Stock valuations have soared to multiyear highs in 2021, helping the S&P 500 hit an all-time high last month. Nevertheless, shares of Kohl's (KSS -2.01%) have been trading at a rock-bottom valuation of less than 10 times forward earnings recently.

Kohl's shares got even cheaper last week, sinking 12% to end the week at $48.56: 25% below their 52-week high. This pullback represents a great buying opportunity for long-term investors.

Kohl's stock performance, data by YCharts.

Why Kohl's stock suddenly plunged

A big analyst downgrade and a weak earnings report from Bed Bath & Beyond (BBBY) caused Kohl's stock to plummet 12% on Thursday alone.

Bank of America analyst Lorraine Hutchinson cut her rating on Kohl's by two notches, from buy to underperform. Meanwhile, she slashed her price target from $75 all the way to $48. Hutchinson noted that supply chain disruptions continue to worsen, particularly in the activewear category. That could make it hard for Kohl's to get enough inventory to grow its sales. She expects the problems to continue into 2022.

Bed Bath & Beyond's awful Q2 earnings report seemed to corroborate Hutchinson's concerns. Comparable sales declined 1% year over year, missing management's forecast of modest growth, due to a sharp slowdown in store traffic in August. Additionally, surging freight costs caused adjusted gross margin to fall short of the company's guidance at 34%.

As a result, Bed Bath & Beyond's adjusted earnings per share plunged 92% year over year to just $0.04. On average, analysts had expected EPS of $0.52. Finally, management warned that the headwinds that hurt Bed Bath & Beyond last quarter have continued into the third quarter.

Bed Bath & Beyond is a poor comparison

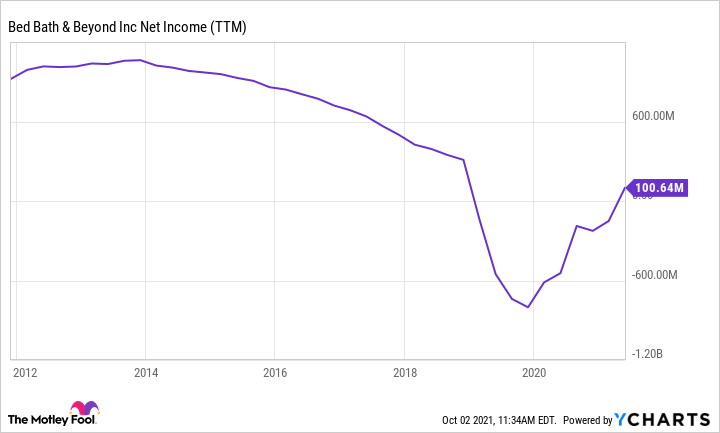

Investors appear to be overreacting to Bed Bath & Beyond's weak results by dumping other retail stocks. Bed Bath & Beyond has been struggling with stagnant sales and deteriorating margins for years. In fiscal 2019 -- before the pandemic hit -- adjusted net earnings totaled just $57 million, down from a peak of $1 billion in fiscal 2013.

Bed Bath & Beyond net income (TTM), data by YCharts. TTM = trailing 12 months.

Kohl's profitability also deteriorated over the same period, but not nearly to the same extent. And whereas Bed Bath & Beyond is closing hundreds of stores due to underperformance, Kohl's has closed just a handful of locations and says that 90% of its stores generate over $1 million of cash flow annually.

Moreover, whereas Bed Bath & Beyond's core banner sales fell 12% last quarter compared to the same period in 2019, Kohl's reported in August that total revenue increased slightly relative to 2019 in its second fiscal quarter. Just as importantly, while Bed Bath & Beyond logged a pitiful 1% adjusted operating margin last quarter, Kohl's posted a stellar 12.8% operating margin in Q2, as gross margin reached 42.5%: up by 3.7 percentage points compared to fiscal 2019.

To be fair, Kohl's second fiscal quarter ended on July 31, while Bed Bath & Beyond's Q2 ended four weeks later. A slowdown in store traffic and a surge in freight costs last month partly explains Bed Bath & Beyond's underperformance. Yet even on an apples-to-apples basis, Kohl's is clearly seeing dramatically better sales and earnings trends than the home furnishings chain.

Image source: Kohl's.

Focus on the long term

Hutchinson (the Bank of America analyst) may be right that supply chain problems will disrupt Kohl's sales growth and weigh on its earnings in the second half of this year and at least part of fiscal 2022. However, that doesn't mean investors should sell Kohl's stock.

The current supply chain challenges will ease sooner or later: probably sometime in 2022. Furthermore, Kohl's recently started opening Sephora beauty shops in some of its stores. This new partnership should drive a big increase in store traffic and sales as Kohl's continues the Sephora rollout over the next two years.

Selling Kohl's stock when it trades for less than 10 times earnings and results should improve significantly by 2023 doesn't make sense. Additionally, Kohl's has at least $1 billion of excess cash and continues to generate strong free cash flow, which will allow it to capitalize on dips in the stock price by ramping up share buybacks. If anything, the long-term investment case for Kohl's looks better than ever after the stock's recent pullback.