Apple (AAPL -1.22%) will release its fiscal 2021 fourth-quarter results on Oct. 28, which means that investors on the hunt for a fast-growing company trading on the cheap may need to act quickly, as the smartphone giant seems on track to report a solid set of numbers that could help arrest the recent slide in its stock price.

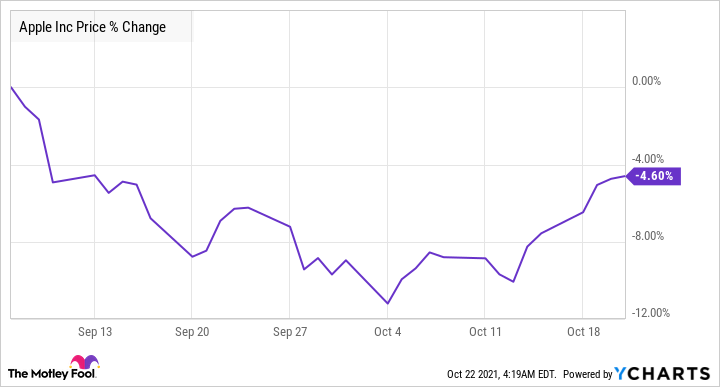

AAPL data by YCharts.

As seen in the chart above, Apple stock has slumped over the past few weeks despite reports that its latest iPhone 13 models are reportedly in greater demand than last year's lineup. Let's look at the reasons why savvy investors should consider taking advantage of the pullback in Apple stock.

Apple's about to deliver impressive growth

Recent reports suggest that Apple's iPhone 13 sales may be restrained by supply chain restrictions. The iPhone maker may have to lose out on sales of up to 10 million units of the iPhone 13, as a worldwide semiconductor shortage could cripple its production lines. The smartphone behemoth was reportedly looking to manufacture 90 million iPhone units in 2021, but third-party reports indicate that it could fall short of that mark.

As it turns out, the chip shortage isn't expected to affect only iPhone production, but also to hinder the output of iPads and MacBooks. Not surprisingly, investor sentiment about Apple stock has turned negative, but one shouldn't forget the massive opportunity the company is sitting on.

Image source: Getty Images.

For instance, Wall Street expects Apple's fourth-quarter revenue to increase nearly 31% year over year to $84.7 billion. Earnings are expected to jump from $0.73 per share a year ago to $1.23 per share. Now, Apple hadn't issued official guidance when it released its fiscal third-quarter results in July, citing the uncertainty posed by the COVID-19 outbreak, but it won't be surprising to see the company exceed the market's expectations.

Apple's iPhone shipments for the quarter that ended in September are expected to jump 17% year over year to 49 million units, according to Morgan Stanley analysts' estimates. Throw in the fact that Apple is enjoying a massive bump in the average selling price of the iPhone in the 5G era, and the revenue from its biggest product line (accounting for 49% of Q3 revenue) could increase significantly. Not surprisingly, Morgan Stanley analysts expect Apple's iPhone revenue to increase 52% year over year for the September quarter.

The higher ASP, along with the fact that the company's services business is growing at a nice clip, should translate to a fatter margin profile. Apple recorded a 33% year-over-year increase in services revenue in the fiscal third quarter, a trend that's likely to continue thanks to the impressive growth of offerings such as Apple TV+.

All of this indicates that Apple is on track to deliver a solid set of results. More importantly, the tech giant is likely to sustain the high levels of growth, as it is at the beginning of a major upgrade cycle.

Don't miss the big picture

Investors shouldn't worry much about the near-term problems that may hamper Apple's iPhone production, as the company has a lot of room for growth in the 5G smartphone era thanks to its huge base of users.

In January, Apple CEO Tim Cook reported that Apple had an installed base of more than 1 billion active iPhone users. The company launched its first 5G-enabled iPhone models just last year, which means that only a small fraction of its installed base is using 5G devices. The iPhone 12 (Apple's first 5G device) clocked 100 million shipments in April this year, indicating that there are millions of users still in an upgrade window.

So Apple can continue to witness a solid increase in shipments over the coming years as more users upgrade to new iPhones. Throw in the improved pricing of its 5G smartphones, and it is not surprising to see why Apple's earnings are expected to grow at an annual rate of nearly 20% for the next five years. That's a big jump over the yearly bottom-line growth of 8.4% the company has clocked in the last five years.

Finally, with Apple trading at a trailing earnings multiple of 29, lower than the tech-heavy Nasdaq-100's multiple of more than 35, it makes sense to buy this tech stock before earnings, as a strong set of numbers and robust guidance can send its shares soaring and inflate the valuation.