its peers. Nevertheless, patience will remain essential for shareholders here. Splunk is still changing as its customers migrate to a more modern cloud-based format. Over the last year, that change from legacy software to the cloud has equated to a hot accounting mess. But Splunk's makeover is starting to yield results, as shown in its Q2 fiscal 2022 report.

Image source: Getty Images.

A return to positive cash generation is imminent

Splunk reported yet another quarter of solid annual recurring revenue growth (or ARR, which combines the annualized value of all cloud and legacy software sales). And with cloud-specific ARR now over one-third of the total (compared to less than 30% in the same period last year, when cloud software was nearly doubling year-over-year), Splunk's actual realized revenue for Q2 2022 (the three months ended July 31, 2021) was regaining positive traction. Q2 revenue was nearly $606 million, up 23% from last year. As a reminder, Splunk's rapid move to cloud-based customer billing was creating a short-term decline in realized sales over the last year.

|

Fiscal Year Period |

Cloud ARR |

YOY Growth |

Total ARR |

YOY Growth |

|---|---|---|---|---|

|

Q2 2021 |

$568 million |

89% |

$1.93 billion |

50% |

|

Q3 2021 |

$630 millino |

71% |

$2.07 billion |

44% |

|

Q4 2021 |

$810 million |

83% |

$2.36 billion |

41% |

|

Q1 2022 |

$877 million |

83% |

$2.47 billion |

39% |

|

Q2 2022 |

$976 million |

72% |

$2.63 billion |

37% |

Data source: Splunk. ARR = annual recurring revenue.

Splunk's cloud business is still growing at a rapid pace, but with the initial wave of customer transitions now in the rearview mirror, the billing effects aren't creating as big a drag on the bottom line anymore. Free cash flow was back in negative territory in Q2, but through the first half of the current fiscal year totaled positive $5.2 million. Management said to expect positive operating cash flow of $100 million for full-year fiscal 2022 on total revenue of at least $2.53 billion (or total ARR of at least $3.09 billion).

A big market with plenty of options

What does all of this mean? Though Splunk is still a bit behind the curve in the modern cloud era, it's making progress on this front. And while billing effects made it appear Splunk was moving backward during fiscal 2021, that wasn't (and still isn't) the case. This is a growth company in the data analytics and cloud observability industry.

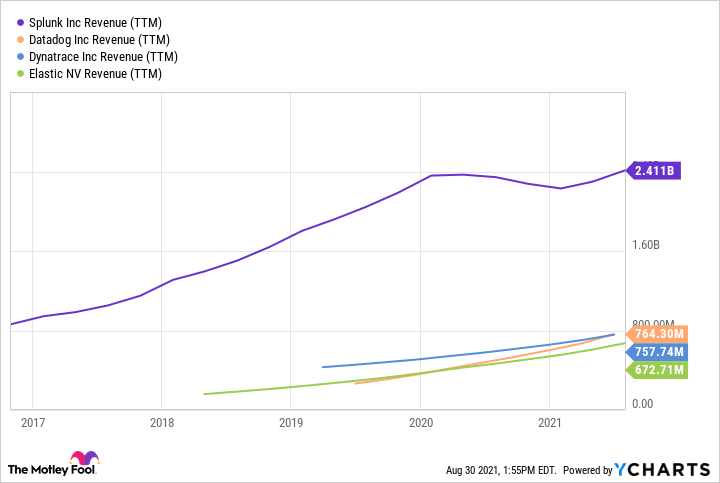

Nevertheless, Splunk is an incumbent here. It's still by far the largest player among its peers, but companies like Datadog, Elastic, and Dynatrace are working hard to catch up.

Data by YCharts.

Don't write off Splunk just yet, though. This is a big market, and cloud computing (and all the basic tools that will be needed to manage cloud operations) will be a massive industry by the end of the decade, encompassing some $1 trillion a year in global spending. As part of its own transformation, Splunk launched new data observability and cybersecurity services in the last quarter alone, and received a $1 billion investment from private equity firm Silverlake to help. It finished out July 2021 with cash and investments of nearly $2.54 billion, offset by convertible debt of $3.05 billion.

It isn't the cleanest balance sheet, but Splunk's return to positive cash generation by the end of the year should start to fix that -- not to mention give it the continued ability to make more strategic acquisitions of smaller data management software outfits. This journey into the next chapter of Splunk's growth story is far from over, but it's starting to pay off for patient shareholders.