Investors have high expectations heading into Nike's (NKE -1.26%) earnings report in just a few days. The footwear and apparel giant revealed impressive growth in the previous quarter, and since that time comments by peers like lululemon athletica and Foot Locker have only increased enthusiasm in the industry.

That's why it's likely Nike will extend its positive momentum with its report on Thursday, September 23. But there are some caution flags for investors to watch out for as the company updates expectations for the rest of its fiscal 2022.

Let's take a closer look.

Image source: Getty Images.

The sales picture

Nike announced a head-turning 96% sales spike back in June. Sure, most of that surge had to do with a depressed year-ago period that saw some of the widest retail shutdowns of the pandemic. But Nike still blew past Wall Street's expectations.

Athleisure specialist lululemon recently posted a surprise growth acceleration through the early summer, and Foot Locker said it has seen no slowdown yet in demand for sneakers and apparel. Nike also recently pushed its marketing spending back up to $1 billion thanks to the resumption of live sport broadcasts.

All those factors help explain why most investors are looking for new record sales from Nike this week, with revenue rising to $12.5 billion from $10.6 billion a year ago.

Better news on profits

Nike likely endured big cost spikes, with raw materials, transportation, and labor expenses all rising in the period. But I would expect it had an easy time passing along those increases through higher prices.

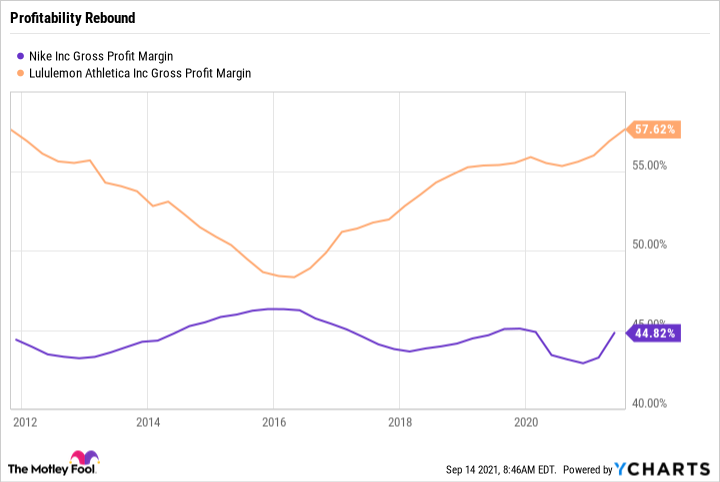

That long-term profitability outlook is a key pillar of the investment thesis for this growth stock. Nike's management team believes it is building a new financial model that relies on direct-to-consumer sales over retailer sales, so it could reasonably target gross margins that are closer to lululemon's 58% figure than the mid-40 range it has seen in recent years.

NKE Gross Profit Margin data by YCharts

Looking out to 2022

Lululemon boosted its growth outlook for the second straight time in 2021, and is predicting that sales will jump as high as $6.3 billion, compared to the prior $5.9 billion forecast. Nike's executives will be looking at similarly strong demand trends when they issue their updated outlook. As it stands today, CEO John Donahoe and his team forecast low-double-digit sales gains in each of the next three years, along with modest boosts in gross and operating profit margin.

The main threat to that positive outlook, beyond an economic slowdown, is inventory and supply chain challenges. Nike will have to compete with other retailers, all seeking freight capacity, to fill its distribution network heading into the holiday season shopping crunch.

In some cases it might have to pay up for the service or pay much more for air freight over container ships. The bigger challenge would be a bottleneck that forces out-of-stock situations that depress sales in late 2021.

But even that scenario would spell just a temporary speed bump that shouldn't worry investors. Nike appears to be on a faster growth trajectory -- one that, along with profit margin gains and dividend payments, promises to deliver solid returns to shareholders over time.