What happened

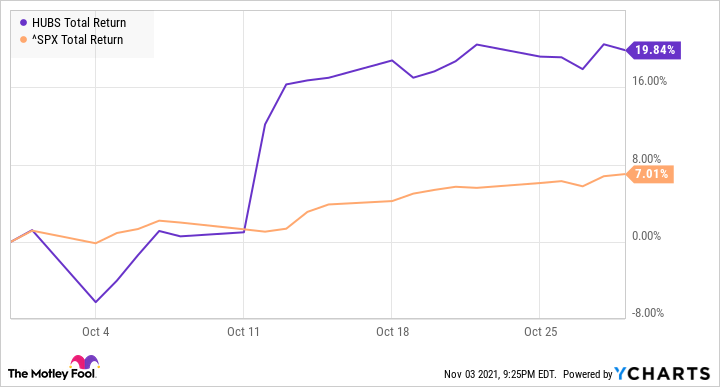

Shares of Hubspot (HUBS -2.82%) rose 19.8% according to data provided by S&P Global Market Intelligence after the company announced a new payment solution at its annual investor conference. The company also an updated CRM platform that was well received. Following the conference, multiple research analysts set price targets well above Hubspot's price. That created even more momentum for the stock, providing professional validation to build on the gains from optimism about Hubspot's new financial products.

HUBS Total Return Level data by YCharts

So what

Hubspot provides customer relationship management software, and it focuses on supporting high-growth businesses. The decision to incorporate financial technology (fintech) services might seem odd for a CRM provider at first glance, but it's a move that makes sense. Hubspot's clients frequently report issues with business-to-business (B2B) payments, so there is clearly an unmet need.

Image source: Getty Images.

Sales activities are already adjacent to purchasing and payments. A transaction is simply the next step in the process after a sales contract is signed, so it's natural to bring these functions under the same roof. The updated Hubspot platform promises to streamline sales, account management, billing, and collections. It also supports recurring payments, such as SaaS or membership subscriptions. This is all being powered through a partnership with Stripe, a high-profile player in the payment processing space.

Hubspot's platform is about to get "stickier." It will retain more of its customers because it will become more deeply embedded in the operations of its users. With this movement into fintech, the company also has a whole new growth industry to monetize.

Now what

Hubspot is performing spectacularly, but it's an expensive stock in a competitive market. The company averages about 30% annual sales growth and is free-cash-flow positive. Consensus forecasts indicate that this growth rate is likely to keep up over the next few years.

That's not lost on investors, and the stock's price assumes stellar performance for years in the future. Hubspot shares trade at nearly 180 times cash flow and 34 times sales, and its price-to-book ratio is 46. Those valuation ratios all indicate an expensive stock. Simply put, it needs to keep growing and producing cash just to live up to expectations. Hubspot stock will probably drop if it reports anything short of those lofty financial expectations.

Investors who love Hubspot's opportunity can easily justify taking a long-term position. Just don't be shocked if there are some ups and downs along the way.