Stratasys (SSYS 1.86%) is slated to report its third-quarter 2021 results before the market open on Thursday, Nov. 4. Its conference call with analysts is scheduled for that day at 8:30 a.m. EDT.

The 3D printing company's report will come ahead of that of its archrival, 3D Systems (DDD -0.28%), which plans to announce its quarterly results after the market close on Monday, Nov. 8, as outlined in this 3D Systems earnings preview.

In 2021, Stratasys stock is up 64.1% through Oct. 25, thanks largely to Monday's 21.4% jump following investment bank Craig-Hallum upgrading the stock's rating to buy from hold, and setting a price target of $42. (Shares closed at $34 on Monday.) For context, 3D Systems stock has gained 174% and the S&P 500 index has returned 23% so far this year.

Here's what to watch in Stratasys' upcoming third-quarter report.

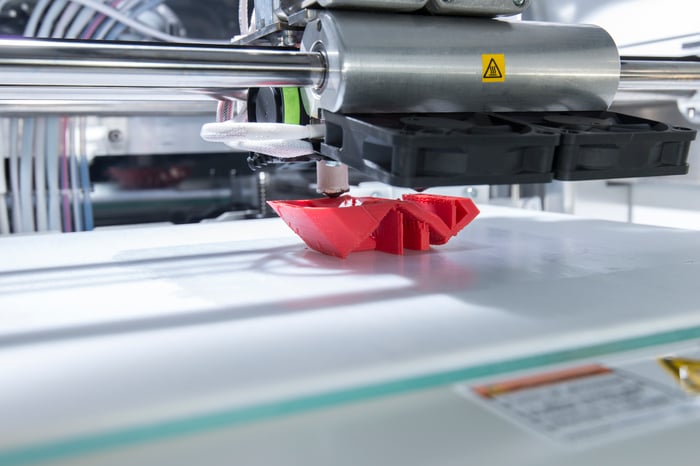

An industrial 3D printer. Image source: Getty Images.

Key numbers

Following are the company's results from the year-ago period, its guidance, and Wall Street's consensus estimates to use as benchmarks.

| Metric |

Q3 2020 Result |

Stratasys' Q3 2021 Guidance | Wall Street's Q3 2021 Consensus Estimate | Wall Street's Projected Change |

|---|---|---|---|---|

|

Revenue |

$127.9 million |

About 17% to 18% growth |

$150.1 million |

17% |

|

Adjusted earnings per share (loss) |

($0.05) |

N/A |

($0.06) |

N/A. Loss expected to widen by 20% |

Data sources: Stratasys and Yahoo! Finance. Note: Stratasys did not provide guidance for earnings.

Stratasys has relatively modest year-over-year comparables stemming from last year's revenue being hurt considerably by the pandemic, which caused many industrial customers to pause their ordering. In the third quarter of 2020, its sales fell 19% year over year.

For context, in the second quarter of 2021, Stratasys' revenue jumped 25% year over year to $147 million, driven by a 36% surge in product sales and a 7% rise in service revenue. That result topped the $136 million consensus estimate and was 9.5% higher than in the first quarter. Net loss according to generally accepted accounting principles (GAAP) was $0.31 per share, compared to a net loss of $0.51 per share in the year-ago period. Adjusted for one-time items, net loss narrowed 85% to $0.02. That result beat the net loss of $0.07 per share analysts had been projecting.

3D Systems has recently been performing better than Stratasys. In the second quarter, its sales soared 44% year over year (and 59% excluding the impact of divestitures). Like Stratasys, it posted a GAAP loss, but it had a profit on an adjusted basis. Moreover, it generated more cash from operations than Stratasys on both an absolute and relative (to revenue) basis.

Operating cash flow

Investors should keep an eye on operating cash flow. It's certainly not a good thing that Stratasys' bottom line in the first and second quarters was awash in red ink on both a GAAP and an adjusted basis. That said, from a cash standpoint, the company is making money running its operations. That is, it had positive operating cash flow in both the first and second quarters. In those two quarters, cash generated from operations was $22.8 million and $5.6 million, respectively.

Fourth-quarter guidance

Management's outlook will probably be the biggest factor driving the stock following the release of the third-quarter report.

For the fourth quarter, Wall Street analysts are modeling for revenue to grow 11% year over year to $157.7 million. They also expect an adjusted net loss of $0.03, down from earnings per share of $0.13 in the year-ago period.