Xerox Holdings (XRX) has ended up suffering more directly from the COVID-19 pandemic than most companies. The document management veteran desperately needs workers to get back to the office. Until then, the business looks bleak.

The stock plunged following Tuesday morning's third-quarter earnings report, closing more than 11% lower. Was that crash a bad sign for long-term investors, or was it an invitation to pick up Xerox shares at a deep discount?

Let's have a look.

Image source: Getty Images.

A mixed earnings report

Third-quarter revenue came in at $1.76 billion. That's about even with the year-ago period but 20% below the pre-COVID-19 result from Q3 2019. On the bottom line, Xerox posted adjusted earnings of $0.48 per diluted share. Again, that's comparable to the $0.48 per share seen in the third quarter of 2020 but far below the $1.08 per share from the same reporting period of 2019. Xerox is holding steady, but the "new normal" is much worse than the 2019 baseline.

CEO John Visentin put a positive spin on the financial results, pointing out that the stable year-over-year comparison was achieved despite the dual challenges of a global supply chain disruption and the delta variant of COVID-19. Together, these issues strained Xerox's own supply chain while also keeping office workers away from their cubicles longer than expected.

Can Xerox survive a long COVID-19 break?

Here's the good news: Xerox's sales may be weak, and the profits are not impressive under these conditions, but the company is profitable and continues to generate positive free cash flow. As such, Xerox should be able to slog through even an extended period of financial and operating challenges, ready to spring back to life when the business world needs its products and services again.

Unfortunately, that silver lining comes with another dark cloud. You see, the coronavirus crisis didn't exactly slam Xerox in the middle of a golden age of surging sales and rising profits.

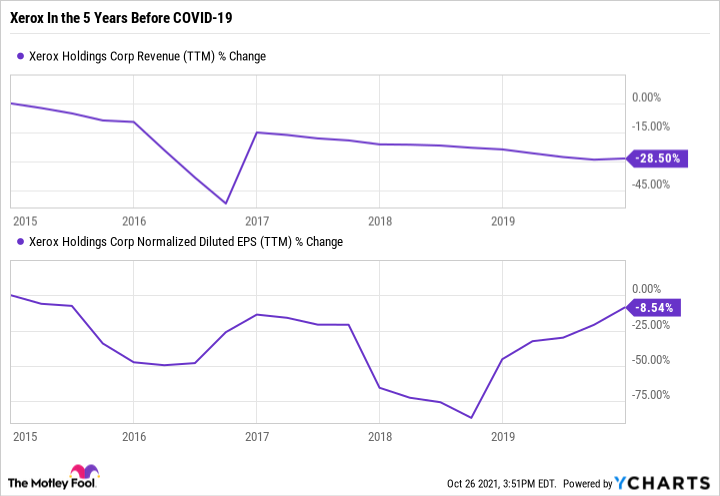

Over the five years ending on Dec. 31, 2019, Xerox had seen revenue slide 29% lower. Earnings were unpredictable but generally trending downward. The stock recorded a 1% gain over those five years, missing out on a 57% gain in the S&P 500 market index.

XRX Revenue (TTM) data by YCharts.

So, is Xerox a buy today?

On top of Xerox's long-running financial woes, I'm not so sure that the business world will ever get back to the office. Many companies have managed to cope quite well with their office staff working remotely. Let's just say that I would hate to own stock in a company that leases out office space to other companies. Sure, there will be a place for traditional office workers in the future, but it won't be the ubiquitous standard that it used to be.

And that's bad news for Xerox in the long run. The company needs to revamp its business model to stay relevant after this drastic change in the business world. Just getting back to what was going on in 2019 wouldn't be good enough, because that was already a long, slow spiral down. And Xerox still measures its operations by page volume in an increasingly digital world. This company could use a bucket of ice water and a bugle fanfare -- whatever it takes to wake up and smell the coffee.

So I'm not tempted to buy Xerox stock today, even though it trades 32% below the 52-week highs of March 2021 and 54% below November 2019's two-year peak. I expect more shareholder pain in the years ahead. That conclusion is based on my view that working remotely will be a long-lasting theme on a global level. If you disagree, you still have to assume that Xerox's worst days are behind it. I find that difficult to believe.