September has historically been one of the worst months for the stock market. But for investors focused on the long term, this only means that if history repeats itself, we will come across shares of excellent companies trading for a discount in the next few weeks.

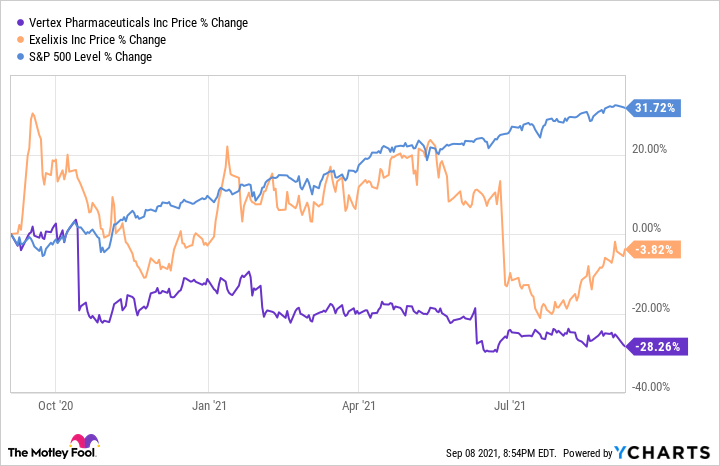

If you aren't willing to wait that long, there are excellent stocks that have lagged well below the broader market in the past year and are definitely worth consideration right now. Two that come to mind are Vertex Pharmaceuticals (VRTX -0.27%) and Exelixis (EXEL 0.22%). Let's see why, despite recent struggles, both of these biotechs may deserve a place in your portfolio.

VRTX data by YCharts.

1. Vertex Pharmaceuticals

Shares of Vertex dropped 15% on Oct. 15 after the company announced it was giving up on one of its pipeline candidates: investigational VX-814 for treatment of alpha-1 antitrypsin deficiency (AATD) -- a genetic disease resulting in a missing liver protein. The company made that decision after unsatisfactory results in a phase 2 clinical trial.

Vertex hasn't recovered from this steep decline. Its share price is actually lower today than it was in mid-October of last year.

But the company's long-term prospects remain bright. Its most important product -- Trikafta, which treats cystic fibrosis (CF) -- was approved in October 2019. That's pretty recent considering the 20 years of patent protection that new clinical compounds are entitled to in the U.S. Trikafta's patent won't expire until well into the 2030s. After posting $3.9 billion in revenue last year, this drug should continue growing at a good clip.

Image source: Getty Images.

Vertex also has promising pipeline candidates. During the company's second-quarter earnings conference call, CFO Charles Wagner said: "We have a number of multibillion-dollar opportunities advancing in the pipeline, many with near-term milestones, including those in beta cell, sickle cell disease, APOL1-mediated kidney disease, pain, type 1 diabetes, and [AATD], each of which have the potential to drive significant growth beyond CF into the 2030s."

The company expects data from the phase 2 clinical trial of VX-548, its investigational treatment for acute pain, within the next six to nine months. It also expects data readouts for VX-880, its potential treatment for type 1 diabetes, within the next six months.

Meanwhile, CTX001, its potential therapy for sickle cell disease and beta-thalassemia, has produced solid results in clinical trials. A phase 3 study is in the works and it could earn regulatory approval within the next couple of years or so. Current standards of care for sickle cell disease and beta-thalassemia leave a lot to be desired, so CTX001 could generate solid revenue if it makes it to market.

With more than $6 billion in cash and cash equivalents, the company also has the means to acquire other promising programs, thereby expanding its pipeline.

What does all this mean for investors? Vertex's future extends well beyond its CF portfolio, and the company is looking to continue its winning ways for many years to come. In short, after underperforming the market over the past year, this biotech stock looks like a buy.

2. Exelixis

Another biotech that saw its stock drop sharply recently is Exelixis -- best known for Cabometyx, a treatment for renal cell carcinoma (RCC), the most common form of kidney cancer; and hepatocellular carcinoma (HCC), the most common form of liver cancer. Cabometyx has been particularly successful in the market for RCC. It was the first therapy to achieve significant improvement in overall survival, objective response rate, and progression-free survival in RCC patients.

Exelixis shares got hammered recently -- falling 20% in a day -- after Cabometyx delivered disappointing results in a clinical trial as a combination treatment for HCC. While the shares have recovered a bit, they are still down sharply.

Yet, Cabometyx remains the top-prescribed tyrosine kinase inhibitor (TKI) for RCC patients. TKIs are targeted therapies that attack specific cancer cells. Cabometyx continues to earn new indications; in January, the U.S. Food and Drug Administration approved Cabometyx together with Bristol Myers Squibb's Opdivo as a combination treatment for patients with advanced RCC.

Image source: Getty Images.

This label expansion has had a meaningful impact on the company's top line. During the second quarter, sales of Exelixis' crown jewel jumped by 59% to $275.6 million, thanks largely to this new regulatory nod. Investors can expect many more label expansions for Cabometyx as a stand-alone or combination therapy. The cancer drug is currently undergoing more than two dozen clinical trials. Exelixis expects Cabometyx's annual sales to reach $1.5 billion in 2022 -- about double its level in 2020.

And Exelixis has already started to plan for life beyond its flagship product. The company is advancing its early stage programs, including several potential cancer medicines. While these products still have a long way to go before contributing to Exelixis' top and bottom lines, the company's growing revenue -- thanks to its Cabometyx franchise -- should enable it to continue posting strong financial results in the meantime.

In my view, the 20% one-day decline was a bit overdone, to say the least. The bright side is that investors can now pick up shares of this biotech stock on the dip.